Credit cards offer a convenient way to make purchases and manage your finances while providing benefits like rewards, cash back, and fraud protection. Effective credit card use can improve your credit score, making it easier to secure loans or better financial products in the future. Explore the rest of this article to learn how to maximize your credit card advantages and avoid common pitfalls.

Table of Comparison

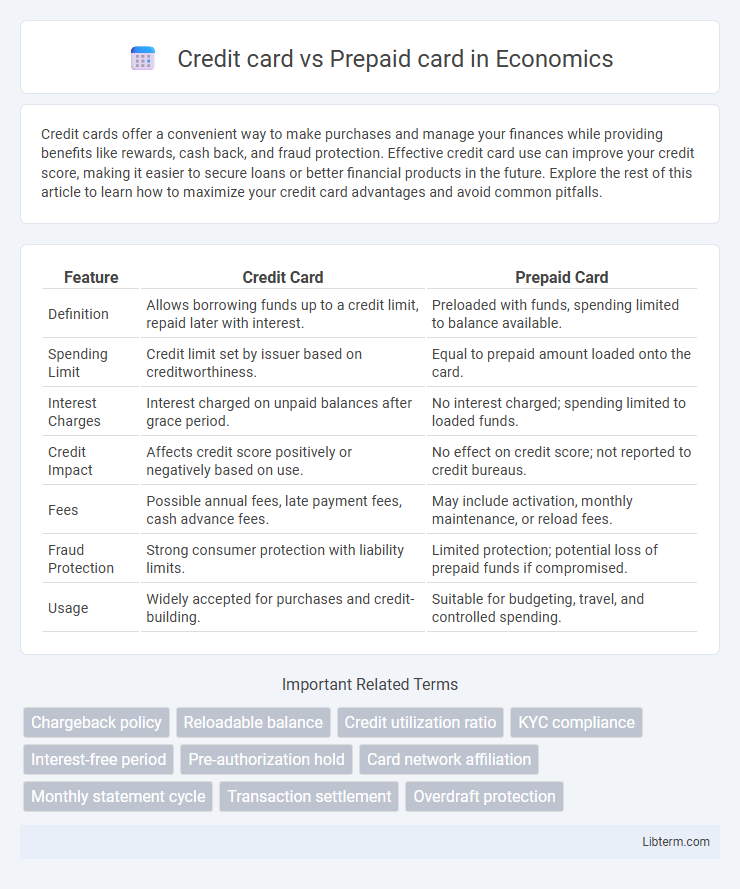

| Feature | Credit Card | Prepaid Card |

|---|---|---|

| Definition | Allows borrowing funds up to a credit limit, repaid later with interest. | Preloaded with funds, spending limited to balance available. |

| Spending Limit | Credit limit set by issuer based on creditworthiness. | Equal to prepaid amount loaded onto the card. |

| Interest Charges | Interest charged on unpaid balances after grace period. | No interest charged; spending limited to loaded funds. |

| Credit Impact | Affects credit score positively or negatively based on use. | No effect on credit score; not reported to credit bureaus. |

| Fees | Possible annual fees, late payment fees, cash advance fees. | May include activation, monthly maintenance, or reload fees. |

| Fraud Protection | Strong consumer protection with liability limits. | Limited protection; potential loss of prepaid funds if compromised. |

| Usage | Widely accepted for purchases and credit-building. | Suitable for budgeting, travel, and controlled spending. |

Introduction to Credit Card vs Prepaid Card

Credit cards offer a line of credit allowing users to borrow funds up to a preset limit, with payments due monthly and potential interest charges on unpaid balances. Prepaid cards require users to load funds in advance, enabling spending only up to the available balance without incurring debt or interest. Both payment methods provide convenience and security, but credit cards build credit history while prepaid cards do not.

What is a Credit Card?

A credit card is a financial tool that allows users to borrow funds up to a predetermined credit limit to make purchases or withdraw cash, with the obligation to repay the amount borrowed plus interest if not paid in full by the billing cycle's due date. Credit cards often come with benefits such as rewards programs, fraud protection, and credit-building opportunities. Unlike prepaid cards, credit cards require a credit check and involve a revolving debt system managed by the issuing bank or financial institution.

What is a Prepaid Card?

A prepaid card is a payment card loaded with a specific amount of money before use, allowing users to spend only the available balance without incurring debt. Unlike credit cards, prepaid cards do not involve borrowing or credit checks, making them accessible for individuals with limited or no credit history. Prepaid cards offer budgeting benefits and reduce the risk of overspending, ideal for controlled financial transactions and gift purposes.

Key Differences Between Credit and Prepaid Cards

Credit cards allow users to borrow funds up to a predetermined credit limit, with monthly billing and interest charges on outstanding balances, while prepaid cards require users to load funds in advance, limiting spending to the available balance. Credit cards often offer rewards, credit building opportunities, and fraud protection, whereas prepaid cards typically have fewer benefits and do not impact credit scores. Unlike credit cards, prepaid cards avoid debt accumulation and interest fees, making them a preferred option for budgeting and controlled spending.

Pros and Cons of Credit Cards

Credit cards offer benefits such as building credit history, rewards programs, and purchase protections, making them valuable for financial management and emergencies. However, high-interest rates and the potential for accumulating debt pose significant risks to users who do not pay balances in full. Credit cards also require credit approval, which can limit access for individuals with poor or no credit history.

Pros and Cons of Prepaid Cards

Prepaid cards offer the advantage of controlled spending by requiring users to load funds in advance, reducing the risk of debt and making budgeting easier. They are widely accepted for purchases and online transactions but may have fees such as activation, reload, or inactivity charges that can add up over time. Unlike credit cards, prepaid cards do not build credit history or offer rewards programs, limiting their benefits for those seeking credit improvement or incentives.

Credit Card Fees vs Prepaid Card Fees

Credit card fees typically include annual fees, interest charges on outstanding balances, late payment fees, and foreign transaction fees, which can accumulate significantly if the balance is not paid in full each month. Prepaid cards usually have lower fees, such as activation fees, reload fees, and monthly maintenance fees, but they do not charge interest since funds are preloaded, reducing the risk of debt. Comparing both, credit cards may be more expensive due to interest and penalty fees, while prepaid cards offer more predictable costs but often lack rewards or credit-building benefits.

Security and Fraud Protection Comparison

Credit cards offer robust security features such as zero liability protection and advanced fraud detection systems provided by issuers like Visa and Mastercard, reducing consumer financial risk during unauthorized transactions. Prepaid cards, while limiting exposure to only the loaded amount, often lack comprehensive fraud protection and may have slower dispute resolution processes. Consumers seeking enhanced security should consider credit cards for superior fraud monitoring and faster reimbursement options.

Which Card Is Best for Your Needs?

Choosing between a credit card and a prepaid card depends on your financial goals and spending habits. Credit cards offer benefits like building credit scores, rewards programs, and purchase protection, making them ideal for responsible users seeking credit history enhancement. Prepaid cards provide controlled spending with no credit risk or interest charges, suitable for budgeting or those with poor or no credit history.

Conclusion: Choosing Between Credit and Prepaid Cards

Credit cards offer borrowing power with interest and rewards, ideal for building credit history and managing large expenses, while prepaid cards provide controlled spending without debt risk or credit checks, suitable for budgeting and limited use. Assessing financial goals, spending habits, and the need for credit access is essential when deciding between the two. The right choice balances convenience, credit benefits, and financial discipline to align with personal financial management strategies.

Credit card Infographic

libterm.com

libterm.com