Ramsey pricing is an economic pricing strategy used to determine prices that maximize social welfare while covering costs, often applied in regulated industries with natural monopolies. This method sets higher prices for products with inelastic demand and lower prices for those with elastic demand, balancing efficiency and equity. Explore the rest of the article to understand how Ramsey pricing can impact your industry and decision-making processes.

Table of Comparison

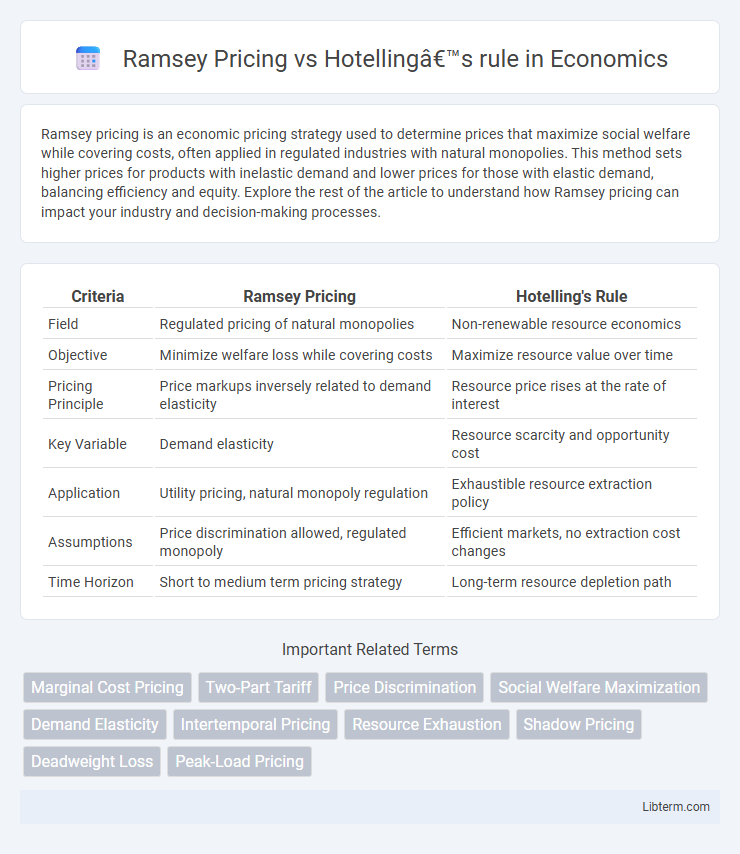

| Criteria | Ramsey Pricing | Hotelling's Rule |

|---|---|---|

| Field | Regulated pricing of natural monopolies | Non-renewable resource economics |

| Objective | Minimize welfare loss while covering costs | Maximize resource value over time |

| Pricing Principle | Price markups inversely related to demand elasticity | Resource price rises at the rate of interest |

| Key Variable | Demand elasticity | Resource scarcity and opportunity cost |

| Application | Utility pricing, natural monopoly regulation | Exhaustible resource extraction policy |

| Assumptions | Price discrimination allowed, regulated monopoly | Efficient markets, no extraction cost changes |

| Time Horizon | Short to medium term pricing strategy | Long-term resource depletion path |

Introduction to Ramsey Pricing and Hotelling’s Rule

Ramsey Pricing is an economic strategy designed to determine optimal prices for goods or services when marginal cost pricing is not feasible, aiming to minimize welfare loss by setting prices inversely proportional to price elasticities of demand. Hotelling's Rule relates to the optimal extraction rate of non-renewable resources, stating that the resource's price should increase at the rate of interest over time, reflecting scarcity and the opportunity cost of extraction. Both concepts play crucial roles in resource economics, with Ramsey Pricing addressing efficient pricing mechanisms and Hotelling's Rule guiding sustainable resource depletion.

Economic Context: Market Efficiency and Resource Allocation

Ramsey Pricing aims to maximize social welfare by setting prices above marginal cost for inelastic demand goods while covering fixed costs, improving market efficiency in regulated industries. Hotelling's rule guides resource allocation by predicting the optimal extraction path of non-renewable resources, ensuring intertemporal efficiency based on the resource's increasing scarcity value. Both principles address economic efficiency: Ramsey Pricing optimizes pricing structures to balance cost recovery and consumption, while Hotelling's rule allocates finite resources to maximize long-term economic value.

