Market flexibility allows businesses to rapidly adjust to changes in consumer demand, supply chain disruptions, and regulatory shifts. Enhanced flexibility supports agile decision-making and fosters innovation, helping companies maintain competitive advantage in dynamic markets. Discover how increasing market flexibility can transform Your business strategies and drive sustainable growth by reading the full article.

Table of Comparison

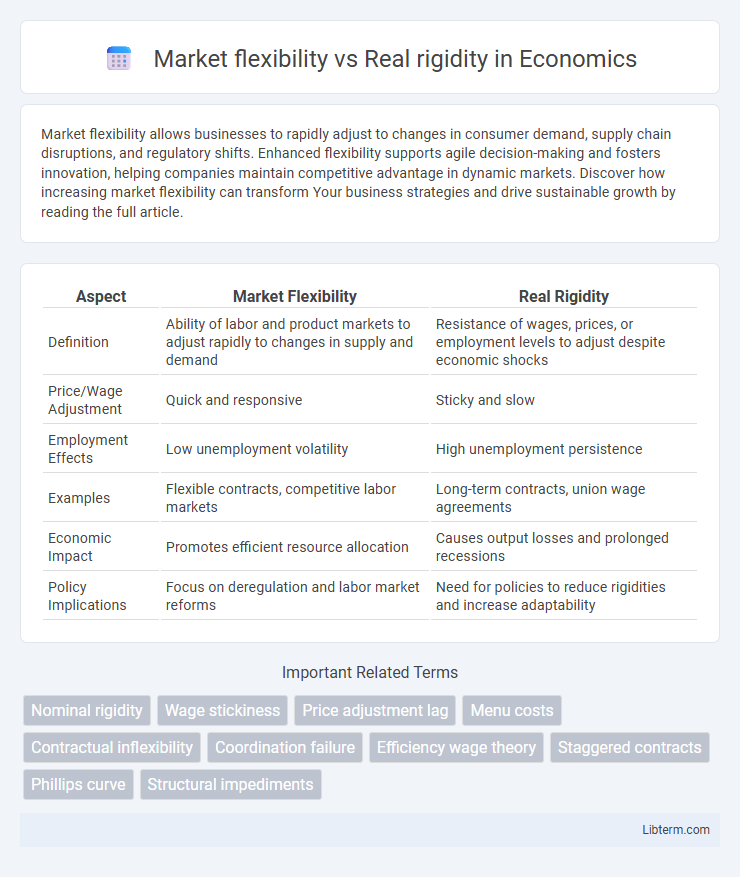

| Aspect | Market Flexibility | Real Rigidity |

|---|---|---|

| Definition | Ability of labor and product markets to adjust rapidly to changes in supply and demand | Resistance of wages, prices, or employment levels to adjust despite economic shocks |

| Price/Wage Adjustment | Quick and responsive | Sticky and slow |

| Employment Effects | Low unemployment volatility | High unemployment persistence |

| Examples | Flexible contracts, competitive labor markets | Long-term contracts, union wage agreements |

| Economic Impact | Promotes efficient resource allocation | Causes output losses and prolonged recessions |

| Policy Implications | Focus on deregulation and labor market reforms | Need for policies to reduce rigidities and increase adaptability |

Understanding Market Flexibility and Real Rigidity

Market flexibility refers to the ability of labor and product markets to adjust quickly to changes in economic conditions, including wages, prices, and employment levels. Real rigidity occurs when wages and prices are resistant to change despite economic fluctuations, often due to institutional constraints like long-term contracts or social norms. Understanding the balance between market flexibility and real rigidity is crucial for analyzing economic adjustments and creating policies that promote efficient resource allocation.

Key Differences Between Market Flexibility and Real Rigidity

Market flexibility refers to the ease with which prices, wages, and employment levels adjust in response to economic changes, promoting efficient resource allocation. Real rigidity occurs when these adjustments are hindered by factors such as institutional constraints, long-term contracts, or behavioral norms, causing prices and wages to remain sticky despite shifts in demand or supply. Key differences include the speed and extent of adjustment--market flexibility enables rapid adaptation, whereas real rigidity leads to persistent unemployment and inefficiencies due to inflexible labor and product markets.

