Demand management policies strategically balance supply and consumption to optimize resource allocation and reduce costs. These policies encompass techniques such as pricing adjustments, incentives, and regulatory measures to influence consumer behavior and ensure sustainability. Explore the full article to discover how demand management can benefit your operations and improve efficiency.

Table of Comparison

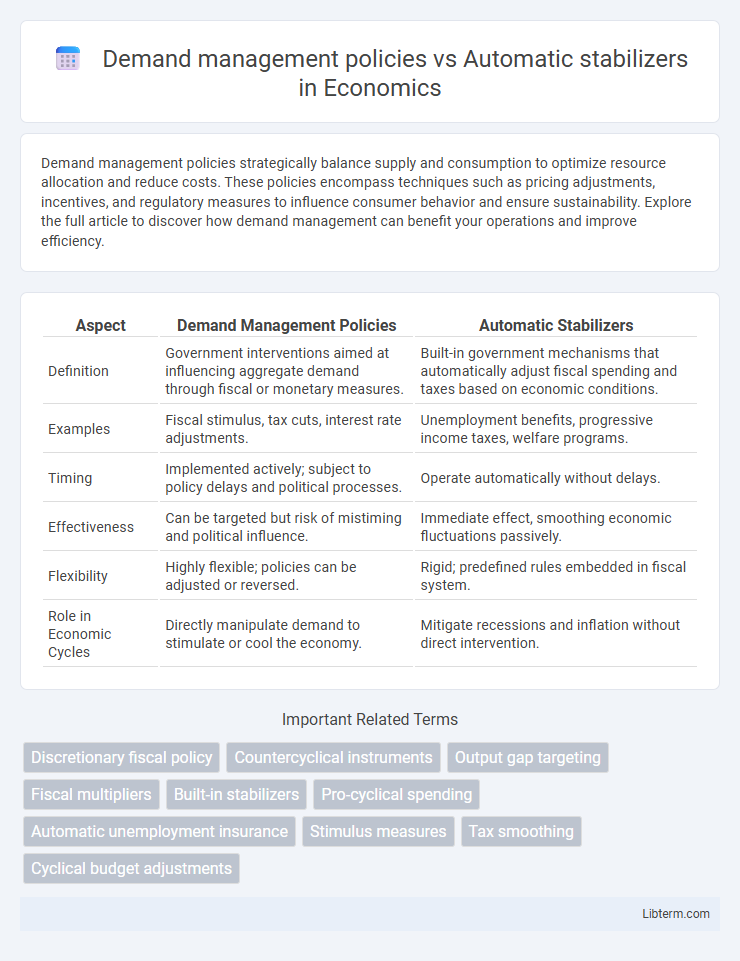

| Aspect | Demand Management Policies | Automatic Stabilizers |

|---|---|---|

| Definition | Government interventions aimed at influencing aggregate demand through fiscal or monetary measures. | Built-in government mechanisms that automatically adjust fiscal spending and taxes based on economic conditions. |

| Examples | Fiscal stimulus, tax cuts, interest rate adjustments. | Unemployment benefits, progressive income taxes, welfare programs. |

| Timing | Implemented actively; subject to policy delays and political processes. | Operate automatically without delays. |

| Effectiveness | Can be targeted but risk of mistiming and political influence. | Immediate effect, smoothing economic fluctuations passively. |

| Flexibility | Highly flexible; policies can be adjusted or reversed. | Rigid; predefined rules embedded in fiscal system. |

| Role in Economic Cycles | Directly manipulate demand to stimulate or cool the economy. | Mitigate recessions and inflation without direct intervention. |

Introduction to Demand Management Policies

Demand management policies encompass governmental strategies aimed at regulating aggregate demand to achieve macroeconomic stability, primarily through fiscal policies like taxation and public spending, and monetary policies including interest rate adjustments. These policies proactively influence economic cycles to curb inflation, reduce unemployment, and stimulate growth, contrasting with automatic stabilizers which function passively by adjusting government revenues and expenditures in response to economic fluctuations. Effective demand management requires precise timing and calibration of policy tools to balance economic objectives without triggering unintended consequences such as excessive inflation or stagnant growth.

