Silver standard is a monetary system where a country's currency value is directly linked to a specific amount of silver. This system influences global trade and economic stability by providing a tangible asset that backs currency, which can help control inflation. Discover how the silver standard shapes financial frameworks and affects your economic decisions by exploring the rest of this article.

Table of Comparison

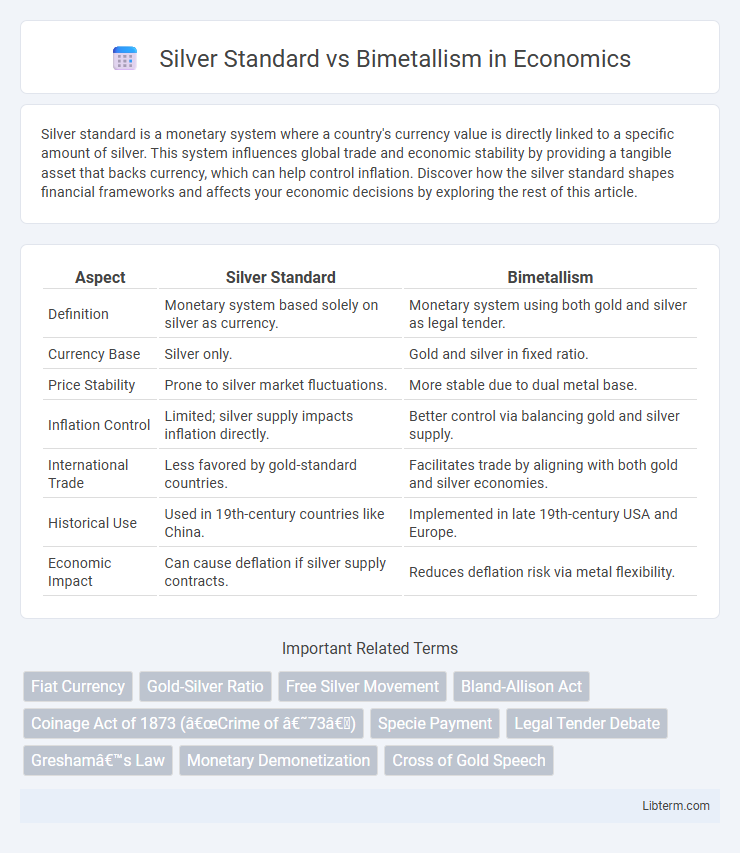

| Aspect | Silver Standard | Bimetallism |

|---|---|---|

| Definition | Monetary system based solely on silver as currency. | Monetary system using both gold and silver as legal tender. |

| Currency Base | Silver only. | Gold and silver in fixed ratio. |

| Price Stability | Prone to silver market fluctuations. | More stable due to dual metal base. |

| Inflation Control | Limited; silver supply impacts inflation directly. | Better control via balancing gold and silver supply. |

| International Trade | Less favored by gold-standard countries. | Facilitates trade by aligning with both gold and silver economies. |

| Historical Use | Used in 19th-century countries like China. | Implemented in late 19th-century USA and Europe. |

| Economic Impact | Can cause deflation if silver supply contracts. | Reduces deflation risk via metal flexibility. |

Introduction to Silver Standard vs Bimetallism

The Silver Standard is a monetary system where a country's currency value is directly linked to a fixed quantity of silver, creating price stability based on silver's intrinsic worth. Bimetallism, in contrast, employs both gold and silver as legal tender at a fixed ratio, enabling flexibility but often causing market fluctuations due to varying metal values. The debate between Silver Standard and Bimetallism centers on economic stability, inflation control, and the balance of monetary supply in 19th-century economies.

Historical Context of Monetary Metals

The debate between silver standard and bimetallism gained prominence in the late 19th century, particularly in the United States, amid economic challenges such as deflation and the Panic of 1893. Advocates for silver standard pushed for the unlimited coinage of silver to increase money supply and assist indebted farmers, while bimetallism aimed to maintain fixed ratios between gold and silver to stabilize currency and support international trade. This conflict reflected deeper economic and political struggles over monetary policy, inflation control, and gold reserves management during the period.

