Opportunity cost measures the value of the next best alternative you give up when making a decision, highlighting the true cost of choices beyond just monetary expenses. Understanding opportunity cost helps optimize resource allocation and improve strategic planning in both personal and business contexts. Explore the rest of the article to learn how recognizing opportunity costs can enhance your decision-making skills.

Table of Comparison

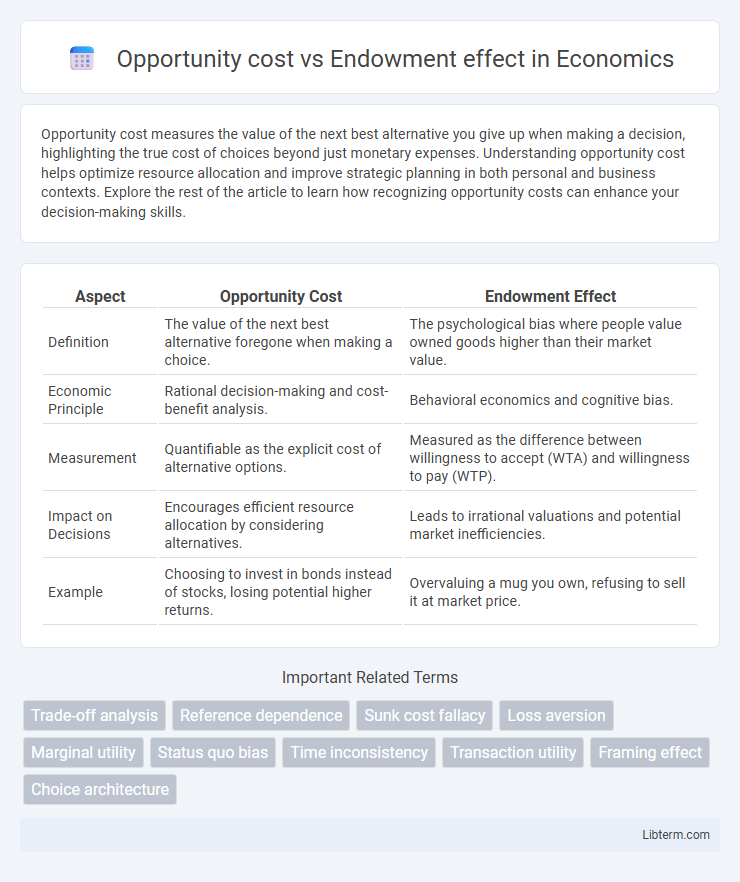

| Aspect | Opportunity Cost | Endowment Effect |

|---|---|---|

| Definition | The value of the next best alternative foregone when making a choice. | The psychological bias where people value owned goods higher than their market value. |

| Economic Principle | Rational decision-making and cost-benefit analysis. | Behavioral economics and cognitive bias. |

| Measurement | Quantifiable as the explicit cost of alternative options. | Measured as the difference between willingness to accept (WTA) and willingness to pay (WTP). |

| Impact on Decisions | Encourages efficient resource allocation by considering alternatives. | Leads to irrational valuations and potential market inefficiencies. |

| Example | Choosing to invest in bonds instead of stocks, losing potential higher returns. | Overvaluing a mug you own, refusing to sell it at market price. |

Defining Opportunity Cost and Endowment Effect

Opportunity cost represents the value of the next best alternative forgone when making a decision, reflecting the trade-offs inherent in resource allocation. The endowment effect refers to the cognitive bias where individuals assign higher value to items they own compared to identical items they do not own, often leading to irrational decision-making. Understanding opportunity cost emphasizes rational economic choices, while the endowment effect highlights behavioral deviations in value perception.

Origins and Psychological Foundations

Opportunity cost stems from classical economics rooted in scarcity and choice theory, highlighting the value of the next best alternative forgone when a decision is made. The endowment effect originates from behavioral economics and cognitive psychology, demonstrating how ownership increases the perceived value of an item due to loss aversion and emotional attachment. Psychological foundations of opportunity cost involve rational decision-making processes, whereas the endowment effect is driven by biases in human judgment and deviations from expected utility theory.

