The auction market is a dynamic platform where buyers and sellers actively compete by placing bids, determining the final price through supply and demand. This market structure enhances price transparency and allows real-time evaluation of asset value, making it essential for commodities, art, and real estate. Discover how understanding the auction market can optimize Your buying or selling strategy by reading the full article.

Table of Comparison

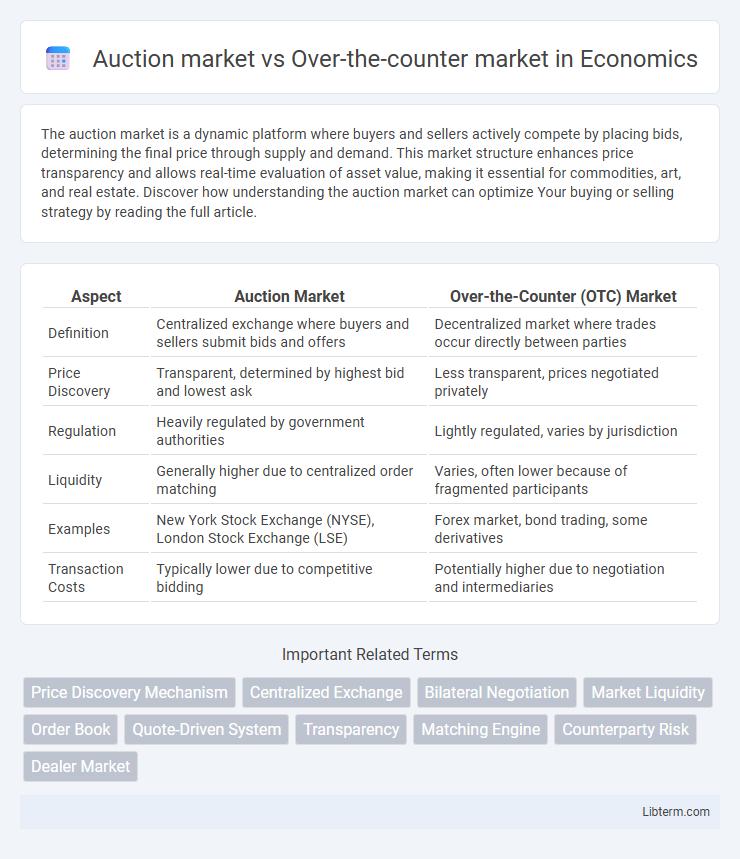

| Aspect | Auction Market | Over-the-Counter (OTC) Market |

|---|---|---|

| Definition | Centralized exchange where buyers and sellers submit bids and offers | Decentralized market where trades occur directly between parties |

| Price Discovery | Transparent, determined by highest bid and lowest ask | Less transparent, prices negotiated privately |

| Regulation | Heavily regulated by government authorities | Lightly regulated, varies by jurisdiction |

| Liquidity | Generally higher due to centralized order matching | Varies, often lower because of fragmented participants |

| Examples | New York Stock Exchange (NYSE), London Stock Exchange (LSE) | Forex market, bond trading, some derivatives |

| Transaction Costs | Typically lower due to competitive bidding | Potentially higher due to negotiation and intermediaries |

Introduction: Understanding Financial Market Structures

Auction markets and over-the-counter (OTC) markets represent distinct financial market structures where securities are traded. Auction markets, exemplified by stock exchanges like the New York Stock Exchange, centralize buyers and sellers to facilitate transparent price discovery through competitive bidding. In contrast, OTC markets operate via decentralized networks of dealers who negotiate directly, offering greater flexibility but often less transparency in pricing.

Defining Auction Markets

Auction markets are centralized platforms where buyers and sellers submit competitive bids and offers, enabling prices to be determined through direct interaction and transparency. These markets facilitate price discovery by matching orders in real-time, with stock exchanges like the New York Stock Exchange exemplifying this system. The transparency and liquidity of auction markets contrast with the decentralized, negotiated nature of over-the-counter (OTC) markets.

What Are Over-the-Counter (OTC) Markets?

Over-the-counter (OTC) markets are decentralized trading venues where securities, commodities, or derivatives are traded directly between parties without a centralized exchange. These markets facilitate the trading of assets such as stocks of smaller companies, bonds, and foreign currencies through broker-dealers, offering greater flexibility but less transparency compared to auction markets. OTC markets play a crucial role in providing liquidity and access for instruments that may not meet exchange listing requirements or prefer private negotiation.

Key Differences Between Auction and OTC Markets

Auction markets operate through centralized exchanges where buyers and sellers place competitive bids and offers, ensuring transparent price discovery and standardized contracts. Over-the-counter (OTC) markets involve direct trading between parties without centralized exchanges, allowing for customized contracts but with less price transparency and higher counterparty risk. Auction markets typically feature higher liquidity and regulatory oversight compared to OTC markets' flexibility and decentralized nature.

Price Discovery Mechanisms

Auction markets facilitate price discovery through centralized bidding where buyers and sellers interact directly, resulting in transparent and competitive price determination. Over-the-counter (OTC) markets rely on decentralized negotiation between parties, often involving dealers who quote prices based on supply and demand, leading to less price transparency. The auction market's open order book fosters more efficient and accurate price discovery compared to the OTC market's reliance on private transactions and dealer inventories.

Liquidity Comparison: Auction vs OTC

Auction markets typically offer higher liquidity due to centralized trading platforms where multiple buyers and sellers converge, facilitating faster price discovery and order execution. Over-the-counter (OTC) markets exhibit lower liquidity as transactions occur directly between parties without a centralized exchange, often resulting in wider bid-ask spreads and less transparent pricing. Consequently, auction markets generally provide more efficient trading environments, while OTC markets accommodate customized, less liquid transactions.

Regulation and Transparency

Auction markets operate under stringent regulatory frameworks imposed by entities like the SEC, ensuring high transparency through centralized order books where prices and trades are publicly visible. Over-the-counter (OTC) markets are less regulated, with transactions conducted directly between parties, resulting in lower transparency and limited public information on pricing and trade volumes. Regulatory oversight in auction markets enhances investor protection, while OTC markets carry higher counterparty risk due to their decentralized and opaque nature.

Participant Types and Market Access

Auction markets involve centralized platforms where multiple buyers and sellers, including institutional investors and individual traders, participate openly with transparent price discovery. Over-the-counter (OTC) markets consist of decentralized networks where dealers and market makers facilitate transactions, primarily including institutional investors and large corporations with negotiated prices. Access to auction markets typically requires brokerage accounts with regulated exchanges, while OTC markets often demand specialized relationships and higher entry thresholds for direct dealings.

Risks Involved in Each Market

Auction markets involve centralized trading with transparent price discovery but carry risks such as potential price manipulation during volatile conditions and limited access for smaller investors. Over-the-counter (OTC) markets, characterized by decentralized trading and less regulation, face higher counterparty risk and reduced liquidity, leading to increased chances of price discrepancies and default. Understanding these risks is vital for investors to navigate market dynamics effectively and mitigate potential financial losses.

Which Market Is Right for You?

Choosing between an auction market and an over-the-counter (OTC) market depends on your investment preferences and risk tolerance. Auction markets, such as stock exchanges, offer transparent pricing and high liquidity, ideal for investors seeking real-time pricing and ease of trade execution. OTC markets suit investors comfortable with less transparency and higher risks, often dealing with smaller, less liquid securities or niche investments.

Auction market Infographic

libterm.com

libterm.com