Interest rate arbitrage involves exploiting differences in interest rates between two countries to earn risk-free profits through currency exchange and investment strategies. This financial technique leverages variations in borrowing and lending rates, often facilitated by the foreign exchange market and international financial instruments. Discover how interest rate arbitrage can optimize your investment returns by reading the rest of the article.

Table of Comparison

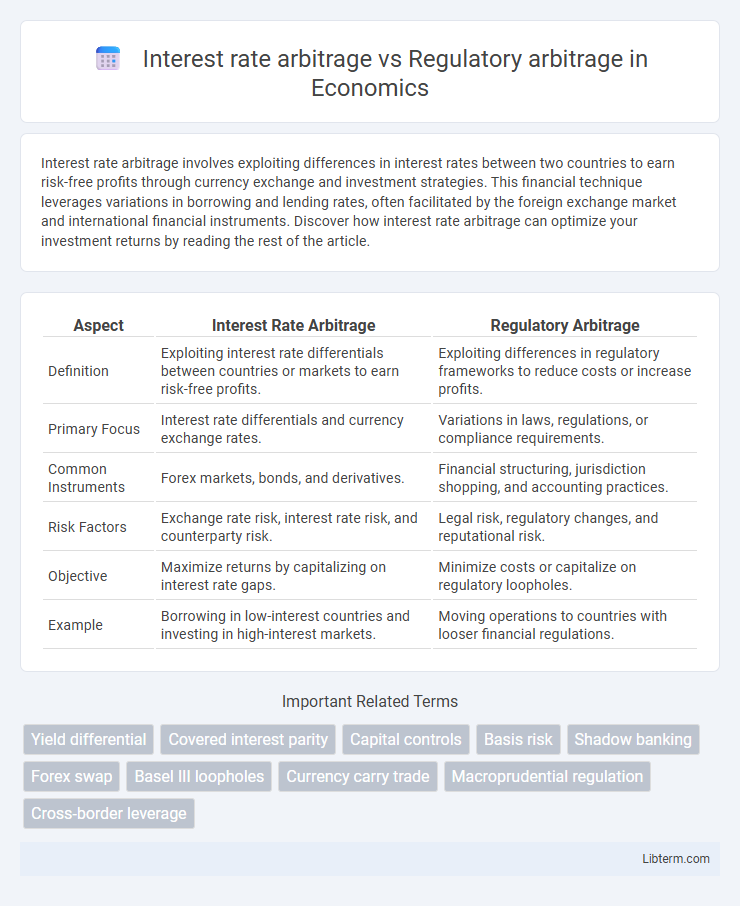

| Aspect | Interest Rate Arbitrage | Regulatory Arbitrage |

|---|---|---|

| Definition | Exploiting interest rate differentials between countries or markets to earn risk-free profits. | Exploiting differences in regulatory frameworks to reduce costs or increase profits. |

| Primary Focus | Interest rate differentials and currency exchange rates. | Variations in laws, regulations, or compliance requirements. |

| Common Instruments | Forex markets, bonds, and derivatives. | Financial structuring, jurisdiction shopping, and accounting practices. |

| Risk Factors | Exchange rate risk, interest rate risk, and counterparty risk. | Legal risk, regulatory changes, and reputational risk. |

| Objective | Maximize returns by capitalizing on interest rate gaps. | Minimize costs or capitalize on regulatory loopholes. |

| Example | Borrowing in low-interest countries and investing in high-interest markets. | Moving operations to countries with looser financial regulations. |

Understanding Interest Rate Arbitrage

Interest rate arbitrage involves exploiting differences in interest rates between countries or financial instruments to earn risk-free profits by borrowing in a low-interest-rate market and investing in a higher-yielding one. This strategy requires careful analysis of interest rate differentials, currency exchange rates, and transaction costs to ensure profitability without exposure to undue risk. Understanding interest rate arbitrage is crucial for investors and financial institutions aiming to optimize returns while managing currency and interest rate risk effectively.

Defining Regulatory Arbitrage

Regulatory arbitrage involves strategically exploiting differences in regulatory frameworks across jurisdictions to minimize compliance costs or capitalize on favorable rules, often without changing the underlying economic activity. Unlike interest rate arbitrage, which seeks to profit from discrepancies in interest rates between markets, regulatory arbitrage targets divergent legal or financial regulations to achieve cost efficiencies or competitive advantages. This practice can influence risk management and regulatory effectiveness by shifting activities to less stringent environments.

