Actual incidence refers to the true rate at which a disease or condition occurs within a specific population over a defined period. Understanding actual incidence is crucial for accurate public health planning, resource allocation, and implementing targeted prevention strategies. Explore the full article to learn how to interpret and apply actual incidence data effectively.

Table of Comparison

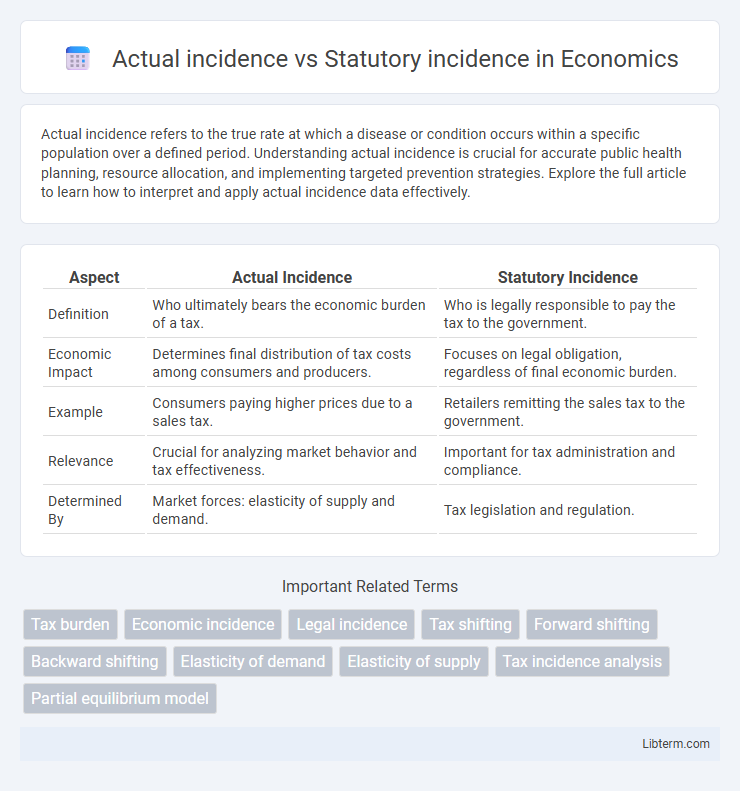

| Aspect | Actual Incidence | Statutory Incidence |

|---|---|---|

| Definition | Who ultimately bears the economic burden of a tax. | Who is legally responsible to pay the tax to the government. |

| Economic Impact | Determines final distribution of tax costs among consumers and producers. | Focuses on legal obligation, regardless of final economic burden. |

| Example | Consumers paying higher prices due to a sales tax. | Retailers remitting the sales tax to the government. |

| Relevance | Crucial for analyzing market behavior and tax effectiveness. | Important for tax administration and compliance. |

| Determined By | Market forces: elasticity of supply and demand. | Tax legislation and regulation. |

Understanding Incidence: Actual vs Statutory

Understanding incidence requires distinguishing between actual incidence, which reflects who ultimately bears the economic burden of a tax, and statutory incidence, defined by the legal obligation to pay the tax. Actual incidence depends on market factors like price elasticity of demand and supply, influencing how the tax burden shifts between consumers and producers. Statutory incidence determines the initial tax liability but does not necessarily indicate the economic impact on different market participants.

Defining Statutory Tax Incidence

Statutory tax incidence defines the legal responsibility imposed by law on a taxpayer to remit a tax to the government, such as income tax liabilities assigned to individuals or corporations. It contrasts with actual incidence, which refers to who ultimately bears the economic burden of the tax after market adjustments. Understanding statutory tax incidence is crucial for fiscal policy design, as it determines the initial tax obligation before shifting effects occur.

Exploring Actual (Economic) Incidence

Actual incidence, also known as economic incidence, refers to the true burden of a tax as it falls on individuals or businesses after market adjustments, differing from statutory incidence which indicates who is legally responsible for payment. Exploring economic incidence involves analyzing how taxes affect prices, wages, and resource allocation, determining the distribution of tax burdens between consumers and producers. Empirical studies on actual incidence use economic models to reveal shifts in supply and demand that influence who ultimately pays the tax, providing insight into tax policy effectiveness and equity.

Key Differences Between Actual and Statutory Incidence

Actual incidence refers to the true economic burden of a tax, indicating who ultimately bears the cost, whereas statutory incidence denotes the legal obligation to pay the tax as established by law. Key differences include the distinction between legal responsibility and economic impact, as statutory incidence focuses on the taxpayer designated by legislation, while actual incidence examines market reactions and shifts in prices influencing who truly absorbs the tax. Understanding these differences clarifies tax incidence analysis, emphasizing that statutory incidence does not necessarily align with actual economic incidence.

Factors Influencing Economic Incidence

Economic incidence of a tax is influenced by factors such as price elasticity of demand and supply, which determine how burden shifts between consumers and producers. When demand is inelastic and supply is elastic, consumers bear a larger share of the tax burden, while the reverse occurs if supply is inelastic and demand is elastic. Market structure, availability of substitutes, and time frame also shape whether the actual incidence deviates from statutory incidence, impacting the ultimate distribution of tax costs.

Legal Imposition vs Economic Burden

Actual incidence refers to the economic burden of a tax, indicating who ultimately bears the cost after market adjustments, while statutory incidence denotes the legal imposition of tax liability on a specific entity as defined by law. The distinction highlights that the entity responsible for paying the tax to the government may not bear the economic burden, as market forces like supply and demand shift the tax's impact. Understanding the divergence between legal imposition and economic burden is crucial for analyzing tax policy efficiency and incidence distribution among consumers and producers.

Case Studies Illustrating Both Incidences

Case studies illustrating actual incidence versus statutory incidence reveal how tax burdens shift beyond legal assignments. In the U.S. cigarette tax example, statutory incidence falls on manufacturers, but actual incidence transfers to consumers through higher prices. Similarly, payroll taxes legally imposed on employers often result in wage reductions, demonstrating employee bears the actual incidence.

Real-World Examples: Shifting Tax Burden

Actual incidence of taxation reveals who ultimately bears the economic burden of a tax, contrasting with statutory incidence, which identifies the entity legally required to pay the tax. For example, when a government imposes a sales tax on retailers, the statutory incidence falls on the seller, but the actual incidence often shifts to consumers via higher prices, as seen in the tobacco tax in the United States. Similarly, corporate income taxes may be nominally paid by companies, but economic studies demonstrate that employees often bear part of this tax burden through reduced wages, illustrating real-world tax incidence shifting mechanisms.

Policy Implications of Incidence Analysis

Actual incidence refers to the true economic burden of a tax as borne by consumers, producers, or workers, while statutory incidence indicates the legal obligation to pay the tax. Policy implications of incidence analysis guide effective tax design by identifying which groups ultimately bear the economic cost, ensuring fairness and efficiency in public finance. Understanding the divergence between actual and statutory incidence informs targeted interventions, minimizing unintended distributional effects and enhancing revenue effectiveness.

Conclusion: Why Distinguishing Incidence Matters

Understanding the difference between actual incidence and statutory incidence is essential for accurately assessing the economic burden of taxes and creating effective fiscal policies. Actual incidence reveals who ultimately bears the cost of a tax, which may shift from the statutory payer due to market responses, altering consumer prices or wage levels. Distinguishing these incidences ensures that policymakers can design tax systems that achieve desired equity and efficiency objectives without unintended economic distortions.

Actual incidence Infographic

libterm.com

libterm.com