Dollarization occurs when a country adopts the US dollar in parallel to or instead of its local currency, stabilizing its economy and attracting foreign investment. This process can help reduce inflation, but it also means losing autonomous monetary policy control. Discover how dollarization might impact Your financial choices and economic stability in the detailed article ahead.

Table of Comparison

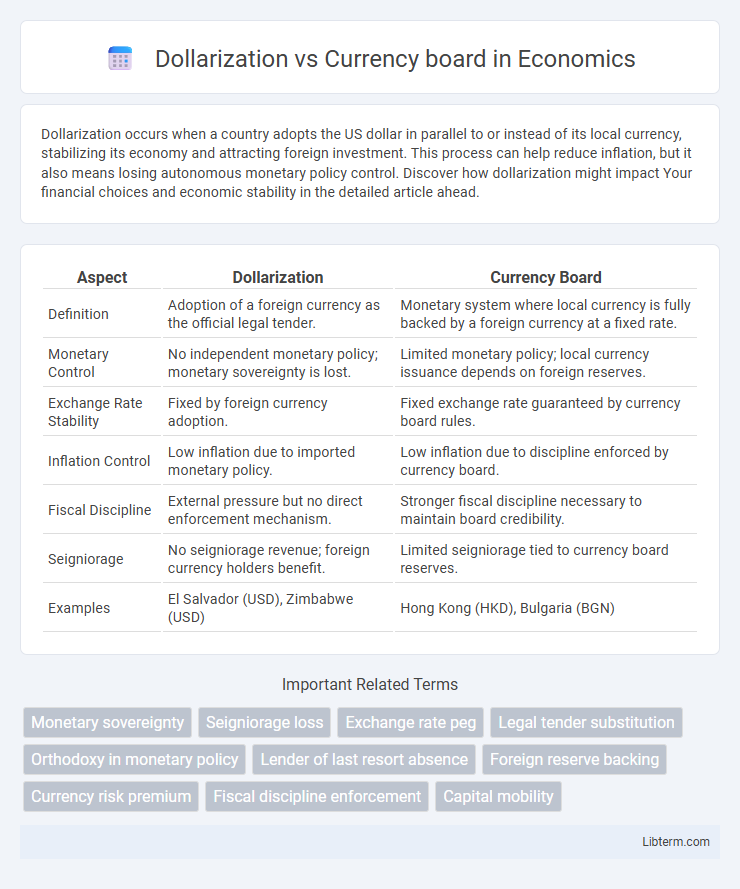

| Aspect | Dollarization | Currency Board |

|---|---|---|

| Definition | Adoption of a foreign currency as the official legal tender. | Monetary system where local currency is fully backed by a foreign currency at a fixed rate. |

| Monetary Control | No independent monetary policy; monetary sovereignty is lost. | Limited monetary policy; local currency issuance depends on foreign reserves. |

| Exchange Rate Stability | Fixed by foreign currency adoption. | Fixed exchange rate guaranteed by currency board rules. |

| Inflation Control | Low inflation due to imported monetary policy. | Low inflation due to discipline enforced by currency board. |

| Fiscal Discipline | External pressure but no direct enforcement mechanism. | Stronger fiscal discipline necessary to maintain board credibility. |

| Seigniorage | No seigniorage revenue; foreign currency holders benefit. | Limited seigniorage tied to currency board reserves. |

| Examples | El Salvador (USD), Zimbabwe (USD) | Hong Kong (HKD), Bulgaria (BGN) |

Introduction to Dollarization and Currency Board

Dollarization occurs when a country adopts a foreign currency, typically the US dollar, as its official legal tender to stabilize its economy and control inflation. A currency board, by contrast, is a monetary authority that pegs the local currency at a fixed exchange rate to a foreign currency, maintaining full backing of domestic currency issuance with foreign reserves. Both mechanisms aim to enhance monetary stability, but dollarization eliminates national currency risks entirely, while a currency board retains national currency issuance under strict reserve constraints.

Historical Context and Global Examples

Dollarization emerged as a response to hyperinflation and economic instability in countries like Ecuador and El Salvador, effectively adopting the US dollar as legal tender to stabilize their economies. Currency boards, exemplified by Hong Kong's peg of the Hong Kong dollar to the US dollar since 1983, create a fixed exchange rate regime backed by foreign reserves to maintain monetary stability. Both mechanisms address currency credibility but differ in sovereignty retention and monetary policy flexibility across global case studies.

