The Harrod-Domar growth model emphasizes the critical role of savings and investment in driving economic growth, highlighting how increased capital accumulation can boost production capacity. It helps explain the relationship between economic output, capital stock, and the rate of growth, providing insight into why some economies expand faster than others. Discover how this model applies to your economic understanding by exploring the rest of the article.

Table of Comparison

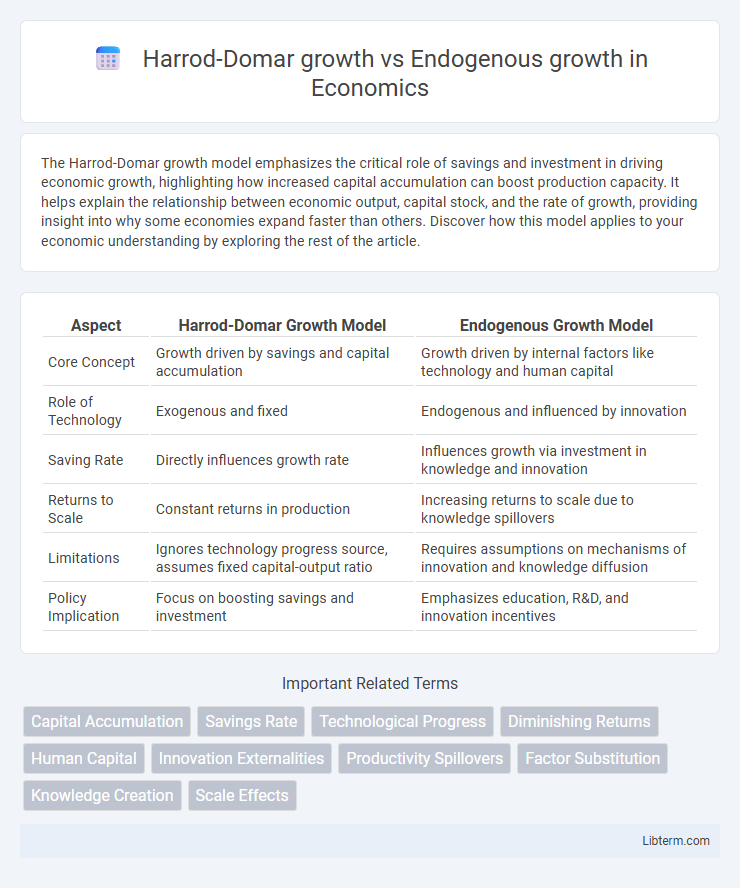

| Aspect | Harrod-Domar Growth Model | Endogenous Growth Model |

|---|---|---|

| Core Concept | Growth driven by savings and capital accumulation | Growth driven by internal factors like technology and human capital |

| Role of Technology | Exogenous and fixed | Endogenous and influenced by innovation |

| Saving Rate | Directly influences growth rate | Influences growth via investment in knowledge and innovation |

| Returns to Scale | Constant returns in production | Increasing returns to scale due to knowledge spillovers |

| Limitations | Ignores technology progress source, assumes fixed capital-output ratio | Requires assumptions on mechanisms of innovation and knowledge diffusion |

| Policy Implication | Focus on boosting savings and investment | Emphasizes education, R&D, and innovation incentives |

Overview of Harrod-Domar Growth Theory

The Harrod-Domar Growth Theory emphasizes the relationship between savings, investment, and economic growth, positing that economic expansion depends on a fixed capital-output ratio and the savings rate. It highlights the instability of growth due to the potential mismatch between planned investment and savings, leading to cycles of inflation or recession. This model contrasts with endogenous growth theories that incorporate technological progress and human capital as internal drivers of sustained long-term growth.

Key Assumptions of Harrod-Domar Model

The Harrod-Domar growth model assumes a fixed capital-output ratio and a constant savings rate, emphasizing the role of investment in driving economic growth. It presumes that growth is constrained by the available balance between savings and investment, leading to potential instability and divergence from steady growth paths. Unlike endogenous growth models, it does not incorporate technological change or human capital as internal factors influencing long-term growth.

