A planned economy involves government control over production, distribution, and pricing decisions to achieve specific economic goals. This system contrasts with market economies by prioritizing centralized planning to allocate resources efficiently and reduce economic inequalities. Explore the rest of the article to understand how a planned economy impacts Your economic environment and global markets.

Table of Comparison

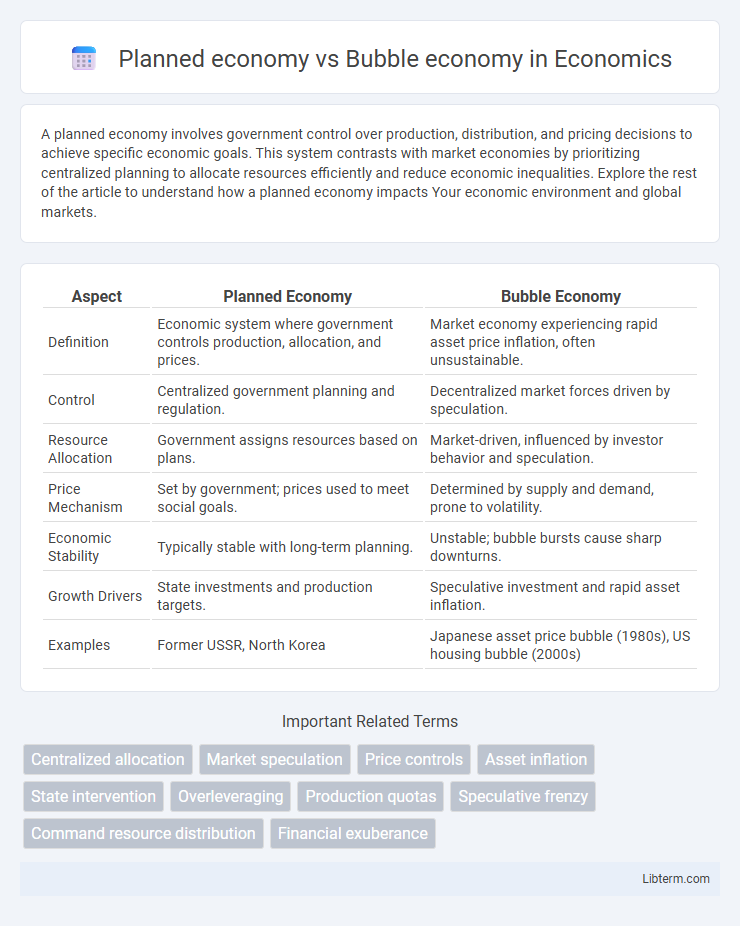

| Aspect | Planned Economy | Bubble Economy |

|---|---|---|

| Definition | Economic system where government controls production, allocation, and prices. | Market economy experiencing rapid asset price inflation, often unsustainable. |

| Control | Centralized government planning and regulation. | Decentralized market forces driven by speculation. |

| Resource Allocation | Government assigns resources based on plans. | Market-driven, influenced by investor behavior and speculation. |

| Price Mechanism | Set by government; prices used to meet social goals. | Determined by supply and demand, prone to volatility. |

| Economic Stability | Typically stable with long-term planning. | Unstable; bubble bursts cause sharp downturns. |

| Growth Drivers | State investments and production targets. | Speculative investment and rapid asset inflation. |

| Examples | Former USSR, North Korea | Japanese asset price bubble (1980s), US housing bubble (2000s) |

Introduction to Planned and Bubble Economies

Planned economies are characterized by centralized government control over production, distribution, and pricing, aiming to allocate resources efficiently and achieve social objectives. Bubble economies emerge when asset prices inflate rapidly beyond intrinsic values due to speculative demand, often leading to market instability and eventual crashes. Understanding these economic models highlights contrasts in resource management and market behavior, essential for analyzing economic policies and financial cycles.

Key Characteristics of Planned Economies

Planned economies centralize decision-making through government control of production, distribution, and resource allocation, aiming to eliminate market uncertainties and ensure equitable growth. Key characteristics include state ownership of assets, fixed pricing mechanisms, and comprehensive economic planning through multi-year plans that dictate industrial output and investment priorities. These economies prioritize stability and social welfare but often suffer from inefficiencies due to lack of market signals and limited consumer choice.

Defining Features of Bubble Economies

Bubble economies exhibit defining features such as rapid asset price inflation fueled by speculative investment and excessive credit expansion. These economies are characterized by overvaluation of assets, unsustainable growth rates, and eventual sharp corrections or crashes. Unlike planned economies, bubble economies thrive on market-driven speculation rather than centralized resource allocation and control.

Historical Examples: Successes and Failures

The Soviet Union exemplified a planned economy with successes in rapid industrialization and space exploration but failures in inefficiency and consumer shortages. Japan during the 1980s demonstrated a bubble economy with extraordinary asset price inflation, leading to a prolonged economic stagnation known as the "Lost Decade." East Germany's planned economy collapsed under the weight of inefficiency, whereas the United States' tech bubble burst in 2000 highlighted the risks of speculative excess in market-driven economies.

Factors Leading to Economic Bubbles

Excessive credit expansion, speculative investments, and asset overvaluation are primary factors leading to economic bubbles, often exacerbated by market inefficiencies and irrational exuberance. In a planned economy, state-controlled resource allocation can suppress or delay bubble formation but may cause misallocation of capital, creating hidden imbalances. Conversely, bubble economies emerge frequently in market-driven systems where deregulated financial markets and investor optimism fuel rapid price inflation detached from intrinsic value.

Government Intervention in Planned Economies

Government intervention in planned economies involves central authorities controlling resource allocation, production, and pricing to achieve specific economic goals and social objectives. This contrasts sharply with bubble economies, where minimal intervention allows speculative markets to drive asset inflation, often leading to economic instability. The structured oversight in planned economies aims to avoid the volatility and market failures typical of bubble-driven growth cycles.

Market Forces in Bubble Economies

Bubble economies are characterized by rapid asset price inflation driven primarily by speculative market behavior rather than fundamental values. Market forces in bubble economies often lead to distorted resource allocation as investor exuberance and credit expansion create unsustainable growth. In contrast, planned economies rely on centralized decision-making to control production and investment, reducing the impact of speculative market fluctuations.

Advantages and Disadvantages Compared

A planned economy ensures resource allocation efficiency and social equity by centralizing decision-making, reducing market volatility while limiting innovation and consumer choice due to bureaucratic constraints. Conversely, a bubble economy drives rapid growth through speculative investment and market enthusiasm but risks severe financial instability and economic recessions when unsustainable asset prices collapse. Balancing strategic state intervention with market dynamics is crucial to mitigate the disadvantages inherent in both economic models.

Societal Impact: Stability vs Volatility

A planned economy provides societal stability through centralized control, reducing economic fluctuations and ensuring consistent access to basic goods and services. In contrast, a bubble economy generates volatility by encouraging speculative investments and rapid price increases, often leading to economic crashes that disproportionately harm vulnerable populations. The societal impact of a planned economy favors long-term stability and equitable resource distribution, whereas bubble economies tend to create wealth disparities and social unrest due to their cyclical nature.

Future Outlook and Lessons Learned

Planned economies offer stability through government control but often face inefficiencies and lack of innovation, limiting long-term growth potential. Bubble economies, driven by speculative investment and rapid asset inflation, risk abrupt market crashes that undermine financial stability. Future economic models should balance regulation with market flexibility to foster sustainable development and avoid past pitfalls of both systems.

Planned economy Infographic

libterm.com

libterm.com