Diversifiable risk refers to the portion of total risk that can be eliminated through proper diversification of investments across different assets or sectors. This type of risk is specific to a particular company or industry and does not affect the entire market, allowing you to reduce potential losses by spreading your portfolio. Explore the rest of the article to understand how managing diversifiable risk enhances your investment strategy.

Table of Comparison

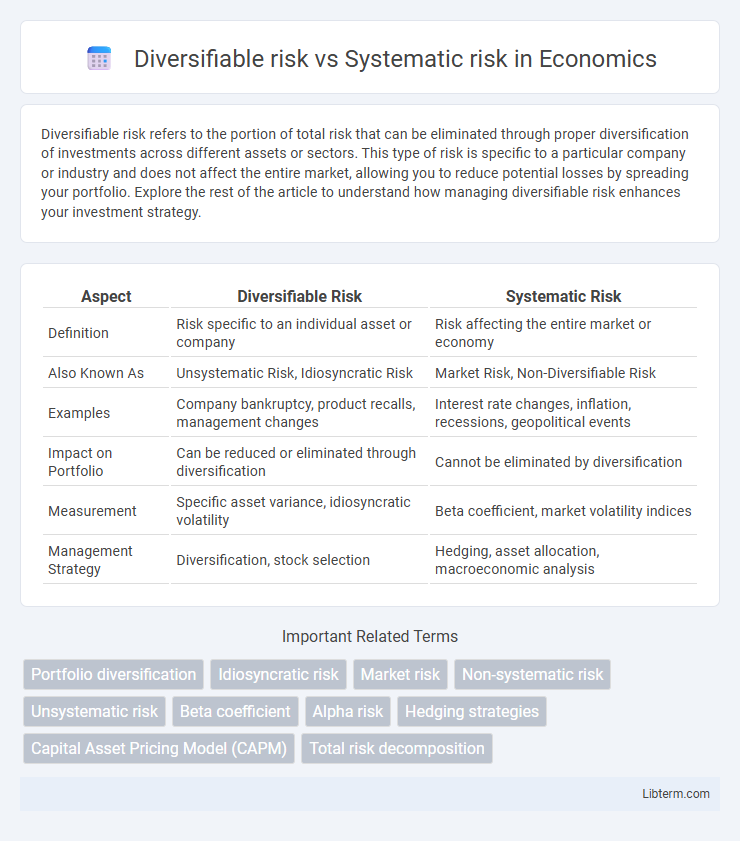

| Aspect | Diversifiable Risk | Systematic Risk |

|---|---|---|

| Definition | Risk specific to an individual asset or company | Risk affecting the entire market or economy |

| Also Known As | Unsystematic Risk, Idiosyncratic Risk | Market Risk, Non-Diversifiable Risk |

| Examples | Company bankruptcy, product recalls, management changes | Interest rate changes, inflation, recessions, geopolitical events |

| Impact on Portfolio | Can be reduced or eliminated through diversification | Cannot be eliminated by diversification |

| Measurement | Specific asset variance, idiosyncratic volatility | Beta coefficient, market volatility indices |

| Management Strategy | Diversification, stock selection | Hedging, asset allocation, macroeconomic analysis |

Introduction to Investment Risks

Diversifiable risk, also known as unsystematic risk, arises from factors unique to a specific company or industry and can be reduced through portfolio diversification. Systematic risk, or market risk, affects the entire market and cannot be eliminated by diversification, including inflation, interest rate changes, and economic recessions. Understanding the distinction between these risks is crucial for investors to effectively manage potential losses and optimize portfolio performance.

Understanding Diversifiable Risk

Diversifiable risk, also known as unsystematic risk, refers to the portion of total risk that can be eliminated through portfolio diversification by investing in different assets or sectors. This risk arises from factors unique to a specific company or industry, such as management decisions or product recalls, and does not affect the entire market. Understanding diversifiable risk is crucial for investors aiming to reduce potential losses by spreading investments and minimizing exposure to individual asset volatility.