Limitations of Harrod-Domar Growth Theory

Harrod-Domar Growth Theory is limited by its reliance on fixed capital-output ratios and the assumption of constant savings rates, which restricts its applicability in dynamic economies with technological change. It fails to incorporate the role of human capital, innovation, and knowledge spillovers that are central to Endogenous Growth Theory, resulting in an incomplete explanation of sustained economic growth. The model also overlooks the impact of institutional factors and productivity improvements, which Endogenous Growth models address by emphasizing internal mechanisms driving innovation and long-term growth.

Introduction to Endogenous Growth Theory

Endogenous growth theory emphasizes the role of internal factors such as human capital, innovation, and knowledge spillovers in driving long-term economic growth, contrasting with the Harrod-Domar model which highlights savings and capital accumulation as the primary growth engines. Unlike the Harrod-Domar framework's assumption of exogenous technological progress, endogenous growth theory incorporates technology as an outcome of economic activity, enabling sustained increasing returns to scale. Key contributors like Paul Romer and Robert Lucas developed models where investment in research and development and education directly influence the growth rate, providing a more dynamic and realistic understanding of economic expansion.

Assumptions Driving Endogenous Growth Model

The Harrod-Domar growth model assumes fixed savings rates and capital-output ratios, emphasizing external factors for economic growth constraints. In contrast, the endogenous growth model is driven by assumptions of constant returns to scale in knowledge and human capital, where innovation and technology are generated within the economy. Endogenous growth highlights the role of investments in research and development, human capital accumulation, and knowledge spillovers as key drivers for sustained economic expansion.

Comparative Analysis: Harrod-Domar vs Endogenous Growth

The Harrod-Domar growth model emphasizes the roles of savings and capital accumulation as primary drivers of economic growth, assuming a fixed production function and constant returns to scale. In contrast, endogenous growth theory highlights innovation, knowledge spillovers, and human capital as intrinsic factors that fuel growth from within the economy, allowing for sustained increases without diminishing returns. While Harrod-Domar predicts steady-state growth constrained by capital and savings rates, endogenous growth models explain persistent growth through technological progress and investment in intangible assets.

Role of Technology and Innovation in Economic Growth

The Harrod-Domar growth model emphasizes capital accumulation as the primary driver of economic growth, with technology considered exogenous and constant, limiting its role in sustaining long-term growth. In contrast, Endogenous growth theory highlights technology and innovation as central, endogenous factors generated by investments in human capital, research and development, and knowledge spillovers, driving continual increases in productivity. Innovation actively shapes economic growth by fostering technological advancements that enhance capital efficiency and create new growth opportunities over time.

Policy Implications of Growth Theories

Harrod-Domar growth model emphasizes investment-driven output growth, suggesting policies should focus on increasing savings and capital accumulation to sustain economic expansion. In contrast, Endogenous growth theory highlights the role of human capital, innovation, and knowledge spillovers, advocating for policies that promote education, research and development, and technological progress. These distinctions guide governments to design tailored interventions: Harrod-Domar favors capital stock expansion, while Endogenous models support fostering innovation ecosystems and continuous skill enhancement.

Empirical Evidence Supporting Each Model

Empirical evidence for the Harrod-Domar model often highlights the critical role of savings and investment rates in driving economic growth, particularly in developing economies where capital accumulation constraints are prominent. Studies supporting endogenous growth theory emphasize the importance of technological innovation, human capital development, and knowledge spillovers as key drivers of sustained long-term growth beyond basic capital accumulation. Cross-country regressions and panel data analyses reveal that while the Harrod-Domar model explains short-term growth patterns, endogenous growth mechanisms better capture persistent growth differentials linked to innovation and education.

Future Directions in Economic Growth Research

Future directions in economic growth research emphasize integrating Harrod-Domar's emphasis on capital accumulation with Endogenous growth models that highlight innovation, human capital, and technological change. Advances in understanding the role of knowledge spillovers, R&D investment, and policy frameworks aim to enhance long-term sustainable growth predictions. Research increasingly focuses on combining macroeconomic factors with micro-level innovation dynamics to develop more comprehensive growth theories.

Harrod-Domar growth Infographic

libterm.com

libterm.com