Econometric analysis applies statistical methods to economic data, unveiling relationships and testing hypotheses that guide informed decision-making. By quantifying economic theories and assessing real-world trends, it empowers businesses and policymakers to anticipate market changes and optimize strategies. Explore the rest of the article to deepen your understanding of how econometric techniques can enhance your analytical skills.

Table of Comparison

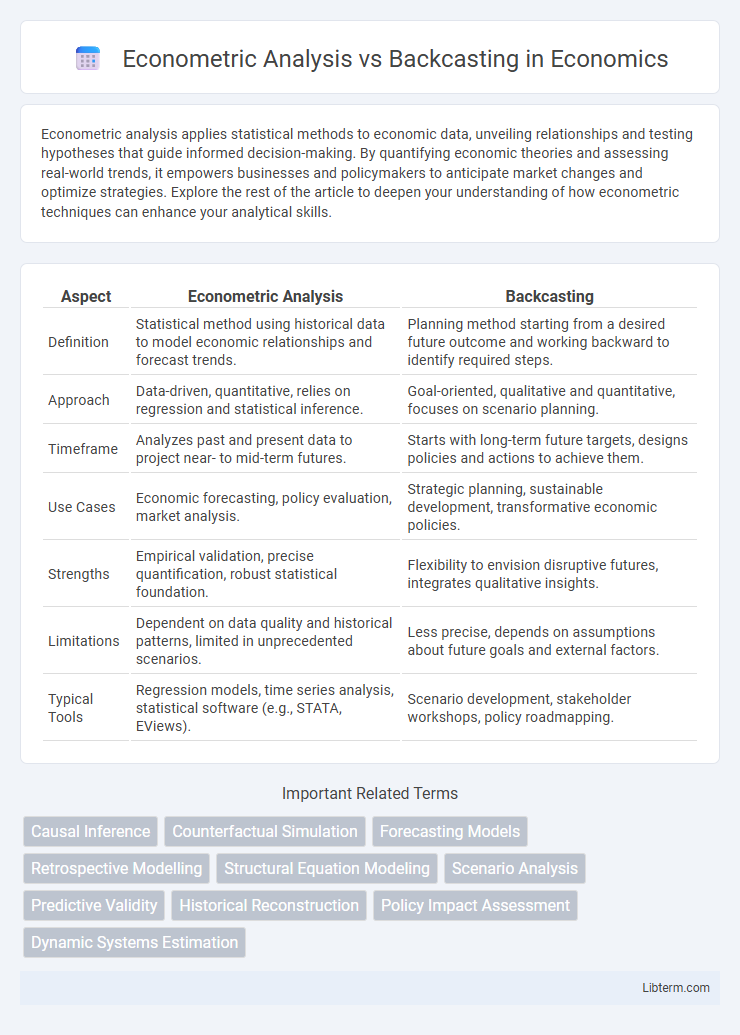

| Aspect | Econometric Analysis | Backcasting |

|---|---|---|

| Definition | Statistical method using historical data to model economic relationships and forecast trends. | Planning method starting from a desired future outcome and working backward to identify required steps. |

| Approach | Data-driven, quantitative, relies on regression and statistical inference. | Goal-oriented, qualitative and quantitative, focuses on scenario planning. |

| Timeframe | Analyzes past and present data to project near- to mid-term futures. | Starts with long-term future targets, designs policies and actions to achieve them. |

| Use Cases | Economic forecasting, policy evaluation, market analysis. | Strategic planning, sustainable development, transformative economic policies. |

| Strengths | Empirical validation, precise quantification, robust statistical foundation. | Flexibility to envision disruptive futures, integrates qualitative insights. |

| Limitations | Dependent on data quality and historical patterns, limited in unprecedented scenarios. | Less precise, depends on assumptions about future goals and external factors. |

| Typical Tools | Regression models, time series analysis, statistical software (e.g., STATA, EViews). | Scenario development, stakeholder workshops, policy roadmapping. |

Introduction to Econometric Analysis and Backcasting

Econometric analysis employs statistical methods to quantify economic relationships by using historical data to estimate model parameters and test hypotheses. Backcasting, in contrast, begins with defining a desired future outcome and works backward to identify the necessary steps and conditions to achieve that future scenario. While econometric analysis is data-driven and focused on explaining past and current trends, backcasting emphasizes strategic planning by envisioning targets and designing trajectories to reach those goals.