Key Mechanisms of Interest Rate Arbitrage

Interest rate arbitrage involves exploiting differences in interest rates between countries or financial instruments by borrowing in low-interest-rate currencies and investing in higher-yielding assets, generating profit from the interest rate differential. Key mechanisms include covered interest rate arbitrage, where forward contracts hedge exchange rate risk, and uncovered interest rate arbitrage, which entails exposure to currency fluctuations. Regulatory arbitrage, by contrast, involves structuring operations or transactions to minimize regulatory costs and capital requirements rather than capitalizing solely on interest rate differentials.

Common Strategies in Regulatory Arbitrage

Common strategies in regulatory arbitrage involve exploiting differences in regulations across jurisdictions or financial products to minimize regulatory costs and maximize returns. Firms often relocate operations to countries with less stringent regulations, reclassify financial instruments to benefit from favorable rules, and engage in regulatory capital arbitrage by shifting assets to entities subject to lighter capital requirements. These approaches enable businesses to reduce compliance burdens while maintaining competitive advantage in global markets.

Comparative Analysis: Risks and Rewards

Interest rate arbitrage involves exploiting differences in interest rates between countries to gain profit, presenting risks such as currency fluctuations and interest rate volatility but offering rewards through relatively predictable returns and liquidity. Regulatory arbitrage focuses on capitalizing on differences in regulatory frameworks across jurisdictions, exposing firms to compliance risk and potential legal penalties while enabling cost savings and competitive advantages through optimized regulatory environments. Compared to interest rate arbitrage, regulatory arbitrage often carries higher uncertainty due to changing regulations but can yield substantial long-term benefits if managed effectively.

Legal and Ethical Considerations

Interest rate arbitrage involves exploiting differences in interest rates between countries or markets, raising legal concerns related to compliance with international banking regulations and anti-money laundering laws. Regulatory arbitrage occurs when firms capitalize on gaps or differences in regulatory frameworks to reduce costs or increase profits, often prompting ethical debates about fairness and financial stability. Both strategies require careful navigation of legal boundaries to avoid penalties and must consider the broader ethical implications on market integrity and consumer protection.

Market Impact and Economic Implications

Interest rate arbitrage exploits differences in interest rates between countries to generate risk-free profits, influencing capital flows and exchange rates, often leading to increased market volatility. Regulatory arbitrage involves exploiting discrepancies in regulatory frameworks across jurisdictions, which can result in regulatory gaps, potentially undermining financial stability and increasing systemic risk. Both strategies impact market dynamics: interest rate arbitrage affects liquidity and price discovery, while regulatory arbitrage shapes regulatory effectiveness and economic resilience.

Case Studies: Real-World Examples

Interest rate arbitrage is exemplified by multinational corporations exploiting differences in borrowing costs across countries, such as Toyota borrowing in low-interest Japanese yen while investing in higher-yield U.S. dollars, maximizing returns. Regulatory arbitrage is illustrated by financial institutions employing strategies like those used by Lehman Brothers before the 2008 crisis, relocating assets off-balance-sheet to avoid capital requirements and gain competitive advantage. These cases highlight the strategic use of regulatory and interest rate environments to optimize financial performance and risk management.

Regulatory Responses and Policy Developments

Regulatory arbitrage involves exploiting differences in regulatory frameworks across jurisdictions, prompting policymakers to harmonize rules and strengthen international cooperation to close loopholes. Interest rate arbitrage, driven by exploiting interest rate differentials, has led to enhanced macroprudential policies aimed at mitigating systemic risks in cross-border capital flows. Recent policy developments emphasize transparency, stricter capital requirements, and the implementation of Basel III standards to address vulnerabilities exposed by both arbitrage practices.

Future Trends in Arbitrage Practices

Interest rate arbitrage is expected to evolve with advancements in algorithmic trading and real-time financial data analysis, enabling faster exploitation of interest rate differentials across global markets. Regulatory arbitrage will likely face increased scrutiny due to tightening international financial regulations and enhanced cross-border cooperation among regulatory bodies, pushing firms to adopt more transparent and compliant strategies. Future arbitrage practices will increasingly rely on technology-driven solutions that balance profit maximization with regulatory adherence, shaping a more sophisticated and resilient financial trading environment.

Interest rate arbitrage Infographic

libterm.com

libterm.com