Returns to scale describe how output changes when all inputs in production are increased proportionally, revealing whether a firm experiences increasing, constant, or decreasing returns. This concept is crucial in understanding long-term production efficiency and cost behavior in your business operations. Explore the rest of the article to learn how returns to scale impact your growth strategy and competitive advantage.

Table of Comparison

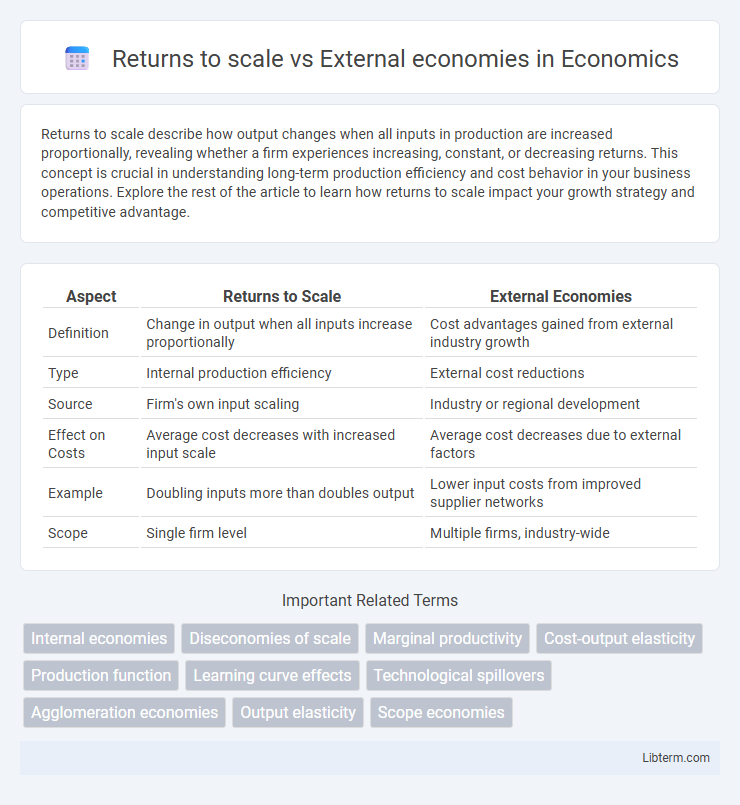

| Aspect | Returns to Scale | External Economies |

|---|---|---|

| Definition | Change in output when all inputs increase proportionally | Cost advantages gained from external industry growth |

| Type | Internal production efficiency | External cost reductions |

| Source | Firm's own input scaling | Industry or regional development |

| Effect on Costs | Average cost decreases with increased input scale | Average cost decreases due to external factors |

| Example | Doubling inputs more than doubles output | Lower input costs from improved supplier networks |

| Scope | Single firm level | Multiple firms, industry-wide |

Introduction to Returns to Scale and External Economies

Returns to scale analyze how output responds to proportional increases in all inputs, distinguishing between increasing, constant, or decreasing returns in production. External economies refer to cost advantages gained by firms due to external factors such as industry growth, technological advancements, or improved infrastructure. Understanding returns to scale highlights internal operational efficiencies, while external economies emphasize benefits arising from the external environment influencing firm productivity.

Defining Returns to Scale

Returns to scale measures the change in output when all inputs in production are increased proportionally, indicating whether production scales up efficiently. External economies refer to cost advantages firms gain from industry growth or external factors, not tied directly to their input levels. Defining returns to scale helps distinguish how internal input changes affect productivity, while external economies emphasize benefits from the broader economic environment.

Understanding External Economies

External economies refer to cost advantages that firms experience due to factors outside their control, such as industry growth, improved infrastructure, or technological advancements in the surrounding environment. Unlike returns to scale, which relate to the internal production scale changes within a single firm, external economies benefit all firms in a particular industry or region, leading to lower average costs as the industry expands. Understanding external economies helps explain how clusters of businesses achieve greater efficiency and innovation through shared resources and knowledge spillovers.

Key Differences Between Returns to Scale and External Economies

Returns to scale measures how output changes when all inputs increase proportionally within a firm, indicating internal production efficiency, while external economies refer to cost advantages arising from factors outside a firm, typically from industry growth or regional development. Returns to scale is an internal concept tied to the firm's production function, whereas external economies depend on external environmental changes benefiting multiple firms. Returns to scale impacts the firm's average cost through input manipulation, whereas external economies lower costs via shared infrastructure, skilled labor pools, or technological advances at the industry level.

Types of Returns to Scale

Returns to scale describe how output changes when all input factors increase proportionally, including increasing returns to scale where output grows more than input, constant returns to scale where output changes proportionally, and decreasing returns to scale where output grows less than input. External economies occur outside a firm but within an industry, benefiting all firms through factors like improved infrastructure or supplier networks, which differ from returns to scale as they do not depend on the firm's input changes. Understanding the distinction between internal returns to scale and external economies is crucial for analyzing firm growth and industry-level productivity improvements.

Forms of External Economies

Forms of external economies include localization economies, which arise when firms in the same industry cluster geographically, and urbanization economies, which occur due to the overall growth of a city benefiting various industries. These external economies improve productivity through shared infrastructure, knowledge spillovers, and specialized labor pools without changing individual firm scale. Returns to scale measure how output changes with proportional input increases within a single firm, while external economies reflect cost reductions shared across firms in an industry or region.

Factors Influencing Returns to Scale

Returns to scale describe how output responds to proportional changes in all inputs, influenced by factors such as technological advancement, managerial efficiency, and production methods. External economies arise from industry-wide improvements like infrastructure development, supplier specialization, and knowledge spillovers that reduce costs. The distinction hinges on returns to scale depending on firm-level input changes, while external economies depend on external industry conditions benefiting multiple firms.

Sources of External Economies

Sources of external economies include improvements in industry infrastructure, technological advancements, and specialized labor pools that benefit all firms within a geographical area. These factors reduce production costs independently of an individual firm's scale, unlike returns to scale, which relate to internal efficiency gains as a firm expands. Clustering of businesses promotes knowledge spillovers and shared supplier networks, amplifying external economies and enhancing overall productivity.

Implications for Business Strategy

Returns to scale directly impact a firm's cost structure, influencing decisions on production expansion and resource allocation to achieve greater efficiency. External economies, driven by industry-wide improvements such as technological innovation or infrastructure development, create an environment where multiple firms benefit from lower costs and increased productivity. Businesses strategize by leveraging returns to scale internally while positioning themselves to capitalize on external economies through collaboration, cluster participation, or investment in shared resources.

Returns to Scale vs External Economies: Summary Table

Returns to scale measure how output changes in response to proportional increases in all inputs within a firm, categorized as increasing, constant, or decreasing returns to scale. External economies arise from external factors such as industry growth, infrastructure, and supplier specialization, boosting productivity beyond the firm's internal input adjustments. Returns to scale are internal to the firm's production function, while external economies stem from broader industry or regional advantages influencing multiple firms simultaneously.

Returns to scale Infographic

libterm.com

libterm.com