The Fisher effect explains the relationship between nominal interest rates, real interest rates, and expected inflation, indicating that nominal rates adjust to reflect changes in inflation expectations. Understanding this concept helps you anticipate how inflation impacts borrowing costs and investment returns over time. Explore the rest of the article to learn how the Fisher effect influences economic decision-making and financial planning.

Table of Comparison

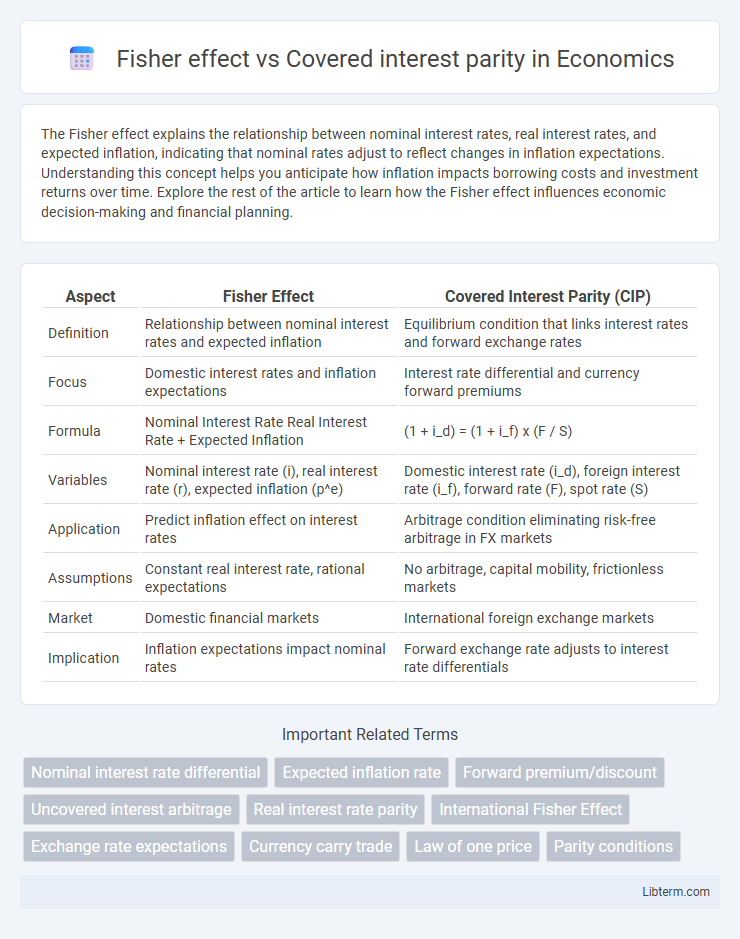

| Aspect | Fisher Effect | Covered Interest Parity (CIP) |

|---|---|---|

| Definition | Relationship between nominal interest rates and expected inflation | Equilibrium condition that links interest rates and forward exchange rates |

| Focus | Domestic interest rates and inflation expectations | Interest rate differential and currency forward premiums |

| Formula | Nominal Interest Rate Real Interest Rate + Expected Inflation | (1 + i_d) = (1 + i_f) x (F / S) |

| Variables | Nominal interest rate (i), real interest rate (r), expected inflation (p^e) | Domestic interest rate (i_d), foreign interest rate (i_f), forward rate (F), spot rate (S) |

| Application | Predict inflation effect on interest rates | Arbitrage condition eliminating risk-free arbitrage in FX markets |

| Assumptions | Constant real interest rate, rational expectations | No arbitrage, capital mobility, frictionless markets |

| Market | Domestic financial markets | International foreign exchange markets |

| Implication | Inflation expectations impact nominal rates | Forward exchange rate adjusts to interest rate differentials |

Introduction to Fisher Effect and Covered Interest Parity

Fisher Effect explains the relationship between nominal interest rates, real interest rates, and expected inflation, suggesting that nominal rates adjust to reflect changes in inflation expectations. Covered Interest Parity (CIP) defines the equilibrium condition where the interest rate differential between two countries is equal to the differential between the forward and spot exchange rates, preventing arbitrage opportunities in foreign exchange markets. Both concepts are fundamental in international finance, with Fisher Effect linking inflation to interest rates and CIP ensuring no riskless profit from currency and interest rate disparities.

Definition of the Fisher Effect

The Fisher Effect explains the relationship between nominal interest rates, real interest rates, and expected inflation, stating that nominal interest rates rise one-for-one with expected inflation to maintain real returns. Covered Interest Parity (CIP) involves the equilibrium condition where the difference in interest rates between two countries is offset by the forward exchange rate premium, ensuring no arbitrage opportunities in foreign exchange markets. While the Fisher Effect centers on inflation adjustment in interest rates, CIP connects interest rate differentials directly to currency forward contracts and exchange rates.

