The GDP gap measures the difference between an economy's actual output and its potential output at full employment, highlighting inefficiencies or underperformance in economic activity. Understanding the GDP gap helps identify whether resources are being underutilized or if the economy is overheating, providing critical insight for policy adjustments. Explore the rest of the article to learn how the GDP gap impacts economic decisions and your financial planning.

Table of Comparison

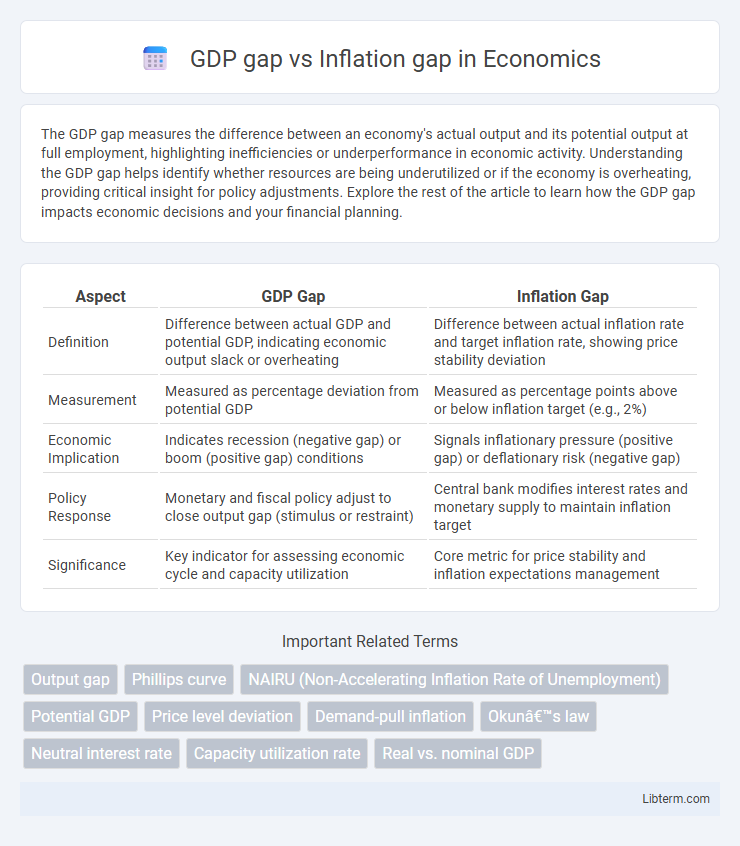

| Aspect | GDP Gap | Inflation Gap |

|---|---|---|

| Definition | Difference between actual GDP and potential GDP, indicating economic output slack or overheating | Difference between actual inflation rate and target inflation rate, showing price stability deviation |

| Measurement | Measured as percentage deviation from potential GDP | Measured as percentage points above or below inflation target (e.g., 2%) |

| Economic Implication | Indicates recession (negative gap) or boom (positive gap) conditions | Signals inflationary pressure (positive gap) or deflationary risk (negative gap) |

| Policy Response | Monetary and fiscal policy adjust to close output gap (stimulus or restraint) | Central bank modifies interest rates and monetary supply to maintain inflation target |

| Significance | Key indicator for assessing economic cycle and capacity utilization | Core metric for price stability and inflation expectations management |

Understanding the GDP Gap: Definition and Importance

The GDP gap measures the difference between actual economic output and potential output, reflecting underutilized resources in an economy. Understanding this gap is crucial for policymakers to identify economic slack and implement measures that stimulate growth without causing excessive inflation. Accurate assessment of the GDP gap aids in balancing demand pressures to maintain price stability and support sustainable economic expansion.

What is the Inflation Gap? Core Concepts Explained

The inflation gap measures the difference between actual inflation and target inflation set by central banks, reflecting deviations from price stability goals. It signals whether an economy is experiencing overheating with inflation above target or slack with inflation below target. Understanding the inflation gap aids policymakers in adjusting monetary policies to stabilize prices and sustain economic growth effectively.