Key Definitions and Core Principles

Dollarization involves a country adopting a foreign currency, typically the US dollar, as its official legal tender to stabilize the economy and curb inflation. A currency board is a monetary authority that issues domestic currency fully backed by a foreign reserve currency at a fixed exchange rate, ensuring convertibility and limiting monetary policy discretion. Both mechanisms aim to enhance economic stability but differ in sovereignty retention and monetary policy control.

Mechanisms of Dollarization

Dollarization involves a country adopting a foreign currency, typically the US dollar, as its official medium of exchange, eliminating the issuance of its own currency to stabilize inflation and foster investor confidence. This mechanism bypasses the domestic central bank's control over monetary policy, relying instead on the stability and credibility of the foreign currency issuer, which can enhance trade facilitation and financial integration. Unlike a currency board that maintains a fixed exchange rate backed by foreign reserves while issuing domestic currency, dollarization fully replaces the national currency, removing exchange rate risk and currency conversion costs.

Structure and Functioning of a Currency Board

A currency board operates with a fixed exchange rate system where the domestic currency is fully backed by foreign reserves, ensuring that every unit issued is convertible on demand at a stable rate. Unlike dollarization, which replaces the local currency entirely with a foreign currency, a currency board maintains a domestic currency tied rigidly to a foreign anchor, providing monetary discipline and reducing exchange rate volatility. Its strict reserve requirement and automatic adjustment mechanism limit discretionary monetary policy, thereby enhancing credibility and preventing inflationary finance.

Economic Impacts: Growth, Stability, and Inflation

Dollarization often leads to enhanced economic stability by eliminating exchange rate risk, thereby attracting foreign investment and promoting growth in dollarized economies. Currency boards maintain a fixed exchange rate but allow a national currency, which can support monetary policy flexibility and moderate inflation if well-managed, though they may be vulnerable to external shocks impacting growth. Both mechanisms reduce hyperinflation risks, but dollarization typically imposes stricter discipline on inflation control due to reliance on a foreign currency's monetary policy.

Policy Autonomy and Monetary Flexibility

Dollarization eliminates a country's policy autonomy by fully adopting a foreign currency, restricting the central bank from adjusting interest rates or implementing independent monetary policies. In contrast, a currency board maintains some monetary flexibility by issuing local currency pegged at a fixed rate to a foreign currency, allowing limited control over money supply but still prioritizing exchange rate stability. While dollarization ensures stability through complete currency substitution, currency boards balance stability with partial policy autonomy.

Risks and Challenges of Each System

Dollarization eliminates exchange rate risk and monetary policy mismanagement but risks losing independent monetary control, limiting responses to economic shocks and potentially worsening fiscal imbalances. Currency boards maintain a fixed exchange rate and issue domestic currency fully backed by foreign reserves, reducing inflation but exposing the economy to rigid monetary conditions and external shocks due to the lack of discretionary policy tools. Both systems face challenges in maintaining sufficient foreign reserves and fiscal discipline, with dollarization risking liquidity shortages and currency boards risking credibility loss if reserves fall short.

Case Studies: Comparative Analysis

Dollarization involves a country adopting a foreign currency, typically the US dollar, to stabilize its economy, as seen in Ecuador and El Salvador, where it reduced inflation but limited monetary policy autonomy. Currency boards, exemplified by Hong Kong and Bulgaria, maintain a fixed exchange rate backed by foreign reserves, allowing for currency issuance only equal to these reserves, which supports credibility but restricts flexibility. Comparative analysis reveals dollarization offers immediate stability with sovereignty loss, while currency boards balance stability and control but remain vulnerable to speculative attacks.

Conclusion: Choosing Between Dollarization and a Currency Board

Choosing between dollarization and a currency board depends on a country's economic stability, monetary policy goals, and need for flexibility. Dollarization offers instant credibility and eliminates currency risk but sacrifices independent monetary policy, while a currency board provides greater control with a fixed exchange rate backed by foreign reserves, maintaining some policy tools. Decision-makers must weigh trade-offs between stability, control, and credibility to align with their macroeconomic priorities.

Dollarization Infographic

libterm.com

libterm.com