Non-superneutrality challenges the traditional assumption that money supply changes only affect nominal variables without impacting real economic outcomes. This concept highlights that variations in monetary policy can influence employment, output, and consumption behavior over time. Discover how understanding non-superneutrality can transform Your perspective on monetary effects in the economy by reading the rest of this article.

Table of Comparison

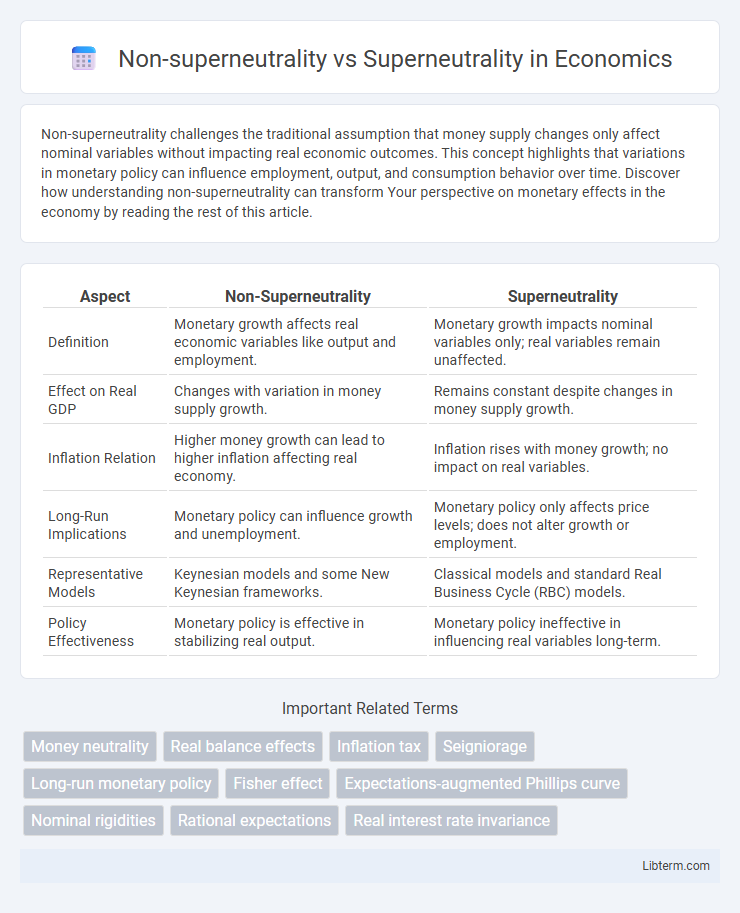

| Aspect | Non-Superneutrality | Superneutrality |

|---|---|---|

| Definition | Monetary growth affects real economic variables like output and employment. | Monetary growth impacts nominal variables only; real variables remain unaffected. |

| Effect on Real GDP | Changes with variation in money supply growth. | Remains constant despite changes in money supply growth. |

| Inflation Relation | Higher money growth can lead to higher inflation affecting real economy. | Inflation rises with money growth; no impact on real variables. |

| Long-Run Implications | Monetary policy can influence growth and unemployment. | Monetary policy only affects price levels; does not alter growth or employment. |

| Representative Models | Keynesian models and some New Keynesian frameworks. | Classical models and standard Real Business Cycle (RBC) models. |

| Policy Effectiveness | Monetary policy is effective in stabilizing real output. | Monetary policy ineffective in influencing real variables long-term. |

Understanding the Concept of Money Neutrality

Non-superneutrality describes the economic condition where changes in the growth rate of the money supply affect real variables like output and employment, contrasting with superneutrality, which posits that only the money supply level, not its growth rate, influences nominal variables such as prices. Understanding money neutrality involves recognizing that in superneutrality, real economic outcomes remain unaffected by monetary policy variations, while non-superneutrality suggests monetary policy can have lasting real effects. Empirical evidence often supports non-superneutrality in the short run, indicating monetary growth rates influence economic performance beyond mere price levels.

Defining Superneutrality and Non-Superneutrality

Superneutrality refers to a property in monetary economics where changes in the growth rate of the money supply affect only nominal variables, leaving real variables like output and employment unchanged in the long run. Non-superneutrality occurs when variations in money growth influence both nominal and real economic variables, indicating that monetary policy can have lasting real effects. Understanding the distinction helps policymakers evaluate the effectiveness of monetary interventions on real economic performance versus price levels.