Definition of Covered Interest Parity

Covered Interest Parity (CIP) is an essential financial theory stating that the difference in interest rates between two countries is equalized by the forward exchange rate premium or discount, eliminating arbitrage opportunities. It ensures that investors receive the same returns on equivalent-risk investments in different currencies when exchange rate risk is hedged using forward contracts. Unlike the Fisher Effect, which links nominal interest rates to expected inflation, CIP specifically addresses the relationship between interest rates and forward exchange rates in the foreign exchange market.

Mathematical Formulas and Relationships

The Fisher effect is expressed by the formula (1 + i) = (1 + r)(1 + p), where i is the nominal interest rate, r the real interest rate, and p the expected inflation rate, highlighting the relationship between inflation and nominal rates. Covered interest parity (CIP) is represented as (1 + i_d) = (1 + i_f)(F/S), where i_d is the domestic interest rate, i_f the foreign interest rate, F the forward exchange rate, and S the spot exchange rate, ensuring no arbitrage opportunities in currency markets. Both frameworks connect interest rates through different economic mechanisms: Fisher effect focuses on inflation adjustments, while CIP governs exchange rate and interest rate parity under covered conditions.

Underlying Economic Theories

The Fisher effect is based on the theory that nominal interest rates adjust to expected inflation, ensuring real interest rates remain stable over time, reflecting time preference and inflation expectations. Covered interest parity relies on the no-arbitrage condition in international finance, positing that the difference in interest rates between two countries is offset by the forward exchange rate premium or discount, ensuring no arbitrage opportunities in the foreign exchange market. Both concepts integrate expectations but differ as the Fisher effect emphasizes inflation's impact on domestic interest rates, while covered interest parity links interest rate differentials to exchange rate movements under forward contracts.

Key Assumptions and Preconditions

The Fisher effect assumes perfect capital mobility, zero transaction costs, and rational expectations with inflation differentials driving nominal interest rate changes. Covered interest parity relies on no arbitrage conditions, capital mobility, and the existence of forward exchange contracts to hedge currency risk. Both frameworks presuppose efficient markets and absence of capital controls to ensure theoretical relationships hold true.

Comparison of Fisher Effect and Covered Interest Parity

The Fisher Effect explains the relationship between nominal interest rates and expected inflation, indicating that nominal rates move one-for-one with inflation expectations to maintain real returns. Covered Interest Parity (CIP) describes the equilibrium condition where the interest rate differential between two countries is offset by the forward exchange rate premium or discount, eliminating arbitrage opportunities in the forex market. Unlike the Fisher Effect, which concentrates on real versus nominal rates within a single economy, CIP focuses on the interaction of interest rates and exchange rates across countries under risk-free conditions.

Practical Implications in International Finance

The Fisher effect explains the relationship between nominal interest rates and expected inflation, guiding investors on real return expectations in different currencies, which critically influences international investment decisions and inflation hedging strategies. Covered interest parity (CIP) ensures that arbitrage opportunities are eliminated by equating the interest rate differential between two countries to the forward exchange rate premium or discount, providing a mechanism for managing currency risk in cross-border lending and borrowing. Practical implications in international finance include aiding multinational corporations and investors in accurately pricing foreign investments, optimizing hedging strategies, and maintaining equilibrium in global capital markets.

Empirical Evidence and Real-World Applications

Empirical evidence shows mixed results for the Fisher effect, with partial verification that nominal interest rates adjust to expected inflation, though deviations occur in short-term horizons and volatile markets. Covered interest parity (CIP) is strongly supported by data under normal market conditions, with arbitrage ensuring that interest rate differentials are offset by forward exchange rates, minimizing riskless profit opportunities. Real-world applications of the Fisher effect inform inflation-indexed bond pricing and inflation forecasting, while CIP underlies cross-border investment strategies, currency hedging, and central bank interventions in foreign exchange markets.

Conclusion: Significance in Global Financial Markets

The Fisher effect and Covered Interest Parity (CIP) both play crucial roles in global financial markets by linking nominal interest rates, inflation expectations, and exchange rates. Understanding the Fisher effect aids in predicting inflation-adjusted returns, while CIP ensures no arbitrage opportunities exist in foreign exchange and interest rate differentials. Together, they facilitate efficient capital allocation, risk management, and the pricing of cross-border financial instruments.

Fisher effect Infographic

libterm.com

libterm.com