Theoretical Foundations: Ramsey Pricing Explained

Ramsey pricing is a regulatory framework designed to minimize welfare loss by setting prices inversely proportional to the price elasticity of demand, ensuring efficient resource allocation while covering fixed costs. It stems from welfare economics and optimal taxation theory, aiming to balance equity and efficiency in monopolistic markets. This contrasts with Hotelling's rule, which focuses on optimal extraction rates of non-renewable resources based on intertemporal price dynamics and scarcity rent.

Hotelling’s Rule: Principles and Application

Hotelling's Rule states that the price of a non-renewable resource should increase at the rate of interest over time, reflecting its scarcity and the opportunity cost of extraction. This principle guides optimal extraction paths by balancing current extraction profits against future resource values, ensuring intertemporal efficiency. In application, Hotelling's Rule helps policymakers and firms manage exhaustible resources like oil and minerals, aligning extraction rates with market and economic conditions to maximize long-term resource value.

Key Differences Between Ramsey Pricing and Hotelling’s Rule

Ramsey Pricing focuses on setting prices to maximize social welfare while covering costs in regulated industries, using demand elasticity to allocate markups efficiently, whereas Hotelling's Rule determines optimal resource extraction rates by equating the rate of resource price increase to the interest rate. Ramsey Pricing addresses pricing strategies for public utilities and services, emphasizing cost recovery and consumption efficiency, while Hotelling's Rule applies to non-renewable resource depletion, guiding intertemporal resource allocation. The key difference lies in Ramsey Pricing's emphasis on welfare-maximizing price structures for regulated goods, contrasted with Hotelling's focus on dynamic extraction rates to optimize resource scarcity over time.

Mathematical Formulations and Assumptions

Ramsey Pricing mathematically optimizes prices by minimizing welfare loss subject to a break-even constraint, expressed as \( \frac{p_i - c_i}{p_i} = \frac{\lambda}{| \epsilon_i |} \), where \( p_i \) is price, \( c_i \) is marginal cost, \( \lambda \) is a Lagrange multiplier, and \( \epsilon_i \) is demand elasticity. Hotelling's rule describes the optimal depletion path of non-renewable resources using \( \frac{dP}{dt} = rP \), where \( P \) is resource price and \( r \) is the interest rate, assuming profit maximization and competitive markets. Ramsey Pricing assumes homogeneous consumers with known elasticities and regulated monopolies, while Hotelling's rule assumes perfect foresight, fixed stock, and no technological change.

Practical Applications in Modern Markets

Ramsey Pricing is widely applied in regulated utilities and telecommunications to balance social welfare and cost recovery by setting prices inversely proportional to demand elasticity. Hotelling's rule guides resource extraction industries, optimizing non-renewable resource depletion by predicting price paths aligned with scarcity and interest rates. Both frameworks influence modern market strategies, with Ramsey Pricing informing tariff design and Hotelling's rule shaping investment and extraction policies in energy markets.

Implications for Policy and Regulation

Ramsey Pricing optimizes welfare by setting prices above marginal cost inversely proportional to demand elasticity, promoting efficient resource allocation in regulated monopolies to recover fixed costs while minimizing distortions. Hotelling's Rule guides intertemporal resource pricing, emphasizing the efficient depletion rate of non-renewable resources by equating resource price growth to the interest rate, which informs policies on sustainable extraction and long-term resource management. Policymakers must balance Ramsey's efficiency in cost recovery with Hotelling's directive on exhaustible resources to design regulations that ensure both economic efficiency and resource sustainability.

Challenges and Limitations of Each Approach

Ramsey Pricing faces challenges in accurately estimating demand elasticities and cost structures, leading to potential inefficiencies in setting optimal prices for public utilities. Hotelling's rule, which governs non-renewable resource extraction rates, assumes perfect market conditions and constant interest rates, which rarely reflect real-world complexities such as technological change and regulatory interventions. Both approaches struggle with uncertainties in dynamic market behaviors and fail to fully address environmental externalities or equity considerations in resource allocation.

Conclusion: Choosing Between Ramsey Pricing and Hotelling’s Rule

Choosing between Ramsey Pricing and Hotelling's Rule depends on the economic context and policy goals; Ramsey Pricing optimizes welfare by minimizing distortions in regulated monopoly pricing, while Hotelling's Rule guides optimal resource extraction by balancing current and future resource values. Regulatory frameworks targeting efficient infrastructure pricing should prioritize Ramsey Pricing for social welfare maximization. Resource management and extraction strategies benefit more from Hotelling's Rule to ensure intertemporal efficiency and sustainability.

Ramsey Pricing Infographic

libterm.com

libterm.com