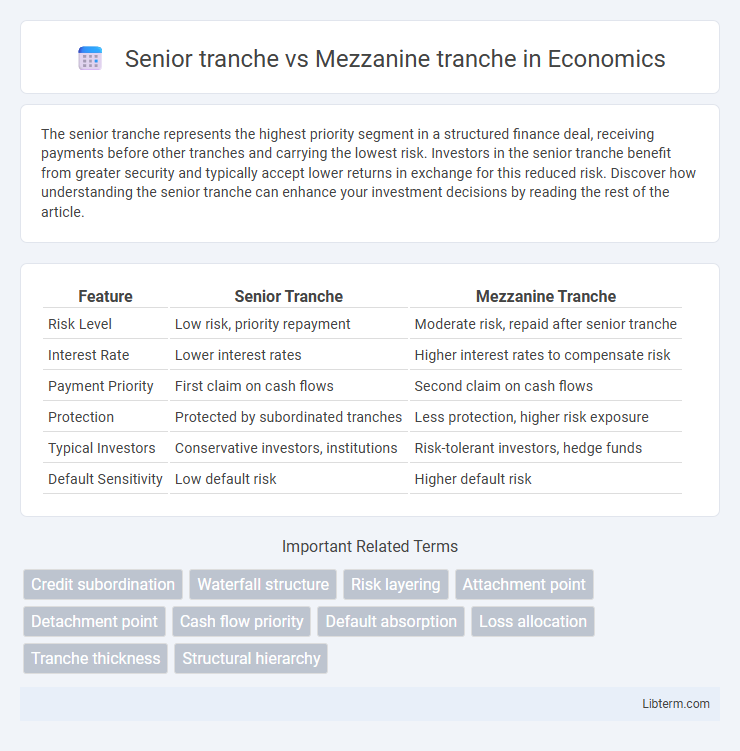

The senior tranche represents the highest priority segment in a structured finance deal, receiving payments before other tranches and carrying the lowest risk. Investors in the senior tranche benefit from greater security and typically accept lower returns in exchange for this reduced risk. Discover how understanding the senior tranche can enhance your investment decisions by reading the rest of the article.

Table of Comparison

| Feature | Senior Tranche | Mezzanine Tranche |

|---|---|---|

| Risk Level | Low risk, priority repayment | Moderate risk, repaid after senior tranche |

| Interest Rate | Lower interest rates | Higher interest rates to compensate risk |

| Payment Priority | First claim on cash flows | Second claim on cash flows |

| Protection | Protected by subordinated tranches | Less protection, higher risk exposure |

| Typical Investors | Conservative investors, institutions | Risk-tolerant investors, hedge funds |

| Default Sensitivity | Low default risk | Higher default risk |

Introduction to Tranche Structures

Senior tranches represent the highest-priority slices in a tranche structure, offering lower risk and lower returns due to their first claim on assets and cash flows. Mezzanine tranches occupy a middle layer, absorbing higher risk and providing higher yields by subordinating to senior tranches but senior to equity tranches. These tiered structures enable diversified risk allocation and tailored investment opportunities within securitized finance products.

Defining Senior Tranche

The senior tranche refers to the highest priority class of debt in a structured finance or securitization deal, offering the lowest credit risk and typically receiving interest and principal payments first. It has priority over the mezzanine tranche, which carries higher risk and yields, acting as a buffer to absorb losses before affecting the senior tranche. Investors in the senior tranche benefit from enhanced credit protection due to this payment hierarchy and lower exposure to default risk.

Understanding Mezzanine Tranche

The mezzanine tranche sits between the senior tranche and equity in a capital structure, bearing higher risk and offering higher returns than the senior tranche but lower risk compared to equity. This tranche absorbs losses after the senior tranche is protected, making it crucial for balancing risk and reward in structured finance deals. Investors in the mezzanine tranche seek enhanced yields by accepting subordinated claim status and moderate volatility, critical for managing portfolio diversification and credit risk.

Key Differences Between Senior and Mezzanine Tranches

Senior tranches hold the highest priority in the capital structure, providing lower yields but greater protection against losses due to their secured positions and first claim on cash flows. Mezzanine tranches occupy a subordinate position, offering higher yields to compensate for increased credit risk and greater exposure to potential defaults. The key differences include senior tranches' lower risk profile and lower interest rates versus mezzanine tranches' elevated risk and higher return potential, reflecting their intermediate position between equity and senior debt.

Credit Risk and Priority of Payments

The senior tranche carries the lowest credit risk due to its highest priority in payment, receiving principal and interest before mezzanine tranches. Mezzanine tranches hold a subordinate position, facing greater credit risk as payments occur after senior obligations are met, leading to higher potential yields to compensate for added risk. This payment hierarchy fundamentally influences investor risk exposure and return expectations within structured finance instruments.

Interest Rates and Return Profiles

Senior tranche typically offers lower interest rates due to its higher priority in the capital structure and reduced default risk, resulting in more stable but modest returns. Mezzanine tranche commands higher interest rates, reflecting increased risk as it sits subordinate to the senior tranche and bears greater exposure to potential losses, leading to higher potential returns. The return profiles differ significantly, with senior tranches appealing to risk-averse investors seeking steady income, while mezzanine tranches suit investors pursuing enhanced yield with moderate risk tolerance.

Role in Structured Finance Transactions

The senior tranche holds the highest priority in structured finance transactions, receiving principal and interest payments first, thus bearing the lowest risk and offering lower yields. The mezzanine tranche occupies a subordinate position, absorbing losses after the senior tranche but before the equity tranche, resulting in moderate risk and higher returns. This tiered payment structure helps in allocating cash flow and credit risk according to investor preferences and risk tolerance.

Investor Suitability and Profiles

Senior tranche investments attract conservative investors seeking lower risk and stable returns due to their higher priority in repayment and secured collateral. Mezzanine tranche appeals to risk-tolerant investors such as private equity firms or hedge funds, offering higher yields in exchange for subordinated debt positions with moderate default risk. Institutional investors typically prefer senior tranches for portfolio diversification, while mezzanine tranches suit those targeting enhanced income and willing to accept increased credit exposure.

Impact on Capital Structure

The senior tranche holds the highest claim on assets and cash flows, resulting in lower risk and priority repayment in a capital structure, which often leads to lower interest rates compared to mezzanine tranches. Mezzanine tranches sit between senior debt and equity, absorbing more risk due to their subordinate position, thus demanding higher returns to compensate for delayed repayment and increased default risk. The presence of mezzanine tranches enhances capital structure flexibility by bridging the gap between secured debt and equity, impacting overall leverage and cost of capital.

Pros and Cons of Each Tranche Type

Senior tranche offers lower risk due to priority in payment and higher credit ratings, making it attractive to conservative investors, but it typically provides lower returns compared to mezzanine tranches. Mezzanine tranche carries higher risk as payments are subordinate to senior debt but ahead of equity, offering higher yields and potential for greater profits. The trade-off involves balancing risk and return, where senior tranches prioritize capital preservation while mezzanine tranches target enhanced income with increased exposure to credit events.

Senior tranche Infographic

libterm.com

libterm.com