Key Differences Between GDP Gap and Inflation Gap

The GDP gap measures the difference between actual and potential economic output, indicating underperformance or overheating in an economy, while the inflation gap reflects the deviation of actual inflation from target inflation rates set by policymakers. Unlike the GDP gap, which is expressed in terms of output or real GDP percentage, the inflation gap is measured in percentage points of price level changes. Understanding these differences helps central banks tailor monetary policies to either stimulate growth during a negative GDP gap or control price stability when the inflation gap widens.

Economic Impact of GDP Gap on Growth

The GDP gap, representing the difference between actual and potential GDP, directly affects economic growth by indicating underutilized resources or overheating in the economy. A negative GDP gap signals recessive conditions reducing investment and employment, thereby slowing long-term growth, while a positive GDP gap can lead to demand-pull inflation pressures. Understanding this gap aids policymakers in balancing stimulus and restraint measures to sustain stable economic expansion.

How the Inflation Gap Influences Monetary Policy

The inflation gap, representing the deviation of actual inflation from its target rate, critically influences monetary policy decisions by prompting central banks to adjust interest rates to stabilize price levels. When inflation exceeds the target, central banks often increase interest rates to reduce spending and weaken demand, thereby narrowing the inflation gap. Conversely, if inflation falls below the target, policymakers may lower interest rates to stimulate economic activity and push inflation toward the desired level, maintaining overall economic stability.

Causes and Drivers of GDP Gap and Inflation Gap

The GDP gap, representing the difference between actual and potential output, is primarily driven by fluctuations in aggregate demand, supply shocks, labor market inefficiencies, and capital utilization rates. Inflation gap, defined as the deviation of actual inflation from target inflation, is influenced by cost-push factors such as rising input prices, demand-pull pressures from excessive spending, and adaptive inflation expectations. Both gaps are interconnected through economic cycles, with GDP gaps often triggering inflation gaps via shifts in economic output and price levels.

Measuring and Calculating GDP Gap vs. Inflation Gap

The GDP gap is measured by calculating the difference between actual GDP and potential GDP, expressed as a percentage of potential GDP to assess economic underperformance or overheating. The inflation gap is determined by the deviation of actual inflation rates from target inflation rates, typically measured using the Consumer Price Index (CPI) or the Personal Consumption Expenditures (PCE) Price Index. Both gaps are crucial for economic policy analysis, as the GDP gap highlights output fluctuations while the inflation gap indicates price stability deviations.

Policy Responses to GDP Gap and Inflation Gap

Policy responses to the GDP gap prioritize stimulating aggregate demand through fiscal expansion or monetary easing when the output is below potential, aiming to close the negative output gap and reduce unemployment. Inflation gap policies focus on controlling demand-pull inflation via contractionary monetary policy, such as raising interest rates, to prevent overheating when inflation exceeds target levels. Central banks and governments must balance these objectives carefully to avoid triggering a stagflation scenario by addressing either the GDP gap or the inflation gap in isolation.

Real-World Examples: GDP Gap and Inflation Gap in Action

The United States experienced a significant GDP gap during the 2008 financial crisis, where actual output fell well below potential GDP, leading to high unemployment and reduced consumer spending. Concurrently, Japan's persistent inflation gap, characterized by prolonged deflation despite economic stimulus, highlighted challenges in achieving price stability. Emerging economies like Brazil often face simultaneous GDP and inflation gaps during commodity price shocks, where output contracts while inflation accelerates, complicating monetary policy decisions.

GDP Gap vs Inflation Gap: Implications for Future Economic Stability

The GDP gap measures the difference between actual and potential economic output, indicating underused resources or overheating, while the inflation gap reflects deviations from target inflation rates, signaling pricing pressures in the economy. Persistent negative GDP gaps suggest slack and reduced demand, often leading to lower inflation, whereas positive gaps can trigger rising inflation due to excess demand. Understanding the interplay between GDP and inflation gaps is crucial for policymakers to calibrate monetary and fiscal responses aimed at sustaining economic stability and avoiding boom-bust cycles.

GDP gap Infographic

libterm.com

libterm.com