Ricardian equivalence suggests that government borrowing does not affect overall demand because individuals anticipate future taxes needed to repay debt and therefore save more to offset government spending. This theory highlights how fiscal policy might be neutralized by changes in private saving behavior. Discover how Ricardian equivalence impacts economic policy and what it means for your financial decisions in the rest of this article.

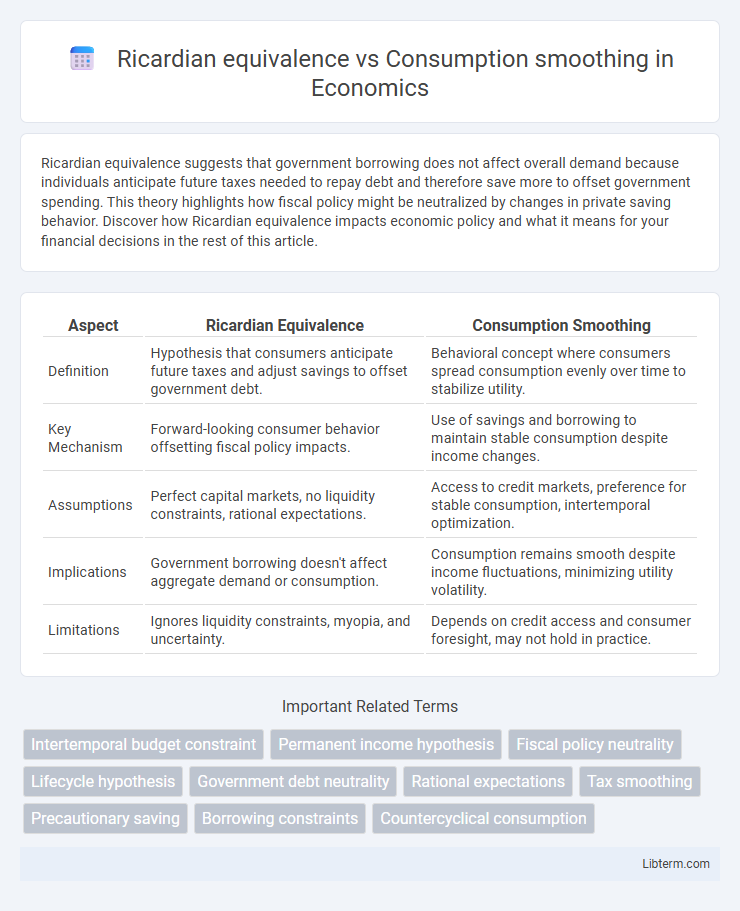

Table of Comparison

| Aspect | Ricardian Equivalence | Consumption Smoothing |

|---|---|---|

| Definition | Hypothesis that consumers anticipate future taxes and adjust savings to offset government debt. | Behavioral concept where consumers spread consumption evenly over time to stabilize utility. |

| Key Mechanism | Forward-looking consumer behavior offsetting fiscal policy impacts. | Use of savings and borrowing to maintain stable consumption despite income changes. |

| Assumptions | Perfect capital markets, no liquidity constraints, rational expectations. | Access to credit markets, preference for stable consumption, intertemporal optimization. |

| Implications | Government borrowing doesn't affect aggregate demand or consumption. | Consumption remains smooth despite income fluctuations, minimizing utility volatility. |

| Limitations | Ignores liquidity constraints, myopia, and uncertainty. | Depends on credit access and consumer foresight, may not hold in practice. |

Introduction to Ricardian Equivalence

Ricardian Equivalence is an economic theory suggesting that consumers anticipate future taxes resulting from government borrowing and thus adjust their savings to offset government debt, leaving overall consumption unchanged. In contrast, consumption smoothing refers to individuals' efforts to maintain stable consumption over time despite fluctuations in income. Understanding Ricardian Equivalence challenges traditional fiscal policy assumptions by highlighting how forward-looking behavior can neutralize government spending effects on aggregate demand.

Understanding Consumption Smoothing

Consumption smoothing refers to individuals' efforts to maintain stable consumption levels over time despite fluctuations in income by saving and borrowing. Ricardian equivalence challenges this notion by suggesting consumers anticipate future taxes linked to government debt and adjust their savings accordingly, neutralizing fiscal policy effects on consumption. Understanding consumption smoothing involves analyzing how these behaviors interact with expectations of fiscal policy and intertemporal budget constraints.