How Opportunity Cost Influences Decision-Making

Opportunity cost influences decision-making by highlighting the value of the next best alternative forgone when choosing one option over another, prompting individuals to evaluate potential benefits and risks carefully. This economic principle drives consumers and investors to weigh trade-offs rationally, optimizing resource allocation to maximize utility or profit. Unlike the endowment effect, which causes people to overvalue owned items emotionally, opportunity cost encourages forward-looking decisions based on comparative potential gains.

The Science Behind the Endowment Effect

The endowment effect arises from individuals' tendency to ascribe higher value to objects they own compared to identical items they do not possess, a phenomenon rooted in loss aversion as described in prospect theory. Neuroscientific studies reveal that ownership activates brain regions such as the insula and the ventromedial prefrontal cortex, which are associated with emotional attachment and value encoding. This cognitive bias contrasts with opportunity cost, where decisions weigh foregone alternatives, emphasizing the psychological disparity in valuation caused by ownership rather than pure economic trade-offs.

Real-Life Examples of Opportunity Costs

Choosing to invest in stocks instead of real estate exemplifies opportunity cost by highlighting the potential returns sacrificed from the alternative asset. The endowment effect skews decision-making, as sellers often overvalue owned items, like overpricing a used car, distorting the actual trade-off in opportunity costs. Real-life financial decisions, such as opting for higher education over immediate employment, clearly demonstrate opportunity cost by weighing future earning potential against current income.

Everyday Manifestations of the Endowment Effect

The endowment effect frequently appears in everyday decisions where individuals assign higher value to items they own compared to equivalent goods they do not, such as holding on to a coffee mug bought at a premium rather than selling it at market price. This cognitive bias contrasts with opportunity cost, which emphasizes the value of the next best alternative foregone, highlighting how ownership skews valuation away from rational cost-benefit analysis. Common examples include reluctance to sell personal belongings, overvaluation of home property, and resistance to trade or exchange, all driven by emotional attachment rather than objective economic considerations.

Comparing the Impact on Consumer Choices

Opportunity cost influences consumer choices by making individuals weigh the benefits of the next best alternative they must forgo, leading to more rational and economically efficient decisions. Endowment effect impacts consumer behavior by causing people to overvalue items they already own, resulting in a reluctance to trade or sell despite potentially better alternatives. Comparing these concepts reveals that opportunity cost promotes optimal allocation of resources, whereas the endowment effect can create biases that distort consumer preferences and reduce market efficiency.

Implications for Investment and Financial Planning

Opportunity cost highlights the potential gains foregone when choosing one investment over another, emphasizing the importance of evaluating alternative asset allocations to maximize portfolio returns. The endowment effect can lead investors to overvalue their current holdings, causing suboptimal decisions such as holding underperforming stocks due to emotional attachment rather than financial rationale. Understanding these cognitive biases is crucial for financial planners to design strategies that promote rational decision-making, optimize asset diversification, and improve long-term investment outcomes.

Strategies to Overcome Cognitive Biases

To overcome opportunity cost and endowment effect biases, individuals can adopt strategies such as deliberate cost-benefit analysis and perspective-taking exercises. Implementing decision frameworks like pre-commitment devices and mental accounting helps reduce attachment to owned items and focus on alternative gains. Behavioral interventions including mindfulness and awareness training further enhance objective evaluation of choices, minimizing irrational attachment or loss aversion.

Harnessing Awareness for Better Decisions

Understanding the opportunity cost enables individuals to recognize the value of foregone alternatives, promoting more rational decision-making. The endowment effect, which causes people to overvalue owned items, often leads to biased choices that ignore true costs and benefits. Harnessing awareness of these cognitive biases encourages better financial and personal decisions by balancing perceived value with realistic opportunity evaluations.

Opportunity cost Infographic

libterm.com

libterm.com