A budget deficit occurs when a government's expenditures exceed its revenues within a fiscal year, leading to borrowing to cover the shortfall. Persistent deficits can impact economic growth, interest rates, and national debt levels, influencing fiscal policy decisions. Discover how budget deficits affect your economy and what strategies can mitigate their impact by reading the full article.

Table of Comparison

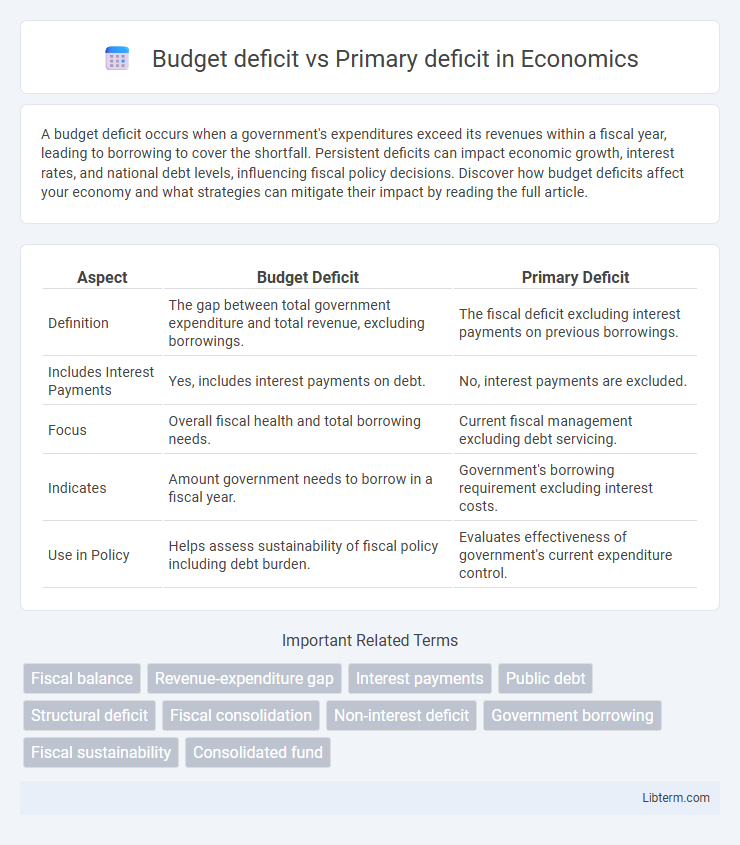

| Aspect | Budget Deficit | Primary Deficit |

|---|---|---|

| Definition | The gap between total government expenditure and total revenue, excluding borrowings. | The fiscal deficit excluding interest payments on previous borrowings. |

| Includes Interest Payments | Yes, includes interest payments on debt. | No, interest payments are excluded. |

| Focus | Overall fiscal health and total borrowing needs. | Current fiscal management excluding debt servicing. |

| Indicates | Amount government needs to borrow in a fiscal year. | Government's borrowing requirement excluding interest costs. |

| Use in Policy | Helps assess sustainability of fiscal policy including debt burden. | Evaluates effectiveness of government's current expenditure control. |

Introduction to Budget Deficit and Primary Deficit

Budget deficit refers to the total shortfall when a government's total expenditures exceed its total revenues, including interest payments on past borrowings. Primary deficit specifically measures the fiscal gap excluding interest payments, highlighting the imbalance caused solely by current government spending and revenue collection. Analyzing both deficits is crucial for understanding the overall fiscal health and sustainability of public finances.

Defining Budget Deficit

A budget deficit occurs when a government's total expenditures exceed its total revenues, including interest payments on debt, within a fiscal year. This contrasts with the primary deficit, which excludes interest payments and reflects the shortfall between revenue and non-interest spending. Understanding the budget deficit is crucial for assessing overall fiscal sustainability and debt management strategies.

Understanding Primary Deficit

Primary deficit measures the fiscal gap excluding interest payments on existing debt, reflecting the government's current borrowing needs from its regular activities. Budget deficit includes total expenditures minus total revenues, encompassing interest payments and offering a complete picture of fiscal imbalance. Understanding primary deficit helps assess the sustainability of fiscal policy by isolating the impact of new borrowing from debt servicing costs.

Key Differences Between Budget Deficit and Primary Deficit

Budget deficit represents the total shortfall when a government's total expenditures exceed its total revenues, including interest payments on outstanding debt. Primary deficit, however, excludes interest payments, reflecting the fiscal gap purely from current government operations. The key difference lies in that the budget deficit accounts for debt servicing costs, while the primary deficit highlights the sustainability of fiscal policy before interest obligations.

Components of Budget and Primary Deficits

The budget deficit represents the total shortfall when government expenditures exceed revenues, encompassing interest payments on existing debt along with primary components. The primary deficit excludes interest payments, measuring only the gap between current government spending and revenue collections, thus reflecting the fiscal stance without debt servicing costs. Understanding these components highlights the influence of interest obligations on overall fiscal health and helps in assessing sustainable budgetary policies.

Causes of Budget and Primary Deficits

Budget deficit occurs when total government expenditures exceed total revenues, driven by factors such as increased public spending, economic downturns reducing tax income, and rising interest payments on debt. Primary deficit specifically reflects the gap between government revenues and expenditures excluding interest payments, often caused by structural fiscal imbalances, inefficient tax systems, or persistent overspending on public goods and services. Both deficits can arise from expansionary fiscal policies aimed at stimulating growth, external shocks like commodity price volatility, and poor fiscal management practices.

Economic Implications of Each Deficit

The budget deficit measures the total shortfall when government expenditures exceed total revenue, affecting national debt and interest obligations. The primary deficit excludes interest payments on existing debt, highlighting the government's fiscal stance without financing costs, which impacts future borrowing needs. Persistent budget deficits can lead to higher debt levels and increased interest rates, while a growing primary deficit signals structural fiscal imbalances that may erode investor confidence and economic stability.

Measuring and Calculating Deficits

Budget deficit measures the total shortfall when government expenditures exceed total revenues, including interest payments on existing debt, calculated by subtracting total revenues from total expenditures. Primary deficit excludes interest payments, focusing solely on fiscal operations by deducting non-interest expenditures from government revenues to assess current fiscal health. Accurate measurement of both deficits requires detailed data on government spending, revenue streams, and interest obligations to differentiate between overall debt burden and operational budget balance.

Government Strategies to Manage Deficits

Government strategies to manage budget deficits focus on balancing total expenditures and revenues, while addressing primary deficits by controlling non-interest spending and enhancing tax revenues. Fiscal policies often include targeted spending cuts, tax reforms, and measures to boost economic growth, thereby increasing government income without raising debt interest costs. Effective management of primary deficits helps reduce the overall budget deficit, stabilizing public debt and ensuring long-term fiscal sustainability.

Conclusion: Importance for Fiscal Policy

Understanding the distinction between budget deficit and primary deficit is crucial for effective fiscal policy, as the budget deficit includes interest payments on debt while the primary deficit excludes them. Policymakers must address the primary deficit to ensure long-term fiscal sustainability and prevent the accumulation of unsustainable debt levels. Targeting the primary deficit helps governments focus on structural fiscal reforms without the distortion caused by interest obligations.

Budget deficit Infographic

libterm.com

libterm.com