Borrowing allows individuals and businesses to access funds for investments, purchases, or emergencies without immediate full payment. It can help improve cash flow, build credit history, and enable the acquisition of assets that generate future income. Discover how borrowing can impact your financial strategy and learn key tips to manage loans responsibly in the rest of this article.

Table of Comparison

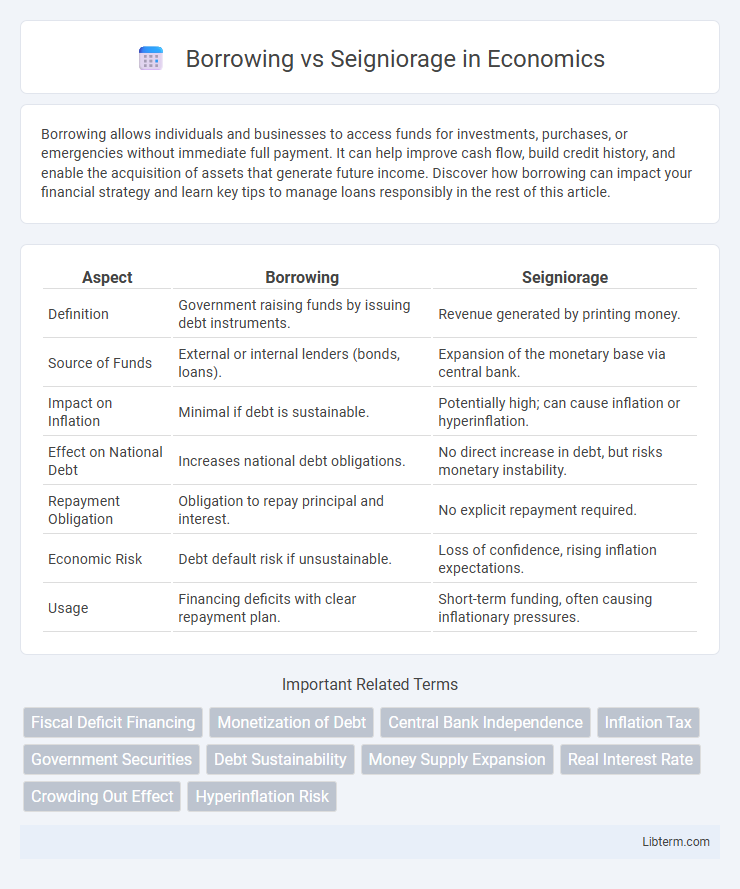

| Aspect | Borrowing | Seigniorage |

|---|---|---|

| Definition | Government raising funds by issuing debt instruments. | Revenue generated by printing money. |

| Source of Funds | External or internal lenders (bonds, loans). | Expansion of the monetary base via central bank. |

| Impact on Inflation | Minimal if debt is sustainable. | Potentially high; can cause inflation or hyperinflation. |

| Effect on National Debt | Increases national debt obligations. | No direct increase in debt, but risks monetary instability. |

| Repayment Obligation | Obligation to repay principal and interest. | No explicit repayment required. |

| Economic Risk | Debt default risk if unsustainable. | Loss of confidence, rising inflation expectations. |

| Usage | Financing deficits with clear repayment plan. | Short-term funding, often causing inflationary pressures. |

Introduction to Borrowing and Seigniorage

Borrowing involves governments raising funds by issuing debt instruments such as bonds, which must be repaid with interest, impacting national debt and fiscal sustainability. Seigniorage refers to the revenue generated by a government through the creation of money, often resulting in inflation if overused. Understanding the balance between borrowing and seigniorage is crucial for effective monetary policy and economic stability.

Defining Borrowing in Public Finance

Borrowing in public finance refers to the government obtaining funds by issuing debt instruments such as bonds or treasury bills to finance budget deficits without raising taxes. It involves a commitment to repay the principal amount along with interest over a specified period, impacting future fiscal policy and debt sustainability. Unlike seigniorage, which generates revenue through money creation and potential inflation, borrowing relies on market-based financing mechanisms.

