Scenario analysis explores multiple future outcomes by evaluating different variables and assumptions, helping businesses anticipate risks and opportunities. This method supports strategic planning by providing a structured framework for decision-making under uncertainty. Discover how scenario analysis can enhance your strategic foresight in the rest of this article.

Table of Comparison

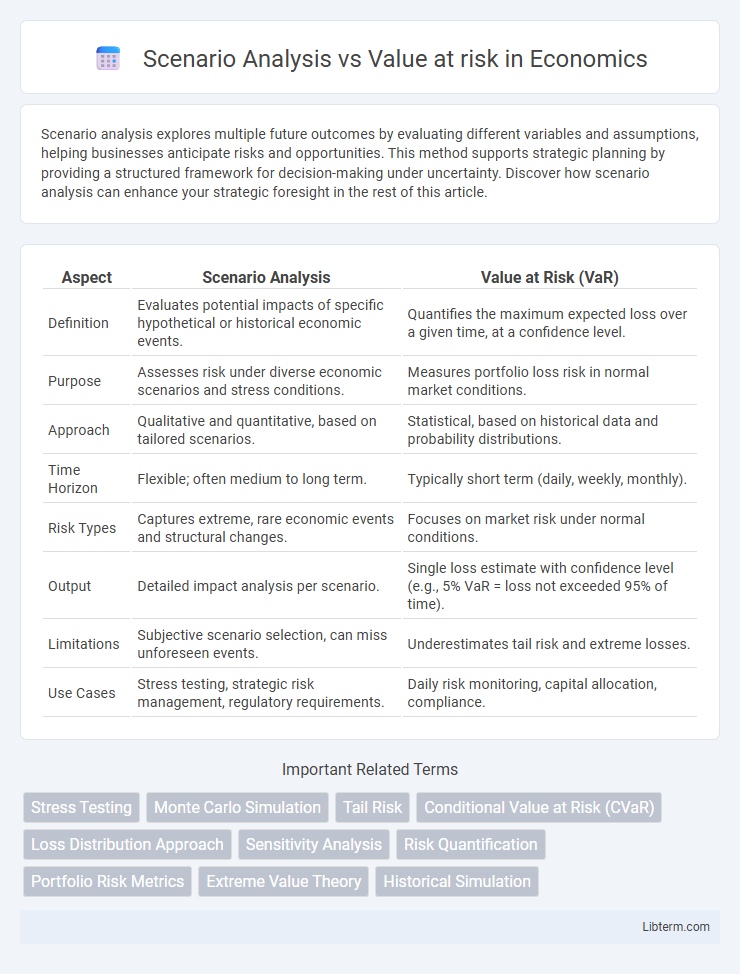

| Aspect | Scenario Analysis | Value at Risk (VaR) |

|---|---|---|

| Definition | Evaluates potential impacts of specific hypothetical or historical economic events. | Quantifies the maximum expected loss over a given time, at a confidence level. |

| Purpose | Assesses risk under diverse economic scenarios and stress conditions. | Measures portfolio loss risk in normal market conditions. |

| Approach | Qualitative and quantitative, based on tailored scenarios. | Statistical, based on historical data and probability distributions. |

| Time Horizon | Flexible; often medium to long term. | Typically short term (daily, weekly, monthly). |

| Risk Types | Captures extreme, rare economic events and structural changes. | Focuses on market risk under normal conditions. |

| Output | Detailed impact analysis per scenario. | Single loss estimate with confidence level (e.g., 5% VaR = loss not exceeded 95% of time). |

| Limitations | Subjective scenario selection, can miss unforeseen events. | Underestimates tail risk and extreme losses. |

| Use Cases | Stress testing, strategic risk management, regulatory requirements. | Daily risk monitoring, capital allocation, compliance. |

Introduction to Scenario Analysis and Value at Risk

Scenario Analysis examines potential financial outcomes by simulating a range of future economic conditions, helping organizations anticipate risks and strategize accordingly. Value at Risk (VaR) quantifies the maximum expected loss within a specific confidence interval over a defined time horizon, providing a probabilistic measure of market risk exposure. Both methods are essential in risk management, offering complementary insights into potential losses under varying market scenarios.

