Political risk refers to the potential for losses or adverse effects on investments and business operations due to changes or instability in a country's political environment. This risk can arise from government actions, regulatory changes, civil unrest, or geopolitical tensions, impacting market confidence and economic stability. Understanding political risk is crucial for protecting your assets and making informed decisions; explore the rest of this article to learn how to assess and manage these challenges effectively.

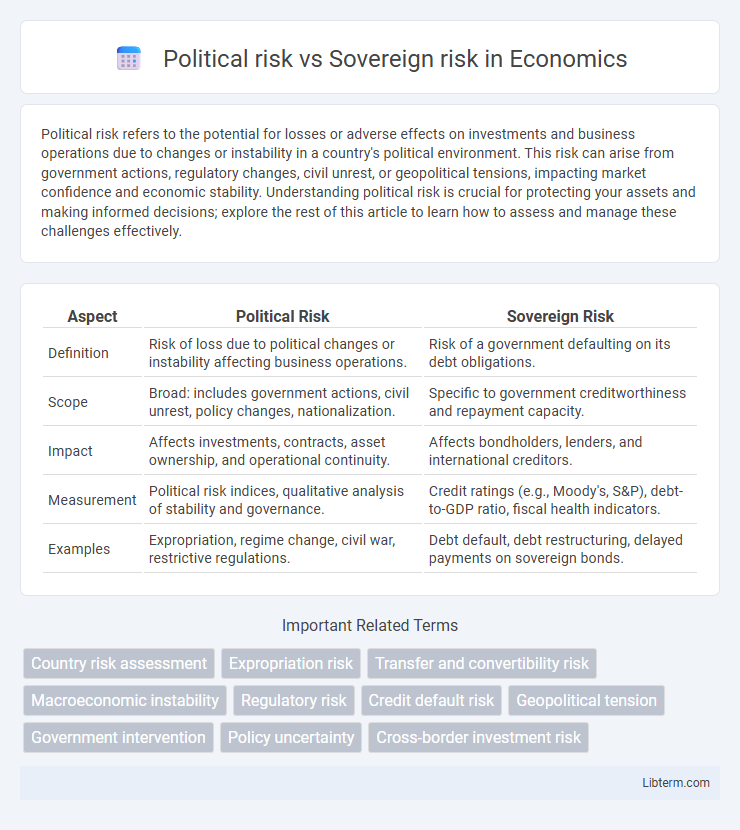

Table of Comparison

| Aspect | Political Risk | Sovereign Risk |

|---|---|---|

| Definition | Risk of loss due to political changes or instability affecting business operations. | Risk of a government defaulting on its debt obligations. |

| Scope | Broad: includes government actions, civil unrest, policy changes, nationalization. | Specific to government creditworthiness and repayment capacity. |

| Impact | Affects investments, contracts, asset ownership, and operational continuity. | Affects bondholders, lenders, and international creditors. |

| Measurement | Political risk indices, qualitative analysis of stability and governance. | Credit ratings (e.g., Moody's, S&P), debt-to-GDP ratio, fiscal health indicators. |

| Examples | Expropriation, regime change, civil war, restrictive regulations. | Debt default, debt restructuring, delayed payments on sovereign bonds. |

Introduction to Political Risk and Sovereign Risk

Political risk refers to the uncertainty businesses and investors face due to changes in government policies, political instability, or social unrest that can affect the profitability or operations in a country. Sovereign risk specifically involves the possibility that a government will default on its debt obligations or fail to meet financial commitments, impacting creditors and investors in sovereign bonds. Understanding the distinctions helps in assessing how political events influence economic stability and investment security in emerging and developed markets.

Defining Political Risk

Political risk refers to the likelihood that political decisions, events, or conditions in a country will adversely affect the profitability or sustainability of an investment. This includes risks such as changes in government, regulatory shifts, expropriation, civil unrest, and corruption. Unlike sovereign risk, which pertains specifically to a government's ability to meet its debt obligations, political risk encompasses broader uncertainties related to the political environment that can impact both public and private sector investments.

Defining Sovereign Risk

Sovereign risk refers to the possibility that a government will default on its debt obligations, driven by factors such as economic instability, political turmoil, or changes in fiscal policy. Unlike broader political risk, which encompasses events like expropriation, nationalization, or civil unrest affecting investments, sovereign risk specifically targets a nation's ability and willingness to fulfill its debt commitments. Credit rating agencies and investors closely monitor sovereign risk to assess the likelihood of government bond defaults and the potential impact on international financial markets.

Key Differences Between Political and Sovereign Risk

Political risk refers to the likelihood of losses due to changes in government policies, political instability, or social unrest that affect business operations or investments. Sovereign risk specifically involves the risk that a government will default on its debt obligations or fail to meet financial commitments. Key differences include political risk's broader scope covering policy changes and instability, while sovereign risk focuses narrowly on a government's creditworthiness and ability to repay debt.

Common Sources of Political Risk

Common sources of political risk include government instability, expropriation of assets, and adverse regulatory changes impacting foreign investments. Sovereign risk specifically focuses on a country's inability or unwillingness to meet its debt obligations, often linked to economic mismanagement or fiscal deficits. Political risk encompasses broader uncertainties like civil unrest, nationalism, or trade restrictions that can disrupt business operations or affect financial returns.

Common Sources of Sovereign Risk

Common sources of sovereign risk include political instability, economic mismanagement, and changes in government policy that affect debt repayment capacity and regulatory environments. Currency inconvertibility and expropriation are also significant factors that can lead to default or restrictions on external payments. These risks often stem from broader political risk but specifically impact the sovereign's ability to meet its financial obligations.

Measuring and Assessing Risks

Political risk involves evaluating factors like government stability, policy changes, and regulatory shifts that could impact investments, while sovereign risk focuses on a country's ability and willingness to repay debt obligations. Measuring political risk often includes qualitative analysis of political events, public sentiment, and geopolitical tensions, whereas sovereign risk assessment relies heavily on quantitative financial indicators such as credit ratings, debt-to-GDP ratios, and fiscal deficits. Both risks require continuous monitoring through risk metrics, scenario analysis, and expert judgment to inform investment decisions and risk mitigation strategies.

Impacts on International Investments

Political risk affects international investments by creating uncertainties through government actions such as expropriation, regulatory changes, or political instability, potentially leading to financial losses or operational disruptions. Sovereign risk specifically pertains to a country's ability and willingness to meet its debt obligations, influencing international lenders and investors' confidence in sovereign bonds or state-guaranteed projects. Both risks directly impact capital allocation, investment returns, and risk assessment strategies in cross-border financial activities.

Risk Mitigation Strategies

Effective risk mitigation strategies for political risk often involve diversification of investment locations, securing political risk insurance, and engaging in thorough stakeholder analysis to anticipate regulatory changes. Sovereign risk mitigation techniques include negotiating debt restructuring agreements, conducting rigorous credit risk assessments, and fostering diplomatic relations to reduce the likelihood of default. Employing comprehensive risk management frameworks tailored to the specific nature of political and sovereign uncertainties enhances resilience and safeguards investment returns.

Conclusion: Navigating Political and Sovereign Risks

Effective management of political risk and sovereign risk requires thorough analysis of geopolitical dynamics, economic stability, and regulatory environments in target countries. Investors and multinational corporations should implement robust risk mitigation strategies, including diversification, political risk insurance, and proactive engagement with local stakeholders. Understanding the nuances between political disruptions and sovereign debt obligations enables more informed decision-making and sustainable international investments.

Political risk Infographic

libterm.com

libterm.com