The life-cycle hypothesis explains how individuals plan their consumption and savings behavior over their lifetime to maintain a stable standard of living. It suggests people save during their working years and dissave during retirement to smooth consumption. Explore this article to understand how the theory impacts financial planning and economic policies.

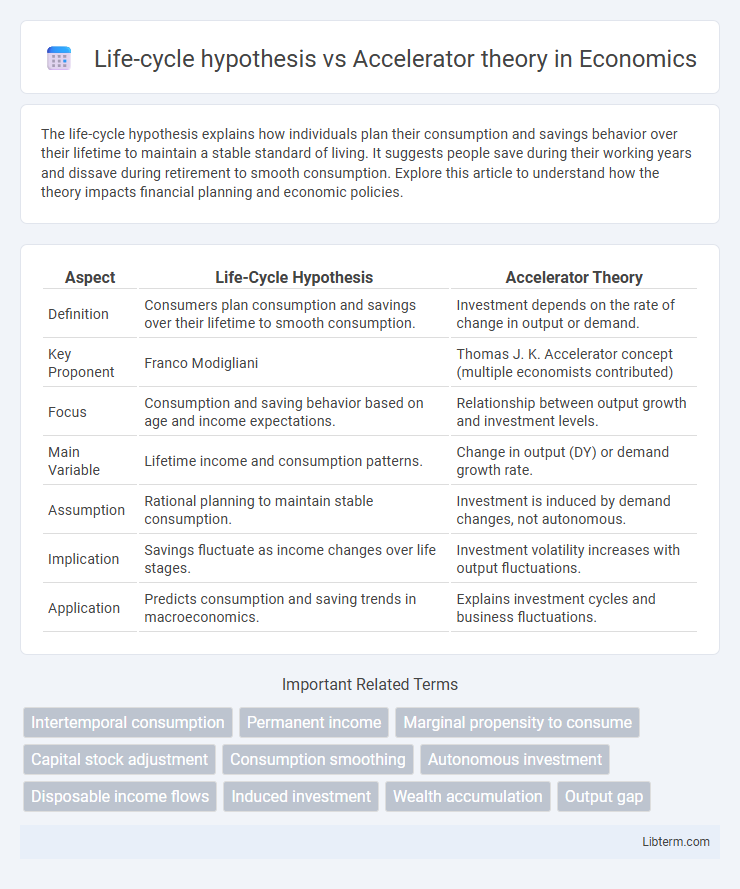

Table of Comparison

| Aspect | Life-Cycle Hypothesis | Accelerator Theory |

|---|---|---|

| Definition | Consumers plan consumption and savings over their lifetime to smooth consumption. | Investment depends on the rate of change in output or demand. |

| Key Proponent | Franco Modigliani | Thomas J. K. Accelerator concept (multiple economists contributed) |

| Focus | Consumption and saving behavior based on age and income expectations. | Relationship between output growth and investment levels. |

| Main Variable | Lifetime income and consumption patterns. | Change in output (DY) or demand growth rate. |

| Assumption | Rational planning to maintain stable consumption. | Investment is induced by demand changes, not autonomous. |

| Implication | Savings fluctuate as income changes over life stages. | Investment volatility increases with output fluctuations. |

| Application | Predicts consumption and saving trends in macroeconomics. | Explains investment cycles and business fluctuations. |

Introduction to Consumption and Investment Theories

Life-cycle hypothesis posits that individuals plan consumption and savings behavior over their lifetime to smooth consumption, based on expected income changes, emphasizing personal intertemporal choices. Accelerator theory explains investment fluctuations as a response to changes in output or demand, where firms increase investment to meet anticipated sales growth. Both theories are foundational in understanding consumption and investment dynamics, highlighting respectively the role of consumer behavior over time and business response to economic activity.

Overview of the Life-Cycle Hypothesis

The Life-Cycle Hypothesis (LCH) explains individual consumption and saving behavior by suggesting that people plan their consumption and savings over their lifetime to smooth out spending, saving during working years and dis-saving during retirement. Developed by economists Franco Modigliani and Richard Brumberg, the LCH emphasizes the role of expected lifetime income in determining consumption patterns, contrasting with short-term income fluctuations. This theory contrasts with the Accelerator Theory, which links investment levels directly to changes in output or demand rather than long-term consumption planning.

