Monetary policy influences economic growth by controlling inflation and stabilizing currency values through interest rate adjustments and money supply regulation. Central banks implement these strategies to maintain price stability and support employment levels. Discover how these mechanisms impact Your financial decisions in the detailed article ahead.

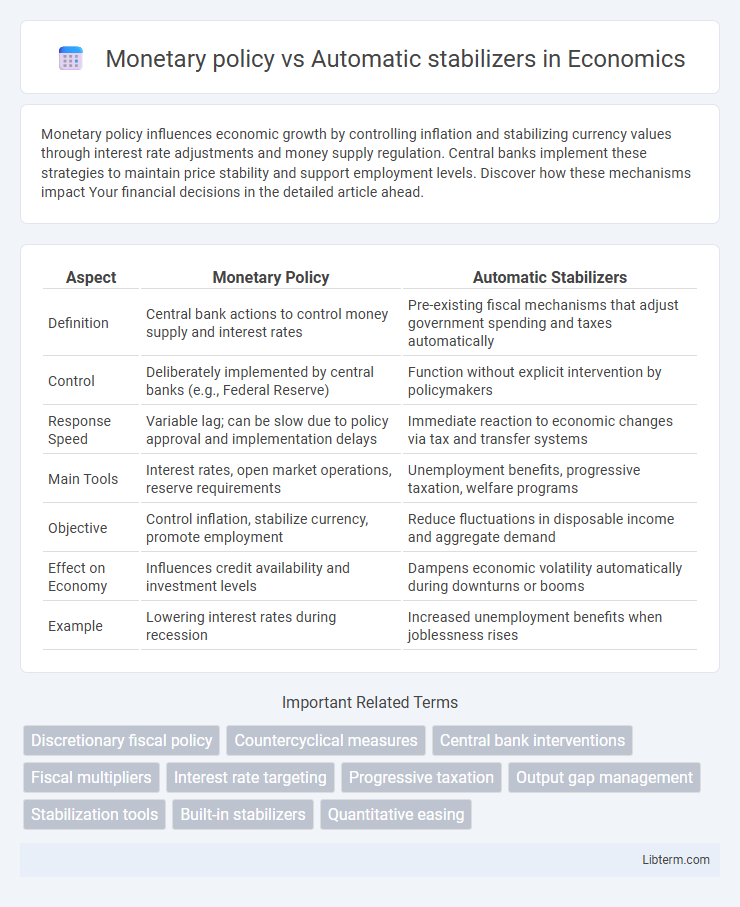

Table of Comparison

| Aspect | Monetary Policy | Automatic Stabilizers |

|---|---|---|

| Definition | Central bank actions to control money supply and interest rates | Pre-existing fiscal mechanisms that adjust government spending and taxes automatically |

| Control | Deliberately implemented by central banks (e.g., Federal Reserve) | Function without explicit intervention by policymakers |

| Response Speed | Variable lag; can be slow due to policy approval and implementation delays | Immediate reaction to economic changes via tax and transfer systems |

| Main Tools | Interest rates, open market operations, reserve requirements | Unemployment benefits, progressive taxation, welfare programs |

| Objective | Control inflation, stabilize currency, promote employment | Reduce fluctuations in disposable income and aggregate demand |

| Effect on Economy | Influences credit availability and investment levels | Dampens economic volatility automatically during downturns or booms |

| Example | Lowering interest rates during recession | Increased unemployment benefits when joblessness rises |

Introduction to Monetary Policy and Automatic Stabilizers

Monetary policy involves central banks adjusting interest rates and controlling money supply to influence economic activity and stabilize inflation. Automatic stabilizers are government programs like unemployment benefits and progressive taxes that naturally counterbalance economic fluctuations without explicit intervention. Both mechanisms play crucial roles in maintaining economic stability but operate through different channels and timing.

Defining Monetary Policy: Tools and Objectives

Monetary policy involves the regulation of money supply and interest rates by central banks to control inflation, stabilize currency, and promote economic growth. Key tools include open market operations, reserve requirements, and the discount rate, each influencing liquidity and borrowing costs within the economy. The primary objectives focus on achieving price stability, full employment, and sustainable economic growth, contrasting with automatic stabilizers that automatically moderate economic fluctuations without direct intervention.