Key Features of Systematic Risk

Systematic risk, also known as market risk, affects the entire market or a broad range of assets and cannot be eliminated through diversification. Key features include sensitivity to macroeconomic factors like interest rates, inflation, and geopolitical events, making it unpredictable and market-wide. This risk influences all securities, requiring investors to consider beta coefficients to measure an asset's responsiveness to overall market movements.

Major Differences Between Diversifiable and Systematic Risk

Diversifiable risk, also known as unsystematic risk, affects specific companies or industries and can be mitigated through portfolio diversification, while systematic risk impacts the entire market and cannot be eliminated by diversification. Major differences include their sources: diversifiable risk arises from firm-specific factors like management decisions or product recalls, whereas systematic risk stems from macroeconomic factors such as interest rates, inflation, and geopolitical events. Diversifiable risk is measurable and adjustable by investors, whereas systematic risk is inherent to the market and influences all investments, reflected by beta in the Capital Asset Pricing Model (CAPM).

Real-World Examples of Diversifiable Risk

Diversifiable risk, also known as unsystematic risk, affects specific companies or industries and can be reduced through portfolio diversification; for example, a sudden product recall at a technology firm or labor strikes in an automotive plant directly impact those businesses without influencing the entire market. In contrast, systematic risk, such as interest rate changes or geopolitical instability, affects the overall market and cannot be eliminated by diversification. Real-world events like corporate fraud scandals or regulatory changes affecting only one sector demonstrate the nature of diversifiable risk.

Real-World Examples of Systematic Risk

Systematic risk, also known as market risk, affects entire markets or economies and cannot be eliminated through diversification. Real-world examples include the 2008 global financial crisis, where widespread bank failures and credit crunches led to a global recession, and the COVID-19 pandemic, which caused unprecedented market volatility and economic disruptions worldwide. These events highlight how factors like economic downturns, geopolitical tensions, or natural disasters impact all sectors simultaneously, contrasting with diversifiable risk that affects specific companies or industries.

Measuring and Analyzing Investment Risks

Diversifiable risk, also known as unsystematic risk, can be measured using metrics such as variance or standard deviation of individual asset returns within a portfolio, highlighting risks unique to specific companies or industries. Systematic risk, or market risk, is quantified by beta, which assesses a security's sensitivity to broad market movements and economic factors affecting the entire market. Analyzing investment risks involves separating these two components to optimize portfolio diversification by minimizing diversifiable risks while managing exposure to systematic risks through asset allocation strategies.

Strategies to Manage Diversifiable Risk

Diversifiable risk, also known as unsystematic risk, can be minimized through portfolio diversification by investing across various industries and asset classes to reduce exposure to any single company or sector. Active management strategies such as thorough research, risk assessment, and asset allocation adjustments help investors identify and mitigate company-specific risks. Utilizing instruments like options and insurance policies further protects against unexpected losses tied to diversifiable risk factors.

Strategies to Address Systematic Risk

Systematic risk, also known as market risk, affects the entire financial market and cannot be eliminated through diversification. Strategies to address systematic risk include asset allocation across different asset classes, hedging using derivatives like options and futures, and investing in low-beta stocks that are less sensitive to market fluctuations. Incorporating macroeconomic analysis and monitoring interest rate movements help investors adjust portfolios proactively to mitigate systematic exposure.

Diversifiable Risk vs Systematic Risk: Final Comparison and Implications

Diversifiable risk, also known as unsystematic risk, pertains to specific companies or industries and can be mitigated through portfolio diversification, while systematic risk affects the entire market and is driven by macroeconomic factors like interest rates and inflation. In portfolio management, understanding this distinction is crucial because diversifiable risks can be reduced to optimize returns without affecting expected market risk exposure. The implication is that investors should focus on minimizing diversifiable risk through asset allocation while accepting systematic risk as inherent to market investments.

Diversifiable risk Infographic

libterm.com

libterm.com