Defining Scenario Analysis

Scenario Analysis is a risk management technique that evaluates the impact of specific hypothetical or historical events on a portfolio's value by modeling various adverse market conditions. It involves constructing detailed narratives or stress tests to assess potential losses under extreme but plausible scenarios. Unlike Value at Risk, which provides a probabilistic estimate of potential losses over a defined time horizon, Scenario Analysis offers qualitative insights into tail risk and extreme events beyond normal market fluctuations.

Understanding Value at Risk (VaR)

Value at Risk (VaR) is a risk management metric that quantifies the maximum potential loss of a portfolio over a specific time horizon at a given confidence level, typically used to assess market risk exposure. Scenario Analysis complements VaR by evaluating portfolio impact under hypothetical or extreme market conditions, providing insights beyond the probabilistic framework of VaR. Firms rely on VaR to set risk limits and regulatory capital requirements, whereas Scenario Analysis helps uncover vulnerabilities not captured by traditional VaR models.

Key Methodological Differences

Scenario Analysis evaluates portfolio risk by simulating specific adverse economic or financial conditions, emphasizing potential outcomes under extreme but plausible situations. Value at Risk (VaR) quantifies the maximum expected loss over a defined time horizon at a given confidence level, relying on historical data and statistical models like variance-covariance or Monte Carlo simulations. Unlike VaR's probabilistic threshold-based approach, Scenario Analysis uses deterministic stress tests to capture tail risks and model nonlinear impacts on assets.

Advantages of Scenario Analysis

Scenario analysis offers a comprehensive assessment of potential financial risks by evaluating the impact of multiple hypothetical situations on an investment portfolio, surpassing the single-threshold focus of Value at Risk (VaR). It enables risk managers to capture extreme market events and tail risks that VaR may underestimate, providing a broader perspective on vulnerabilities. The qualitative insights from scenario analysis also support strategic decision-making under uncertainty by incorporating expert judgment and stress testing beyond historical data limitations.

Benefits of Value at Risk

Value at Risk (VaR) provides a clear, quantifiable measure of potential losses within a specified confidence interval, making it a crucial risk management tool for financial institutions. It offers a standardized metric that facilitates regulatory compliance and capital allocation decisions, enhancing transparency and communication among stakeholders. VaR's ability to aggregate risk across diverse asset classes enables comprehensive portfolio risk assessment, which is less scenario-dependent compared to the subjective nature of scenario analysis.

Limitations of Scenario Analysis

Scenario analysis faces limitations such as the subjective selection of scenarios, which may lead to biased or incomplete risk assessments. It often relies on historical data and expert judgment, potentially overlooking unprecedented market events or extreme tail risks. Unlike Value at Risk (VaR), scenario analysis lacks a standardized quantitative framework, making it difficult to compare results across portfolios or institutions consistently.

Drawbacks of Value at Risk

Value at Risk (VaR) often underestimates potential losses by assuming normal market conditions and ignoring extreme events, making it less effective during financial crises. Scenario Analysis addresses this drawback by evaluating the impact of specific adverse conditions and stress events on portfolios, providing insight into tail risks. However, VaR's reliance on historical data and fixed confidence intervals limits its ability to capture rare but catastrophic market movements.

Practical Applications in Risk Management

Scenario analysis evaluates potential financial losses by exploring a range of hypothetical events, allowing risk managers to assess the impact of extreme but plausible market conditions. Value at Risk (VaR) quantifies potential portfolio losses within a specific confidence interval and time horizon, offering a precise statistical measure for daily risk limits. Integrating scenario analysis with VaR enhances practical risk management by combining quantitative precision with qualitative insights into rare, high-impact events.

Choosing the Right Approach for Your Organization

Scenario analysis provides a detailed exploration of potential outcomes by simulating specific economic or financial conditions, ideal for organizations seeking insight into extreme events and tail risks. Value at Risk (VaR) delivers a quantifiable metric that estimates the maximum potential loss over a given time frame at a certain confidence level, suitable for standard risk reporting and regulatory compliance. Selecting the right approach depends on your organization's risk tolerance, the complexity of your portfolio, and the need for transparency in risk communication.

Scenario Analysis Infographic

libterm.com

libterm.com