What Are Automatic Stabilizers?

Automatic stabilizers are government programs and policies, such as unemployment benefits and progressive tax systems, that automatically adjust to economic fluctuations without direct intervention. They help stabilize the economy by increasing spending or decreasing taxes during recessions and doing the opposite in expansions, smoothing out economic cycles. Unlike monetary policy, which requires active decisions by central banks, automatic stabilizers function continuously and respond immediately to changes in economic conditions.

How Monetary Policy Influences the Economy

Monetary policy influences the economy primarily by controlling interest rates and money supply, which affects consumer spending, business investment, and inflation rates. Central banks adjust policy tools such as the federal funds rate to stimulate or cool down economic activity, thereby managing economic growth and employment levels. This targeted intervention contrasts with automatic stabilizers, which operate passively through taxation and government spending adjustments in response to economic fluctuations.

Role of Automatic Stabilizers in Economic Stability

Automatic stabilizers, such as unemployment benefits and progressive tax systems, play a critical role in maintaining economic stability by automatically increasing government spending or reducing tax burdens during economic downturns without the need for new legislative action. These mechanisms help smooth fluctuations in aggregate demand by supporting household incomes and consumption, thereby mitigating the severity of recessions and dampening inflationary pressures during booms. Unlike discretionary monetary policy, automatic stabilizers provide timely and continuous counter-cyclical support, enhancing overall economic resilience and stability.

Comparative Analysis: Active vs. Passive Economic Instruments

Monetary policy involves active interventions by central banks to influence interest rates and control money supply, directly impacting inflation and economic growth, while automatic stabilizers are passive fiscal mechanisms such as unemployment benefits and progressive taxes that automatically counterbalance economic fluctuations without new government action. Active monetary policies provide flexibility and timeliness but risk lag effects and policy misjudgments, whereas automatic stabilizers offer predictable, built-in economic cushioning with minimal administrative delay. Both instruments serve to stabilize economies, but monetary policy focuses on deliberate adjustments, and automatic stabilizers react instinctively to changes in economic activity.

Effectiveness during Economic Downturns

Monetary policy leverages central bank tools like interest rate adjustments and quantitative easing to influence economic activity quickly during downturns, promoting liquidity and encouraging investment. Automatic stabilizers such as unemployment benefits and progressive taxation provide immediate, built-in fiscal support without new legislation, cushioning income shocks and sustaining consumer demand. Monetary policy effectiveness depends on prevailing interest rates and financial conditions, while automatic stabilizers deliver consistent, countercyclical support, making both critical for stabilizing economies during recessions.

Limitations and Challenges of Each Approach

Monetary policy faces limitations such as time lags in implementation and effectiveness, potential inflationary pressures, and reduced impact during liquidity traps when interest rates are near zero. Automatic stabilizers encounter challenges including insufficient scope to fully counteract severe economic downturns and structural budget constraints that limit government spending flexibility. Both approaches require careful calibration to avoid unintended economic distortions and often cannot address supply-side issues effectively.

Complementary Roles in Modern Fiscal Policy

Monetary policy and automatic stabilizers play complementary roles in modern fiscal policy by stabilizing economic fluctuations through distinct mechanisms. Monetary policy, managed by central banks, adjusts interest rates and controls money supply to influence inflation and economic growth, while automatic stabilizers like unemployment benefits and progressive taxes automatically increase or decrease government spending without additional legislative action. Their coordination enhances economic stability by providing immediate fiscal relief during downturns and refining macroeconomic conditions through targeted monetary interventions.

Conclusion: Balancing Monetary Policy and Automatic Stabilizers

Balancing monetary policy and automatic stabilizers is crucial for effective economic management as monetary policy offers targeted interventions like adjusting interest rates, while automatic stabilizers provide immediate fiscal support through mechanisms such as unemployment benefits and progressive taxation. Coordinating these tools enhances economic stability by addressing both demand fluctuations and income distribution without excessive lag or politicization. Optimal outcomes arise when central banks and fiscal authorities align strategies to sustain growth and control inflation simultaneously.

Monetary policy Infographic

libterm.com

libterm.com