Historical Background of Monetary Theories

Non-superneutrality and superneutrality of money represent contrasting views within the historical development of monetary theories, particularly during the 20th century. Non-superneutrality suggests that changes in the money supply can affect real economic variables such as output and employment, a perspective rooted in Keynesian economics and supported by empirical observations during periods like the Great Depression. Superneutrality, advocated by classical and some new classical economists, posits that long-term changes in the money growth rate do not influence real variables, reflecting theories developed in the classical dichotomy and quantity theory of money that emphasized monetary neutrality in the long run.

Key Differences Between Superneutrality and Non-superneutrality

Non-superneutrality occurs when nominal interest rates influence real economic variables such as output and employment, reflecting rigidities or frictions in price and wage adjustments. Superneutrality implies that changes in the nominal interest rate or money supply growth rate have no long-term effect on real variables, with neutral impacts confined solely to price levels and inflation rates. The key difference lies in the presence of real effects from nominal changes: superneutrality assumes that real economic activity remains unaffected by monetary policy over time, while non-superneutrality highlights persistent real impacts driven by market imperfections or adjustment costs.

The Role of Money in Economic Growth

Non-superneutrality occurs when changes in the money supply affect real economic variables such as output and growth, indicating that money has a significant role in influencing economic productivity and long-term growth rates. In contrast, superneutrality implies that variations in the money supply only impact nominal variables like price levels or inflation, leaving real growth and output unchanged, thereby diminishing money's influence on economic development. Empirical evidence often supports non-superneutrality, highlighting that monetary policy and inflation can alter investment decisions, capital accumulation, and productivity, which ultimately affect economic growth trajectories.

Short-Run vs Long-Run Effects of Money Supply

Non-superneutrality occurs when changes in the money supply affect real variables in the short run, such as output and employment, before prices and wages fully adjust. In contrast, superneutrality implies that changes in the growth rate of money supply do not impact real economic activity even in the long run, affecting only nominal variables like inflation. Empirical evidence supports non-superneutrality in the short run due to sticky prices, while many models show superneutrality holds in the long run as markets adjust and real variables return to natural levels.

Policy Implications: Central Bank Strategies

Non-superneutrality implies that changes in money supply affect real economic variables, requiring central banks to carefully adjust monetary policy to manage inflation and output. In contrast, superneutrality suggests that long-term money supply variations do not impact real economic outcomes, allowing central banks to focus primarily on price stability without altering real growth or employment. Central bank strategies under non-superneutrality prioritize active intervention to stabilize economic fluctuations, while superneutrality supports more passive, rule-based approaches emphasizing nominal stability.

Empirical Evidence: Case Studies and Data

Empirical evidence comparing non-superneutrality and superneutrality reveals mixed results across different economies and time periods. Case studies from countries experiencing liquidity traps, such as Japan and the Eurozone, often support non-superneutrality, showing that changes in money supply influence real interest rates and output levels. Conversely, periods of stable inflation and well-anchored expectations, like in the United States during the 1990s, provide data suggesting near-superneutral effects where variations in money supply have minimal long-term impact on real economic variables.

Criticisms and Limitations of Each Perspective

Non-superneutrality argues that monetary policy has long-term real effects, which critics claim underestimates the economy's capacity to return to natural output levels after shocks, leading to potential overemphasis on policy interventions. Superneutrality proponents assert money supply changes impact only nominal variables without affecting real output or employment, but this perspective is criticized for oversimplifying complex economic dynamics and ignoring short-term frictions like price stickiness and wage rigidity. Both perspectives face limitations in empirical validation due to varying economic contexts and measurement challenges, highlighting the need for nuanced models that account for structural factors and market imperfections.

Future Research Directions in Monetary Theory

Future research in monetary theory should explore the nuanced effects of monetary policy under non-superneutrality, emphasizing the impact of nominal shocks on real economic variables and long-term equilibrium. Investigating the conditions and mechanisms that differentiate superneutral from non-superneutral environments can provide deeper insights into inflation dynamics and output persistence. Empirical studies leveraging high-frequency data and advanced econometric models are critical to validate theoretical predictions and refine policy implications in varying macroeconomic contexts.

Non-superneutrality Infographic

libterm.com

libterm.com