Rational expectations theory posits that individuals form forecasts about the future based on all available information, ensuring their predictions are unbiased and consistent with actual economic models. This concept plays a critical role in macroeconomic policy, influencing how markets respond to policy changes and how agents anticipate inflation or interest rates. Explore the rest of the article to understand how rational expectations shape economic decision-making and impact your financial planning.

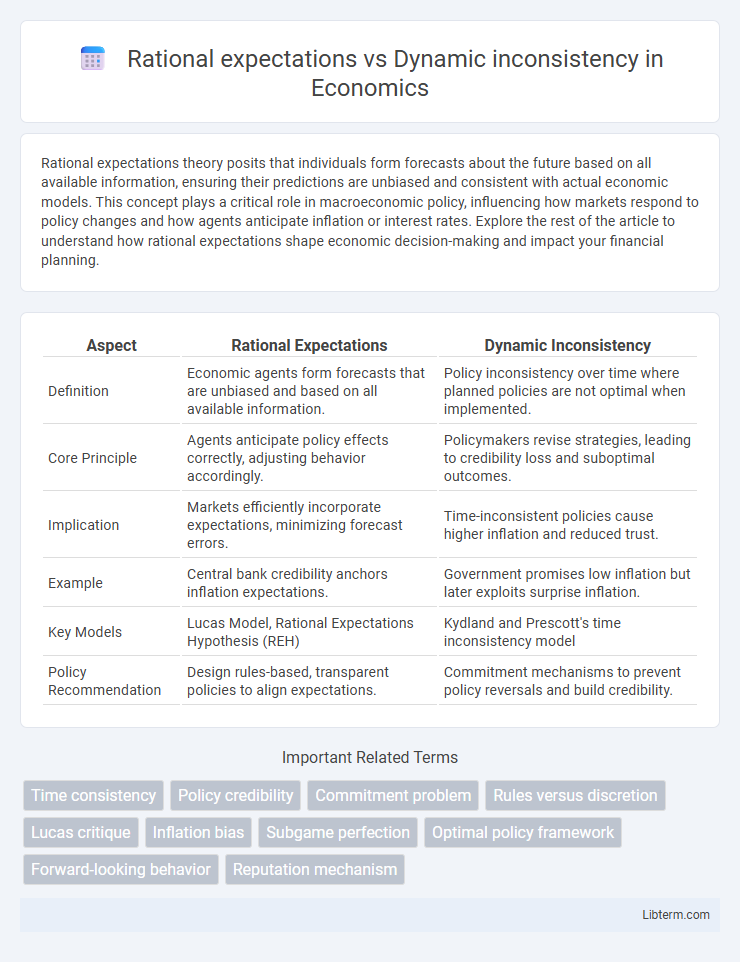

Table of Comparison

| Aspect | Rational Expectations | Dynamic Inconsistency |

|---|---|---|

| Definition | Economic agents form forecasts that are unbiased and based on all available information. | Policy inconsistency over time where planned policies are not optimal when implemented. |

| Core Principle | Agents anticipate policy effects correctly, adjusting behavior accordingly. | Policymakers revise strategies, leading to credibility loss and suboptimal outcomes. |

| Implication | Markets efficiently incorporate expectations, minimizing forecast errors. | Time-inconsistent policies cause higher inflation and reduced trust. |

| Example | Central bank credibility anchors inflation expectations. | Government promises low inflation but later exploits surprise inflation. |

| Key Models | Lucas Model, Rational Expectations Hypothesis (REH) | Kydland and Prescott's time inconsistency model |

| Policy Recommendation | Design rules-based, transparent policies to align expectations. | Commitment mechanisms to prevent policy reversals and build credibility. |

Introduction to Rational Expectations and Dynamic Inconsistency

Rational expectations theory asserts that economic agents use all available information efficiently to forecast future variables, aligning their anticipations with the true model of the economy. Dynamic inconsistency occurs when a policymaker's optimal plan changes over time due to shifts in incentives, leading to a lack of credibility and time-inconsistent policies. Understanding the interplay between rational expectations and dynamic inconsistency is crucial for designing commitment mechanisms that ensure credible and effective economic policies.

