A terms of trade shock occurs when there is a sudden and significant change in the ratio of export prices to import prices for a country, impacting its economic stability and trade balance. This shock can affect national income, exchange rates, and overall economic growth, influencing how much a country has to pay for goods compared to what it earns from exports. Explore the rest of the article to understand how terms of trade shocks influence your economy and what measures can mitigate their effects.

Table of Comparison

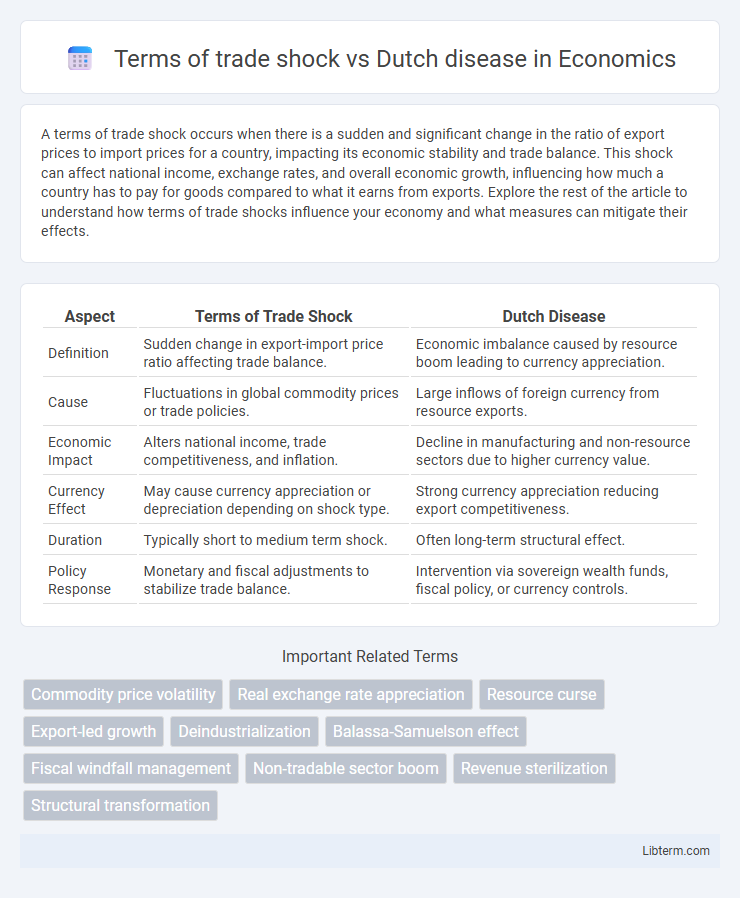

| Aspect | Terms of Trade Shock | Dutch Disease |

|---|---|---|

| Definition | Sudden change in export-import price ratio affecting trade balance. | Economic imbalance caused by resource boom leading to currency appreciation. |

| Cause | Fluctuations in global commodity prices or trade policies. | Large inflows of foreign currency from resource exports. |

| Economic Impact | Alters national income, trade competitiveness, and inflation. | Decline in manufacturing and non-resource sectors due to higher currency value. |

| Currency Effect | May cause currency appreciation or depreciation depending on shock type. | Strong currency appreciation reducing export competitiveness. |

| Duration | Typically short to medium term shock. | Often long-term structural effect. |

| Policy Response | Monetary and fiscal adjustments to stabilize trade balance. | Intervention via sovereign wealth funds, fiscal policy, or currency controls. |

Introduction to Terms of Trade Shock and Dutch Disease

Terms of trade shock refers to sudden changes in the price of exports relative to imports, impacting a country's economic stability and trade balance. Dutch disease describes the negative economic consequences following a resource boom, where resource sector growth leads to currency appreciation and harm to tradable sectors. Both concepts highlight the challenges in managing resource wealth and external price fluctuations on an economy's structure and competitiveness.