Key Concepts in Econometric Analysis

Econometric Analysis employs statistical methods to quantify relationships between economic variables, utilizing regression models to test hypotheses and forecast trends based on historical data. Key concepts include parameter estimation, hypothesis testing, and model specification, which ensure accurate representation of economic phenomena. This approach contrasts with Backcasting, which starts with defining a desired future and works backward to determine necessary actions.

Understanding the Backcasting Method

Backcasting is a strategic planning method that involves defining a desirable future scenario and then working backward to identify policies, actions, and steps needed to achieve that future. Unlike econometric analysis, which relies on historical data and statistical models to predict future trends, backcasting prioritizes normative goals and long-term vision over predictive accuracy. This method is particularly useful in sustainability planning and complex systems where future conditions may deviate significantly from past patterns.

Comparative Overview: Econometric Analysis vs Backcasting

Econometric analysis leverages historical data to build statistical models that forecast future economic trends by identifying relationships between variables, ensuring data-driven precision in projections. Backcasting, contrastingly, begins with defining a desired future scenario and works backward to identify policies or strategies necessary to achieve that outcome, emphasizing goal-oriented planning over predictive modeling. The key distinction lies in econometric analysis's reliance on past data correlations versus backcasting's strategic pathway design, making each method optimal for different decision-making contexts in economic planning and policy formulation.

Data Requirements and Sources for Both Approaches

Econometric analysis relies on large datasets from historical economic indicators, government databases, and financial market records to model relationships and forecast trends. Backcasting requires scenario-specific data, often gathered from expert judgments, policy documents, and qualitative sources to define future targets and identify pathways to achieve them. While econometric methods demand extensive time-series data for robust statistical inference, backcasting emphasizes context-driven, multidisciplinary information to create actionable strategies.

Methodological Differences Explained

Econometric analysis utilizes statistical methods and historical data to establish causal relationships and forecast future trends by estimating economic models, often relying on regression techniques. Backcasting starts with defining a desired future outcome or target and works backwards to identify the necessary steps and policies to achieve that future, emphasizing scenario planning rather than prediction. The methodological difference lies in econometrics' focus on empirical data-driven inference versus backcasting's normative approach that prioritizes strategic planning from a specified future state.

Strengths and Limitations of Econometric Analysis

Econometric analysis excels in quantifying relationships between variables using historical data, enabling precise forecasting and hypothesis testing through statistical models such as regression analysis. Its strengths lie in rigorous data-driven insights and the ability to control for confounding variables, but it faces limitations including sensitivity to data quality, assumptions of model specification, and challenges in capturing structural changes or non-linear dynamics. Unlike backcasting, which operates from desired future outcomes backward, econometric analysis primarily relies on past and present data, potentially limiting its effectiveness in long-term strategic planning under unprecedented scenarios.

Pros and Cons of Backcasting in Practice

Backcasting offers the advantage of starting with a desired future outcome and working backward to identify necessary steps, fostering innovative and goal-oriented planning. However, its reliance on scenario assumptions can lead to subjective bias and less precise quantitative predictions compared to econometric analysis, which uses historical data for more statistically robust forecasts. In practice, backcasting's flexibility benefits long-term strategic planning but may pose challenges in validation and empirical rigor.

Practical Applications and Case Studies

Econometric analysis uses statistical methods to quantify relationships between economic variables, making it invaluable for delivering data-driven insights in market forecasting and policy evaluation, as seen in case studies on inflation prediction and labor market dynamics. Backcasting focuses on setting goals and working backwards to identify necessary steps, proving effective in sustainable urban planning and energy transition projects where future targets guide present actions. Practical applications demonstrate econometric models' strength in analyzing historical data patterns, while backcasting excels in strategic scenario development for long-term planning and decision-making.

Choosing the Right Approach for Economic Forecasting

Econometric analysis relies on historical data and statistical models to predict future economic trends, making it suitable for analyzing relationships among variables with quantifiable data. Backcasting starts from a desired future outcome and works backward to identify policies or actions needed to achieve that target, ideal for strategic planning under uncertainty. Choosing the right approach depends on the forecast's purpose: econometric analysis suits data-driven projections, while backcasting is preferable for goal-oriented scenarios requiring policy evaluation.

Econometric Analysis Infographic

libterm.com

libterm.com