Defining Rational Expectations: Key Concepts

Rational expectations refer to the assumption that economic agents form forecasts about the future based on all available information and consistent economic models, ensuring their predictions are unbiased and statistically accurate. This concept implies that agents do not systematically make errors when anticipating policy impacts or economic variables, as they incorporate expectations into their decision-making processes. Understanding rational expectations is critical for analyzing dynamic inconsistency, where policymakers face incentives to deviate from previously announced plans once agents adjust their behavior based on these expectations.

Understanding Dynamic Inconsistency in Economic Policy

Dynamic inconsistency in economic policy arises when policymakers' optimal plans change over time due to shifting incentives, leading to credibility problems and suboptimal outcomes. Rational expectations imply that agents anticipate these policy shifts, adjusting their behavior accordingly, which undermines the effectiveness of inflation targeting or debt stabilization efforts. Recognizing dynamic inconsistency is crucial for designing commitment mechanisms, such as independent central banks or policy rules, to ensure credible and predictable economic policies.

Historical Evolution of the Two Theories

Rational expectations theory emerged in the 1960s, pioneered by John Muth and later expanded by Robert Lucas, emphasizing that agents use all available information to forecast future economic variables accurately. Dynamic inconsistency, introduced by Finn Kydland and Edward Prescott in the late 1970s, highlighted the problem where policies deemed optimal in the present may become suboptimal over time as agents anticipate future policy changes. The historical evolution of these theories shaped modern macroeconomic policy design, influencing central banks' commitment mechanisms and credibility to reduce time-inconsistency problems.

Theoretical Framework: Comparing the Models

Rational expectations theory assumes agents use all available information to forecast future economic variables accurately, promoting time-consistent policy outcomes. In contrast, the dynamic inconsistency model highlights situations where policymakers' optimal plans change over time due to incentive misalignments, leading to credibility problems. Comparing these frameworks reveals that while rational expectations require commitment mechanisms to sustain trust, dynamic inconsistency emphasizes the role of reputation and institutional constraints to align policies with long-term objectives.

Implications for Monetary and Fiscal Policy

Rational expectations theory implies that economic agents anticipate policy actions, reducing the effectiveness of surprise monetary and fiscal measures, which often leads to policy ineffectiveness in influencing real variables such as output and employment. Dynamic inconsistency arises when policymakers have an incentive to deviate from previously announced plans, causing credibility loss and prompting agents to adjust their expectations, complicating the implementation of optimal time-consistent policies. The interplay between these concepts highlights the importance of credible, rule-based monetary and fiscal frameworks to anchor expectations, minimize inflation bias, and enhance macroeconomic stability.

Rational Expectations: Strengths and Criticisms

Rational expectations assume individuals use all available information efficiently to forecast future economic variables, leading to unbiased predictions and market equilibrium. This approach strengthens economic modeling by improving policy effectiveness predictions and reducing systematic forecast errors. However, criticisms highlight unrealistic assumptions of perfect information and cognitive abilities, neglecting behavioral biases and market imperfections that often cause deviations from rational forecasts.

Policy Design Challenges under Dynamic Inconsistency

Dynamic inconsistency creates significant challenges for policy design because policymakers face incentives to deviate from previously announced plans once private agents have formed their expectations. Rational expectations imply that agents foresee such shifts, undermining the credibility of policies and resulting in suboptimal outcomes like inflation bias or time-inconsistent fiscal policies. Effective policy design must incorporate commitment mechanisms or institutional constraints to align incentives and enhance credibility under conditions of dynamic inconsistency.

Case Studies: Real-World Applications and Outcomes

Empirical case studies of rational expectations highlight how agents anticipate policy changes, such as in the 1970s U.S. inflation scenario where wage setters adjusted expectations, limiting central bank effectiveness. Dynamic inconsistency is evident in instances like the European Exchange Rate Mechanism crises where policymakers deviated from announced commitments, triggering market losses and credibility damage. These real-world outcomes underscore the importance of credible policy frameworks to align expectations and reduce costly policy reversals.

Conclusion: Insights and Future Research Directions

Rational expectations assume agents make unbiased predictions using all available information, yet dynamic inconsistency reveals that optimal plans can change over time, leading to time-inconsistent policies. Understanding the divergence between these concepts highlights the need for models incorporating commitment mechanisms or adaptive expectations to better predict economic behavior. Future research should explore integrating bounded rationality and evolving preferences to enhance policy credibility and long-term decision-making efficacy.

Rational expectations Infographic

libterm.com

libterm.com