Core Assumptions Behind Ricardian Equivalence

Ricardian equivalence assumes that consumers are forward-looking and fully rational, anticipating future taxes to offset government borrowing and thus increase savings to smooth consumption over time. It presupposes perfect capital markets with no borrowing constraints, allowing consumers to adjust their savings based on expected lifetime income rather than current income fluctuations. This contrasts with consumption smoothing, which emphasizes consumers' efforts to maintain stable consumption levels despite income variability but does not require the strict rational expectations or perfect foresight integral to Ricardian equivalence.

Mechanisms of Consumption Smoothing

Mechanisms of consumption smoothing rely on intertemporal choices where individuals adjust spending and saving to maintain stable consumption despite income fluctuations, utilizing tools such as savings, borrowing, and credit markets. Ricardian equivalence suggests that consumers anticipate future tax liabilities associated with government debt, prompting them to increase savings to offset expected tax increases, thus neutralizing fiscal policy effects. Both frameworks emphasize forward-looking behavior, but consumption smoothing centers on optimizing lifetime utility, whereas Ricardian equivalence hinges on the perceived intergenerational transfer of debt and taxes.

Policy Implications: Government Debt and Taxes

Ricardian equivalence suggests that government debt does not affect overall consumption because individuals anticipate future taxes to repay debt and adjust their savings accordingly, implying fiscal policy may be neutral in influencing demand. In contrast, consumption smoothing assumes consumers adjust spending based on current income rather than future liabilities, indicating government debt can stimulate aggregate demand by shifting tax burdens over time. Policymakers must consider that under Ricardian equivalence, increased borrowing may not boost consumption, while in consumption smoothing frameworks, deficit spending can effectively support economic activity during downturns.

Empirical Evidence: Testing Ricardian Equivalence

Empirical evidence testing Ricardian equivalence reveals mixed results across different economies and time periods, with many studies finding partial support rather than full validation. Consumption smoothing behavior often contradicts Ricardian assumptions, as households tend to adjust spending in response to fiscal policy changes instead of fully offsetting public debt through saving. Data from longitudinal surveys and natural experiments indicate that liquidity constraints, uncertainty, and finite planning horizons significantly limit the applicability of Ricardian equivalence in real-world consumption patterns.

Consumption Smoothing Across the Life Cycle

Ricardian equivalence suggests individuals anticipate future taxes from government borrowing and adjust savings accordingly, neutralizing fiscal policy effects on consumption. Consumption smoothing across the life cycle emphasizes that individuals plan their spending to maintain stable consumption despite fluctuations in income during different life stages. Empirical evidence indicates consumption smoothing is a primary driver of household behavior, often overshadowing pure Ricardian equivalence assumptions due to liquidity constraints and imperfect foresight.

Limitations and Criticisms of Ricardian Equivalence

Ricardian equivalence faces significant limitations such as unrealistic assumptions of perfect capital markets and infinite planning horizons, which do not hold true for most households. The theory also overlooks liquidity constraints and myopic behavior that prevent consumers from fully offsetting government debt through increased savings. Empirical studies often find weak or mixed evidence supporting Ricardian equivalence, indicating its limited applicability in explaining consumption smoothing in real-world economies.

Interaction Between Fiscal Policy and Household Behavior

Ricardian equivalence posits that households anticipate future taxes to repay government debt, leading them to adjust savings and consumption accordingly, thus neutralizing fiscal policy effects. Consumption smoothing theory suggests that households evenly distribute consumption over time to maintain stable utility despite income fluctuations. The interaction between fiscal policy and household behavior reveals that the effectiveness of fiscal stimulus depends on whether consumers perceive government debt as future tax liabilities or rely on smoothing mechanisms, influencing aggregate demand and economic outcomes.

Conclusion: Comparing Ricardian Equivalence and Consumption Smoothing

Ricardian equivalence theorizes that consumers anticipate future taxes and thus save rather than increase consumption when government borrowing rises, while consumption smoothing emphasizes stable consumption patterns by adjusting savings to maintain welfare across income fluctuations. Empirical evidence often challenges Ricardian equivalence due to liquidity constraints and myopia, highlighting the practical relevance of consumption smoothing in real-world behavior. Optimal fiscal policy must balance these theories, recognizing that consumers do not fully internalize future taxes and prioritize stable consumption over intergenerational wealth neutrality.

Ricardian equivalence Infographic

libterm.com

libterm.com