Defining Terms of Trade Shock

A Terms of Trade (ToT) shock occurs when there is a significant and unexpected change in the ratio of export prices to import prices, directly impacting a country's purchasing power and economic stability. This shock can lead to substantial shifts in national income and resource allocation, often resulting in either a gain or loss in economic welfare depending on whether export prices rise or fall relative to import prices. Dutch disease arises as a potential consequence of a positive ToT shock, characterized by currency appreciation and a decline in the manufacturing sector due to resource reallocation towards the booming export industry.

Explaining the Dutch Disease Phenomenon

The Dutch Disease phenomenon occurs when a resource boom, such as a sudden increase in commodity prices, leads to currency appreciation, making other export sectors less competitive internationally. This deindustrialization effect results from capital and labor shifting towards the booming resource sector, causing a decline in manufacturing and agriculture. Unlike a generic terms of trade shock, Dutch Disease specifically highlights the structural economic imbalance and long-term negative impact on non-resource sectors.

Key Differences Between Terms of Trade Shock and Dutch Disease

Terms of trade shock refers to sudden changes in the relative prices of a country's exports and imports, affecting national income and trade balance, while Dutch disease describes the adverse economic consequences arising primarily from natural resource booms leading to currency appreciation and manufacturing decline. The key difference lies in that terms of trade shock focuses on price fluctuations impacting economic output and welfare, whereas Dutch disease centers on resource-driven exchange rate effects causing sectoral imbalance. Understanding these distinctions aids policymakers in crafting appropriate responses to trade and resource-driven economic challenges.

Causes of Terms of Trade Shock

Terms of trade shock occurs when a sudden change in the relative prices of exports and imports disrupts a country's trade balance, often triggered by volatile commodity prices, changes in global demand, or trade policy shifts. Unlike Dutch disease, which refers to the currency appreciation and subsequent decline in the manufacturing sector due to resource booms, terms of trade shocks specifically stem from external economic factors affecting export revenues. For example, a drop in oil prices can cause a negative terms of trade shock for oil-exporting nations, reducing national income and altering trade dynamics.

Mechanisms Behind Dutch Disease

Terms of trade shock occurs when a country's export prices change relative to import prices, impacting national income and resource allocation. The mechanisms behind Dutch disease involve a resource boom increasing revenues, leading to currency appreciation and a decline in the tradable goods sector due to reduced export competitiveness. This process results in structural economic shifts where the non-resource sectors contract, influenced by changes in labor and capital distribution triggered by the initial terms of trade shock.

Economic Consequences of Terms of Trade Shocks

Terms of trade shocks can cause significant fluctuations in a country's export and import prices, leading to volatility in national income and consumption patterns. These shocks often result in reduced competitiveness for non-resource sectors, risking deindustrialization similar to Dutch disease but driven primarily by external price changes rather than resource windfalls. The economic consequences include exchange rate appreciation, inflationary pressures, and potential declines in long-term growth due to over-reliance on volatile commodity revenues.

Impact of Dutch Disease on Economic Structure

Dutch Disease causes a significant shift in economic structure by overvaluing the currency, which makes the manufacturing and agriculture sectors less competitive internationally. This results in deindustrialization and a decline in export diversity, increasing dependency on the booming resource sector. In contrast, a terms of trade shock primarily affects the trade balance and income levels without necessarily causing long-term structural changes like Dutch Disease.

Policy Responses to Terms of Trade Shocks and Dutch Disease

Policy responses to terms of trade shocks often include stabilizing fiscal measures such as sovereign wealth funds and counter-cyclical fiscal policies to mitigate volatility in national income. In contrast, addressing Dutch disease requires structural policies like currency intervention, diversification of the economic base, and investment in tradable sectors to counteract real exchange rate appreciation. Both approaches prioritize maintaining economic stability and competitiveness while managing resource wealth effectively.

Case Studies: Real-World Examples and Lessons

The 1970s oil boom in Nigeria exemplifies a terms of trade shock causing Dutch disease, where resource windfalls led to currency appreciation and manufacturing decline. Norway's management of oil revenues through a sovereign wealth fund demonstrates how careful fiscal policy can mitigate Dutch disease effects. These case studies highlight the importance of economic diversification and stabilization mechanisms to buffer against volatility from external shocks.

Terms of trade shock Infographic

libterm.com

libterm.com