Final incidence refers to the total number of new cases of a specific disease or condition that develop in a defined population during a set period. This metric is crucial for understanding the risk and spread of diseases, helping healthcare professionals and policymakers devise effective prevention strategies. Explore the rest of the article to learn how final incidence impacts public health planning and your community.

Table of Comparison

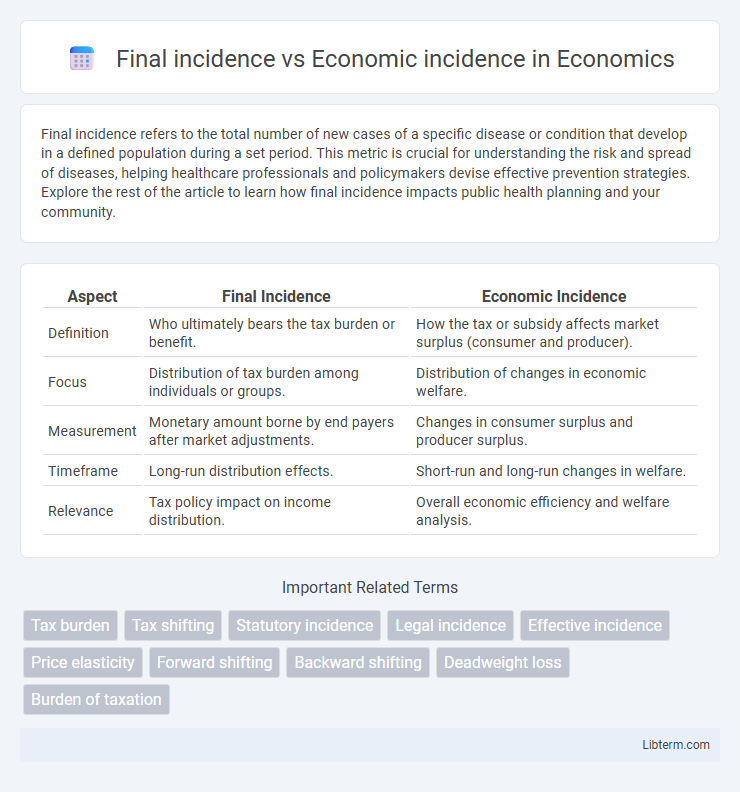

| Aspect | Final Incidence | Economic Incidence |

|---|---|---|

| Definition | Who ultimately bears the tax burden or benefit. | How the tax or subsidy affects market surplus (consumer and producer). |

| Focus | Distribution of tax burden among individuals or groups. | Distribution of changes in economic welfare. |

| Measurement | Monetary amount borne by end payers after market adjustments. | Changes in consumer surplus and producer surplus. |

| Timeframe | Long-run distribution effects. | Short-run and long-run changes in welfare. |

| Relevance | Tax policy impact on income distribution. | Overall economic efficiency and welfare analysis. |

Understanding Final Incidence and Economic Incidence

Final incidence refers to the ultimate burden of a tax or economic policy on the different stakeholders, determining who actually bears the cost after market adjustments. Economic incidence analyzes how the tax burden shifts between producers and consumers based on elasticity of supply and demand, influencing prices and quantities traded. Understanding these concepts reveals that the statutory payer of a tax may differ significantly from those who experience the financial impact, shaping effective fiscal policy decisions.

Key Definitions: Final vs Economic Incidence

Final incidence refers to the actual burden of a tax as borne by the end consumer who ultimately pays it through higher prices or reduced consumption. Economic incidence, on the other hand, analyzes how the tax burden is distributed between producers and consumers based on elasticity of supply and demand, regardless of who legally remits the tax to the government. Understanding the distinction is crucial for evaluating tax policies and their real impact on market participants and economic behavior.

The Importance of Incidence in Policy Analysis

Understanding final incidence and economic incidence is crucial in policy analysis as it reveals how taxes or subsidies ultimately affect different groups beyond legal tax burden. Economic incidence examines who really bears the cost or gains from a policy by analyzing market adjustments, while final incidence reflects the actual distribution of effects on consumers, producers, or workers. Accurate assessment of incidence informs efficient and equitable policy design by predicting behavioral responses and identifying unintended consequences.

Taxation: Who Really Bears the Burden?

Final incidence of taxation reveals who ultimately bears the economic burden of a tax, contrasting with statutory incidence, which identifies the initial taxpayer legally responsible. Economic incidence depends on supply and demand elasticities, determining how tax costs shift between producers and consumers, often resulting in a shared burden regardless of tax collection point. Understanding this distinction helps policymakers design equitable tax systems by predicting real-world impacts on income distribution and market behavior.

Shifting the Burden: Mechanisms and Examples

Final incidence refers to the distribution of a tax or cost after market adjustments, while economic incidence captures the initial burden before market responses. Shifting the burden occurs through mechanisms like price adjustments, supply and demand elasticity, and negotiation between producers and consumers. For example, a tax on producers may be partially passed to consumers via higher prices or absorbed by producers through lower profit margins, illustrating the dynamic nature of incidence shifting in economic markets.

Case Studies: Final vs Economic Incidence in Practice

Case studies analyzing final incidence versus economic incidence reveal the complexity of tax burden distribution among consumers and producers. For example, in markets with inelastic demand like gasoline, final incidence often falls heavily on consumers despite statutory tax obligations. Conversely, in more elastic markets such as luxury goods, producers may absorb more of the tax burden, demonstrating economic incidence diverging from statutory incidence.

Factors Influencing Economic Incidence

Economic incidence of a tax depends on factors such as price elasticity of demand and supply, market structure, and the ability of producers or consumers to shift the tax burden. When demand is inelastic relative to supply, consumers bear a greater share of the tax incidence, whereas more elastic demand shifts the burden toward producers. Market characteristics like competition level and availability of substitutes also critically influence how the economic incidence is distributed, regardless of the statutory or final incidence assigned by law.

Measuring Incidence: Tools and Approaches

Measuring final incidence and economic incidence involves analyzing how taxes or subsidies affect different stakeholders, such as consumers, producers, and workers. Tools like tax incidence models, elasticity analysis, and computable general equilibrium (CGE) models help estimate the distributional effects by assessing changes in prices, output, and income. Approaches often combine micro-level data on consumer and producer behavior with macroeconomic indicators to capture both direct and indirect incidence accurately.

Implications for Tax Policy and Social Equity

Final incidence determines who bears the actual economic burden of a tax, while economic incidence analyzes the shift in tax effects between consumers and producers. Understanding these distinctions is crucial for tax policy design to avoid unintended economic distortions and ensure equitable burden distribution across income groups. Effective tax policies must consider these incidences to promote social equity by minimizing regressive impacts and targeting resources towards vulnerable populations.

Final Thoughts: Bridging the Gap Between Final and Economic Incidence

Final incidence refers to who actually bears the economic burden of a tax or policy, while economic incidence examines the broader market adjustments and indirect effects influencing that burden. Understanding the interplay between final and economic incidence is crucial for accurate policy analysis, as it reveals who truly pays in practical terms beyond statutory obligations. Bridging this gap enables policymakers to design equitable interventions that consider both immediate and systemic impacts on consumers, producers, and the overall economy.

Final incidence Infographic

libterm.com

libterm.com