Cointegration refers to a statistical relationship between two or more time series variables that share a common long-term equilibrium despite short-term deviations. This concept is essential in fields like economics and finance for modeling integrated variables and avoiding misleading regression results. Explore the article to understand how cointegration can improve your data analysis and forecasting accuracy.

Table of Comparison

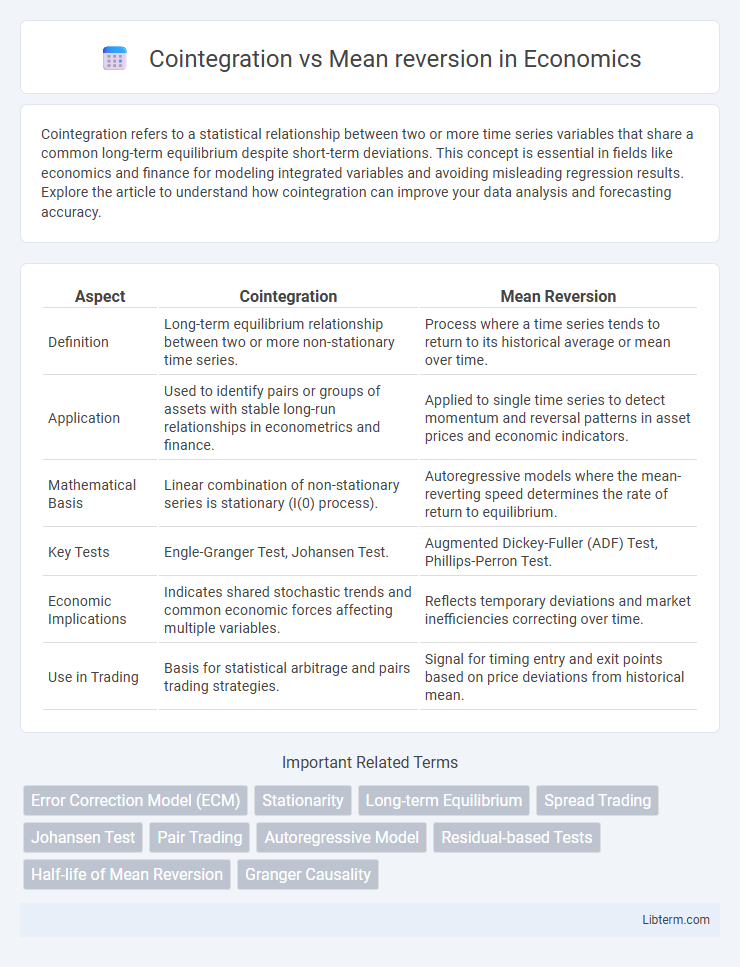

| Aspect | Cointegration | Mean Reversion |

|---|---|---|

| Definition | Long-term equilibrium relationship between two or more non-stationary time series. | Process where a time series tends to return to its historical average or mean over time. |

| Application | Used to identify pairs or groups of assets with stable long-run relationships in econometrics and finance. | Applied to single time series to detect momentum and reversal patterns in asset prices and economic indicators. |

| Mathematical Basis | Linear combination of non-stationary series is stationary (I(0) process). | Autoregressive models where the mean-reverting speed determines the rate of return to equilibrium. |

| Key Tests | Engle-Granger Test, Johansen Test. | Augmented Dickey-Fuller (ADF) Test, Phillips-Perron Test. |

| Economic Implications | Indicates shared stochastic trends and common economic forces affecting multiple variables. | Reflects temporary deviations and market inefficiencies correcting over time. |

| Use in Trading | Basis for statistical arbitrage and pairs trading strategies. | Signal for timing entry and exit points based on price deviations from historical mean. |

Introduction to Cointegration and Mean Reversion

Cointegration refers to a statistical relationship between two or more non-stationary time series that move together in the long run, maintaining an equilibrium despite short-term deviations. Mean reversion describes a process where a time series tends to revert to its historical average or long-term mean, indicating temporary fluctuations around a stable value. While mean reversion applies to individual series, cointegration specifically identifies pairs or groups of series with synchronized movements, making it crucial for pairs trading and long-term equilibrium modeling.