Defining the Silver Standard

The Silver Standard is an economic system where the value of a country's currency is directly tied to a specific quantity of silver, establishing its role as the sole monetary metal for backing money supply. This contrasts with Bimetallism, which uses both gold and silver as dual standards for currency valuation, aiming to stabilize the economy by balancing the metals' values. The Silver Standard's reliance on silver alone often led to distinct monetary policies and economic impacts, particularly in countries with abundant silver resources.

Understanding Bimetallism

Bimetallism is an economic system that uses both silver and gold as monetary standards, aiming to stabilize currency value by fixing the exchange rate between the two metals. This system contrasts with the silver standard, which relies solely on silver for currency valuation, often leading to fluctuations tied to silver's market value. Understanding bimetallism involves recognizing its intent to balance the advantages of gold's stability and silver's abundance, thus preventing the issues of inflation or deflation associated with a single-metal standard.

Key Differences Between Silver Standard and Bimetallism

The Silver Standard relies exclusively on silver as the monetary base, fixing currency value to a specific quantity of silver, while Bimetallism uses both gold and silver as legal tender, establishing a fixed rate of exchange between the two metals. Silver Standard typically results in price stability linked to silver's market value, whereas Bimetallism aims to combine the strengths of both metals to stabilize currency and control inflation. In practice, Bimetallism often faces challenges like arbitrage and market imbalances, which are less prevalent under a pure Silver Standard system.

Economic Impacts of the Silver Standard

The silver standard often led to inflationary pressure due to the abundance and lower value of silver compared to gold, destabilizing currency values and reducing international trade confidence. Countries adhering to the silver standard experienced fluctuating purchasing power, which hindered long-term investments and economic growth. Bimetallism, by contrast, aimed to balance currency value through both metals but frequently faced challenges in maintaining consistent coinage ratios, impacting monetary stability.

The Effects of Bimetallism on Global Trade

Bimetallism influenced global trade by stabilizing currency values through the use of both silver and gold, reducing exchange rate volatility and facilitating international transactions. Countries adopting bimetallism often experienced increased trade volume due to enhanced monetary flexibility and greater confidence in currency convertibility. However, fluctuating silver and gold market values sometimes led to imbalances, causing trade disruptions and economic uncertainty in affected regions.

Major Advocates and Opponents

Silver Standard proponents included farmers and miners who believed it would increase money supply and combat deflation, with major advocates like William Jennings Bryan championing bimetallism. Opponents, primarily bankers and industrialists, favored the Gold Standard to ensure currency stability and protect creditor interests, with figures such as President Grover Cleveland opposing silver coinage expansion. The debate centered on economic control, monetary inflation, and the interests of agrarian versus financial sectors.

The Demise and Legacy of Metallic Standards

The demise of silver standard and bimetallism arose from fluctuating metal values and the rise of fiat currency, leading to abandoned metallic baselines in the late 19th and early 20th centuries. The shift toward the gold standard marked a critical transition, as economies favored stability and international trade compatibility over dual-metal systems. The legacy of these monetary standards persists in modern economic debates on currency valuation and inflation control, influencing central banking policies and global financial frameworks.

Modern Perspectives on Metal-Based Monies

Modern perspectives on metal-based monies highlight the debate between silver standard advocates and supporters of bimetallism, emphasizing the economic stability and inflation control provided by each system. The silver standard offers a single-metal monetary base that can reduce market volatility, while bimetallism incorporates both gold and silver, aiming to balance their values and increase money supply flexibility. Contemporary analyses often focus on how these metal standards impact currency valuation, trade balance, and fiscal policy in a digital economy context.

Silver Standard Infographic

libterm.com

libterm.com