Understanding Automatic Stabilizers

Automatic stabilizers refer to government policies, such as progressive income taxes and unemployment benefits, that automatically adjust to economic fluctuations without requiring explicit intervention. These mechanisms stabilize disposable income and aggregate demand by increasing support during economic downturns and reducing it during expansions. Unlike discretionary demand management policies, automatic stabilizers operate continuously and respond quickly, helping to moderate business cycle volatility efficiently.

Key Objectives of Demand Management Policies

Demand management policies primarily aim to regulate aggregate demand to achieve stable economic growth, control inflation, and reduce unemployment through fiscal and monetary tools. These policies focus on adjusting government spending, taxation, and interest rates to influence consumption and investment levels in the economy. In contrast, automatic stabilizers like unemployment benefits and progressive taxes work passively to moderate economic fluctuations without direct intervention, maintaining economic stability through built-in fiscal mechanisms.

How Automatic Stabilizers Work in the Economy

Automatic stabilizers function by automatically adjusting government spending and taxation based on economic fluctuations without explicit policy changes, smoothing out business cycle volatility. During economic downturns, tax revenues decline and welfare payments like unemployment benefits rise, increasing aggregate demand and mitigating recession impacts. Conversely, in economic expansions, higher tax revenues and reduced welfare spending help cool overheating economies, promoting stability without legislative intervention.

Fiscal Policy Tools in Demand Management

Demand management policies encompass deliberate government actions, including fiscal policy tools such as government spending and taxation adjustments, aimed at influencing aggregate demand to stabilize the economy. Automatic stabilizers, like progressive tax systems and unemployment benefits, function without explicit intervention by automatically increasing demand during economic downturns and cooling it during booms. Fiscal policy tools differ as they require active decision-making and timing by policymakers to either stimulate or restrain demand, whereas automatic stabilizers provide a continuous, built-in mechanism for smoothing economic fluctuations.

Comparing Effectiveness: Policies vs. Stabilizers

Demand management policies involve deliberate government interventions such as fiscal stimulus or monetary adjustments designed to influence economic activity, often with implementation lags and political constraints. Automatic stabilizers like unemployment benefits and progressive taxes operate instantaneously, cushioning economic fluctuations without new legislative action, enhancing short-term responsiveness. While demand management policies can target specific sectors or goals with adjustable intensity, automatic stabilizers provide continuous, predictable cushioning, making their combined use essential for balanced macroeconomic stability.

Advantages of Automatic Stabilizers

Automatic stabilizers, such as unemployment benefits and progressive tax systems, provide timely and continuous economic support without the need for legislative approval, ensuring immediate response to economic fluctuations. These mechanisms operate counter-cyclically, reducing the severity of recessions by maintaining consumer spending and mitigating inflation during expansions. Their built-in nature minimizes policy lags and political delays, improving overall economic stability compared to discretionary demand management policies.

Challenges in Implementing Demand Management Policies

Demand management policies face challenges such as time lags in recognizing economic shifts and implementing fiscal or monetary measures, which can exacerbate economic volatility. Political constraints and conflicting interests often delay or dilute policy responses, reducing their effectiveness in stabilizing aggregate demand. In contrast, automatic stabilizers like unemployment benefits and progressive taxation operate without legislative action, providing timely and consistent cushioning against economic fluctuations.

Real-World Examples: Policies and Stabilizers in Action

Demand management policies in the United States include targeted fiscal stimuli such as the 2020 CARES Act, which injected direct payments and expanded unemployment benefits to boost consumer spending during the COVID-19 recession. Automatic stabilizers function continuously, exemplified by progressive tax systems and unemployment insurance in countries like Canada and Germany, which naturally increase government spending and reduce tax burdens when economic growth slows. These measures work in tandem, with policies providing deliberate, large-scale interventions and stabilizers offering ongoing economic cushioning without new legislative approval.

Policy Implications and Future Considerations

Demand management policies, such as fiscal stimulus or monetary tightening, require active government intervention to influence economic cycles and aim to stabilize output and employment levels. Automatic stabilizers like progressive taxes and unemployment benefits operate without explicit government action, reducing volatility by smoothing disposable income and consumption during economic fluctuations. Future considerations involve balancing the timely responsiveness of demand management policies with the inherent stability of automatic stabilizers, while addressing challenges like policy lags, fiscal sustainability, and evolving economic shocks.

Demand management policies Infographic

libterm.com

libterm.com