Understanding Seigniorage: Concept and Mechanism

Seigniorage refers to the profit a government earns by issuing currency, specifically the difference between the face value of money and its production cost, which serves as a non-tax revenue source. This mechanism enables central banks to finance public spending by increasing the money supply, although excessive seigniorage can lead to inflationary pressures. Understanding seigniorage requires analyzing its impact on monetary policy, inflation rates, and the trade-offs between currency issuance and economic stability.

Historical Context: Borrowing vs Seigniorage

Historically, governments have relied on borrowing through issuing bonds and seigniorage by printing currency as key methods to finance deficits. During periods such as the Great Depression and World War II, borrowing surged to support large-scale public expenditures while excessive reliance on seigniorage, notably in hyperinflation episodes like Weimar Germany, led to severe inflationary consequences. The choice between borrowing and seigniorage has often depended on economic conditions, debt sustainability, and monetary policy frameworks.

Economic Implications of Government Borrowing

Government borrowing increases national debt, leading to higher future interest obligations and potential crowding out of private investment, which can hinder long-term economic growth. Seigniorage, or money creation, may cause inflationary pressures by increasing the money supply without corresponding economic output. Economically, borrowing provides immediate resources without causing inflation but risks sustainability, while seigniorage offers short-term fiscal relief at the potential cost of diminished currency value and economic stability.

Seigniorage and Its Impact on Inflation

Seigniorage refers to the profit that a government earns by issuing currency, especially when the face value of money exceeds its production cost. This process effectively increases the money supply, often leading to inflationary pressures as more currency chases the same amount of goods and services. Unlike borrowing, which involves future repayment obligations, seigniorage can cause a direct rise in inflation, eroding purchasing power and potentially destabilizing the economy if overused.

Comparative Advantages and Disadvantages

Borrowing enables governments to raise large sums of capital quickly but increases future debt obligations and interest payments, potentially leading to fiscal strain. Seigniorage generates revenue by creating money, avoiding direct debt but risking inflation and currency devaluation if overused. The comparative advantage of borrowing lies in maintaining monetary stability, while seigniorage offers immediate fiscal relief without increasing nominal liabilities.

Policy Considerations: When to Borrow or Use Seigniorage

Governments should consider borrowing when long-term investments are expected to generate higher future returns than the cost of debt, preserving currency stability and avoiding inflationary pressures associated with seigniorage. Seigniorage is more viable when immediate liquidity is needed, but excessive reliance risks accelerating inflation and undermining monetary credibility. Policy decisions balance fiscal sustainability, inflation targeting, and market confidence to determine the optimal mix of debt issuance and money creation.

Global Case Studies: Borrowing vs Seigniorage in Practice

Global case studies reveal contrasting fiscal strategies where countries like the United States rely heavily on borrowing to finance deficits, leading to significant national debt accumulation, while Zimbabwe's extensive use of seigniorage triggered hyperinflation and economic instability. Economies such as Japan demonstrate the sustainable use of borrowing through low-interest rates and strong credit markets, whereas Venezuela's overdependence on seigniorage caused currency devaluation and loss of public trust. These examples underscore the importance of balancing borrowing and seigniorage, highlighting borrowing's potential for controlled growth against seigniorage's risk of inflationary spirals.

Conclusion: Balancing Fiscal Tools for Sustainable Growth

Balancing borrowing and seigniorage as fiscal tools requires careful consideration of long-term economic stability and inflation control. Excessive reliance on borrowing can lead to unsustainable debt levels, while unchecked seigniorage risks hyperinflation and currency depreciation. A strategic mix, aligned with fiscal responsibility and monetary policy objectives, supports sustainable growth and financial resilience.

Borrowing Infographic

libterm.com

libterm.com