Key Concepts: Defining Cointegration

Cointegration refers to a statistical property of a collection of time series variables whereby a linear combination of them is stationary, even if the individual series themselves are non-stationary. This concept implies a long-term equilibrium relationship among the variables, distinguishing it from mean reversion, which describes the tendency of a single time series to return to its historical average. In financial modeling, identifying cointegrated pairs enables traders to exploit relative price movements while accounting for long-term associations, enhancing strategy robustness compared to relying solely on mean reversion assumptions.

Understanding Mean Reversion in Time Series

Mean reversion in time series refers to the tendency of a variable to move back towards its historical average or equilibrium level over time, indicating that deviations from the mean are temporary and statistically predictable. This concept differs from cointegration, which specifically involves a stable, long-term relationship between two or more non-stationary series, implying they share a common stochastic trend. Understanding mean reversion helps in modeling asset prices and economic indicators by identifying when values are likely to correct themselves, providing key insights for trading strategies and risk management.

Mathematical Foundations of Cointegration

Cointegration is mathematically defined through the existence of a linear combination of non-stationary time series that results in a stationary series, indicating a long-term equilibrium relationship. This concept relies on unit root tests such as the Engle-Granger two-step method or Johansen's procedure to identify cointegrated vectors and corresponding adjustment dynamics. Mean reversion, in contrast, describes a single series fluctuating around a constant mean, often modeled using Ornstein-Uhlenbeck processes, but does not require multiple integrated series or vector error correction frameworks.

Statistical Techniques for Identifying Mean Reversion

Statistical techniques for identifying mean reversion include the Augmented Dickey-Fuller (ADF) test, which detects stationarity in time series data, indicating a mean-reverting process. The Johansen cointegration test is crucial for assessing long-term equilibrium relationships between multiple non-stationary series, differentiating true cointegration from spurious correlations. Variance ratio tests and Hurst exponent analysis also help quantify the speed and strength of mean reversion by measuring the persistence of deviations from the mean.

Cointegration vs Mean Reversion: Core Differences

Cointegration and mean reversion are both concepts used in time series analysis to identify relationships between variables, but differ fundamentally in their applications. Cointegration examines whether a set of non-stationary series move together over time, maintaining an equilibrium relationship despite individual trends. Mean reversion focuses on a single series' tendency to return to its historical average, highlighting short-term fluctuations around a long-term mean.

Practical Applications in Financial Markets

Cointegration is widely used in pairs trading strategies to identify asset pairs with a stable long-term equilibrium, allowing traders to exploit price divergences and capture profits when prices revert to their mean relationship. Mean reversion models, applied in statistical arbitrage, help detect temporary price deviations within single assets, enabling short-term trades based on the assumption that prices will return to historical averages. Both concepts serve as foundational tools in risk management and algorithmic trading by enhancing portfolio diversification and improving the timing of entry and exit points.

Common Challenges and Pitfalls

Cointegration and mean reversion analyses often encounter challenges such as spurious regression results caused by non-stationary data and misinterpreting short-term fluctuations as long-term equilibrium relationships. Model specification errors and overlooking structural breaks or regime shifts can lead to incorrect inferences about cointegration and mean reversion properties. Ensuring robustness requires rigorous testing for stationarity, appropriate lag length selection, and accounting for potential non-linear dynamics to avoid misleading conclusions.

Tools and Software for Analysis

Cointegration analysis often relies on software tools such as EViews, R (with packages like "urca" and "tseries"), and Python libraries including statsmodels and arch for conducting Johansen and Engle-Granger tests. Mean reversion analysis typically uses MATLAB, R (quantmod and TTR packages), and Python libraries like pandas and NumPy for detecting mean-reverting behavior through statistical tests and time series modeling. Advanced platforms like Stata and SAS also support both cointegration and mean reversion analyses by offering robust econometric modeling capabilities and integrated visualization tools.

Conclusion: Choosing the Right Approach

Cointegration is ideal for analyzing the long-term equilibrium relationship between non-stationary time series, ensuring that the series move together over time despite short-term deviations. Mean reversion focuses on the tendency of a single stationary time series to return to its historical mean, useful for identifying short-term trading opportunities. Selecting the right approach depends on whether the analysis targets long-term equilibrium dynamics with cointegrated pairs or short-term price corrections with mean-reverting assets.

Cointegration Infographic

libterm.com

libterm.com