Fundamentals of the Accelerator Theory

The Accelerator Theory fundamentally explains investment fluctuations based on changes in output or demand, positing that increased production leads firms to invest in capital goods to support expanded capacity. This theory contrasts with the Life-cycle Hypothesis, which centers on consumption smoothing over an individual's lifespan rather than investment dynamics. The Accelerator Theory relies on the accelerator coefficient, a key parameter measuring the sensitivity of investment to changes in output growth rates.

Key Assumptions: Life-Cycle Hypothesis vs Accelerator Theory

The Life-Cycle Hypothesis assumes individuals plan consumption and savings over their lifetime, smoothing consumption based on expected income changes. In contrast, the Accelerator Theory assumes investment depends on changes in output or demand, with firms accelerating investment in response to increased sales forecasts. The hypothesis centers on household behavior, while the theory focuses on firm investment decisions linked to economic fluctuations.

Mechanisms of Consumer Behavior in the Life-Cycle Hypothesis

The Life-Cycle Hypothesis explains consumer behavior through individuals' consumption and saving patterns over their lifetime, emphasizing mechanisms such as income anticipation, wealth accumulation, and intertemporal smoothing of consumption. Consumers adjust their spending based on expected lifetime resources rather than solely current income, contrasting with the Accelerator Theory which focuses on investment driven by changes in output and income levels. This model highlights the role of future income expectations and accumulated wealth in shaping durable consumption decisions.

Investment Dynamics in the Accelerator Theory

The Accelerator Theory explains investment dynamics by linking changes in output or sales to the required capital stock, emphasizing that firms invest to adjust their capital to meet expected demand. Investment fluctuates more intensely than output because a small increase in sales leads to a proportionally larger demand for new capital goods, reflecting the accelerator coefficient. This contrasts with the Life-cycle Hypothesis, which focuses on consumption and saving patterns over an individual's lifetime rather than on firm investment behavior driven by output changes.

Comparative Analysis: Predictive Power and Limitations

The Life-cycle hypothesis predicts consumption patterns based on individuals' income smoothing over their lifetime, effectively explaining long-term savings behavior but struggling with short-term fluctuations. In contrast, the Accelerator theory emphasizes investment dynamics driven by changes in output, offering robust short-term investment predictions but often neglecting consumer behavior and income distribution factors. Both models have limitations: the Life-cycle hypothesis assumes rational foresight, which may not hold true universally, while the Accelerator theory tends to oversimplify investment responses to demand changes, reducing its predictive accuracy in diverse economic conditions.

Real-world Applications and Empirical Evidence

The Life-cycle hypothesis explains consumption patterns by suggesting individuals plan their spending and saving behavior based on expected lifetime income, influencing retirement planning and social security policies. The Accelerator theory links investment levels directly to changes in output or demand, providing empirical support for fiscal stimulus effects on short-term economic growth. Both theories find practical use in macroeconomic modeling, with empirical studies showing the Life-cycle hypothesis accurately predicts aggregate savings rates, while the Accelerator exemplifies investment sensitivity to business cycles.

Policy Implications of Both Theories

The Life-cycle hypothesis suggests that fiscal policies should focus on smoothing consumption over individuals' lifetimes, encouraging pension reforms and social security systems to stabilize aggregate demand. In contrast, the Accelerator theory implies that investment policies must respond to changes in output growth, advocating for incentives that stimulate capital formation during economic expansions. Policymakers balancing these theories should combine long-term consumption stability measures with short-term investment triggers to optimize economic growth and stability.

Conclusion: Integrating Consumption and Investment Insights

The Life-cycle Hypothesis explains consumption patterns based on income smoothing over an individual's lifetime, while the Accelerator Theory links investment levels directly to changes in output or demand. Integrating these models highlights how consumption stability influences firms' expectations and investment decisions, creating a feedback loop between household consumption and capital investment. This synthesis emphasizes the interconnectedness of consumer behavior and business investment in driving economic fluctuations.

Life-cycle hypothesis Infographic

libterm.com

libterm.com