Factors Influencing Market Flexibility

Market flexibility is influenced by factors such as labor mobility, regulatory frameworks, and technological innovation that enable rapid adjustments in supply and demand. Real rigidity arises from wage contracts, institutional constraints, and social norms that hinder price and wage adjustments. Efficient markets exhibit high flexibility when labor laws support mobility, technological adoption accelerates, and regulatory environments reduce barriers to entry.

Causes and Consequences of Real Rigidity

Real rigidity arises from factors such as long-term contracts, institutional regulations, and coordination failures that prevent prices and wages from adjusting promptly to market changes. This inflexibility leads to persistent unemployment, slower economic recovery during recessions, and prolonged periods of disequilibrium in labor and goods markets. Understanding the causes of real rigidity is crucial for policymakers aiming to implement structural reforms that enhance market responsiveness and reduce economic volatility.

The Role of Price Adjustments in Market Flexibility

Price adjustments play a crucial role in enhancing market flexibility by allowing supply and demand to rapidly reach equilibrium, minimizing unemployment and output gaps. In contrast, real rigidity occurs when firms and workers resist changing wages and prices due to long-term contracts, menu costs, or fairness concerns, preventing efficient reallocation of resources. Understanding the balance between nominal price flexibility and underlying real rigidities is essential for policymakers aiming to stabilize markets and promote economic resilience.

Wage Stickiness as a Source of Real Rigidity

Wage stickiness, a primary source of real rigidity, impedes labor market adjustments by preventing wages from rapidly responding to changes in supply and demand, thereby limiting market flexibility. This rigidity can lead to prolonged unemployment or inefficient labor allocation during economic fluctuations. Empirical studies show that contractual obligations, minimum wage laws, and social norms contribute significantly to wage stickiness, reinforcing real rigidity in labor markets.

Impact of Flexibility and Rigidity on Economic Efficiency

Market flexibility enhances economic efficiency by allowing prices and wages to adjust swiftly to supply and demand changes, promoting optimal resource allocation and reducing unemployment. Real rigidity, characterized by sticky prices and wages due to institutional factors or contract constraints, impedes this adjustment process, leading to prolonged economic imbalances and inefficiencies. Empirical studies show that economies with higher market flexibility experience faster recoveries from shocks and better overall growth performance compared to rigid markets.

Market Responses During Economic Shocks

Market flexibility enhances economic resilience by allowing rapid adjustments in prices, wages, and employment levels during economic shocks, facilitating resource reallocation and minimizing unemployment. Real rigidity, characterized by inflexible wages and prices due to contracts, regulations, or social norms, exacerbates downturns by delaying market responses and prolonging recessions. Empirical studies demonstrate that economies with higher market flexibility recover faster from shocks due to more efficient labor and product market adjustments.

Policy Implications: Addressing Market Flexibility vs Real Rigidity

Market flexibility enables rapid adjustment to economic changes through wage and price variations, boosting labor market responsiveness and overall efficiency. Real rigidity refers to the structural and institutional factors that prevent wages and prices from adjusting downward, causing unemployment and prolonged economic downturns. Policies should focus on reducing real rigidity by promoting wage bargaining reforms, easing hiring and firing regulations, and enhancing workforce skills to improve labor mobility and align market outcomes with economic fundamentals.

Case Studies Illustrating Flexibility and Rigidity in Markets

Market flexibility is exemplified by the housing market in Germany, where adaptive rental regulations and responsive pricing mechanisms enable swift adjustments to demand fluctuations, promoting equilibrium. Conversely, the real estate market in New York City illustrates real rigidity, as rent control laws and long-term lease contracts restrict price mobility, resulting in persistent imbalances and reduced supply elasticity. These case studies highlight how regulatory frameworks and contract structures directly influence market responsiveness and efficiency.

Market flexibility Infographic

libterm.com

libterm.com