Uncovered interest parity (UIP) explains the relationship between interest rates and exchange rate expectations in international finance. It states that the difference in interest rates between two countries equals the expected change in exchange rates, helping investors anticipate currency movements. Discover how UIP impacts your investment decisions and exchange rate predictions in the full article.

Table of Comparison

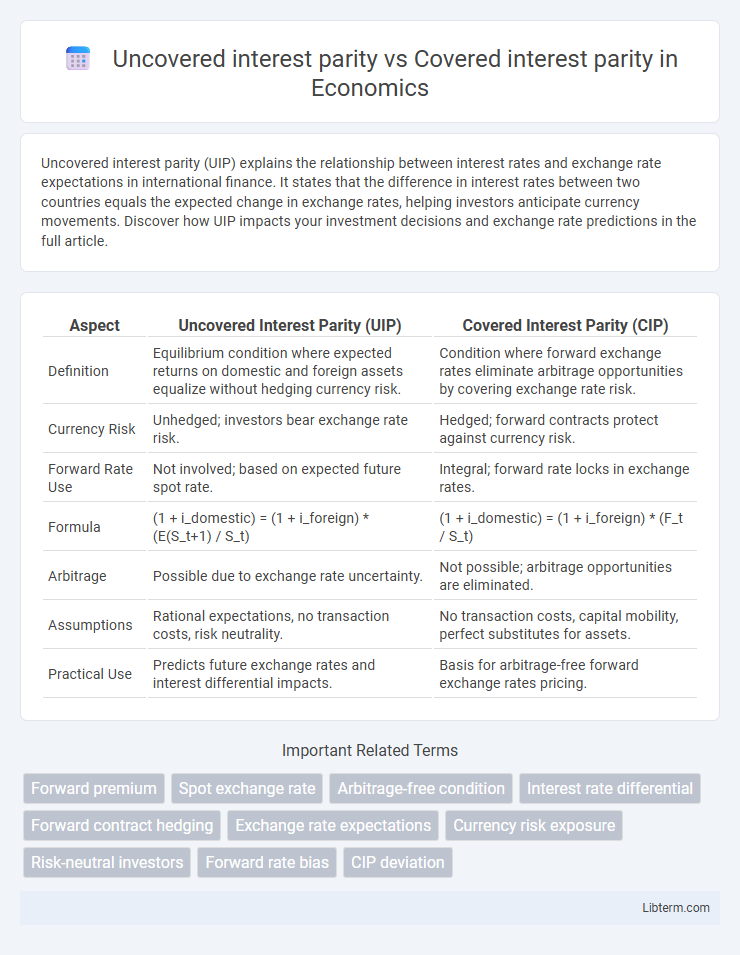

| Aspect | Uncovered Interest Parity (UIP) | Covered Interest Parity (CIP) |

|---|---|---|

| Definition | Equilibrium condition where expected returns on domestic and foreign assets equalize without hedging currency risk. | Condition where forward exchange rates eliminate arbitrage opportunities by covering exchange rate risk. |

| Currency Risk | Unhedged; investors bear exchange rate risk. | Hedged; forward contracts protect against currency risk. |

| Forward Rate Use | Not involved; based on expected future spot rate. | Integral; forward rate locks in exchange rates. |

| Formula | (1 + i_domestic) = (1 + i_foreign) * (E(S_t+1) / S_t) | (1 + i_domestic) = (1 + i_foreign) * (F_t / S_t) |

| Arbitrage | Possible due to exchange rate uncertainty. | Not possible; arbitrage opportunities are eliminated. |

| Assumptions | Rational expectations, no transaction costs, risk neutrality. | No transaction costs, capital mobility, perfect substitutes for assets. |

| Practical Use | Predicts future exchange rates and interest differential impacts. | Basis for arbitrage-free forward exchange rates pricing. |

Introduction to Interest Rate Parity

Interest Rate Parity (IRP) establishes the relationship between interest rates and exchange rates to prevent arbitrage opportunities in the foreign exchange market. Uncovered Interest Parity (UIP) assumes no forward contracts, implying expected future spot rates adjust to offset interest rate differentials, while Covered Interest Parity (CIP) relies on forward contracts to lock in exchange rates, ensuring no risk-free arbitrage. The distinction between UIP and CIP is crucial for understanding how exchange rate expectations and forward market interventions influence international capital flows.

Defining Uncovered Interest Parity (UIP)

Uncovered Interest Parity (UIP) is a fundamental concept in international finance stating that the expected returns on deposits in different currencies are equal when adjusted for expected changes in exchange rates. Unlike Covered Interest Parity (CIP), which involves no arbitrage opportunities due to forward contracts locking in exchange rates, UIP allows for exchange rate risk since it relies on expected future spot rates rather than forward rates. UIP is essential for understanding currency risk and predicting exchange rate movements based on interest rate differentials.

Explaining Covered Interest Parity (CIP)

Covered Interest Parity (CIP) ensures that the forward exchange rate, interest rates in two countries, and the spot exchange rate align to prevent arbitrage opportunities in the foreign exchange market. It states that the interest rate differential between two countries equals the differential between the forward and spot exchange rates, adjusted for exchange rate risk by using forward contracts. CIP plays a crucial role in currency hedging by locking in returns on foreign investments, unlike Uncovered Interest Parity (UIP), which involves expected future spot rates and carries currency risk.

Mathematical Formulations of UIP and CIP

Uncovered Interest Parity (UIP) is expressed mathematically as \( E_t\left(\frac{S_{t+1}}{S_t}\right) = \frac{1 + i_t}{1 + i_t^*} \), where \( S_t \) is the current spot exchange rate, \( E_t(S_{t+1}) \) is the expected future spot rate, \( i_t \) is the domestic interest rate, and \( i_t^* \) is the foreign interest rate. Covered Interest Parity (CIP) is formulated as \( \frac{F_t}{S_t} = \frac{1 + i_t}{1 + i_t^*} \), where \( F_t \) is the forward exchange rate locked in at time \( t \). The key difference lies in UIP involving expected future spot rates without arbitrage constraints, while CIP involves no-arbitrage conditions using forward contracts to hedge exchange rate risk.

Key Assumptions of UIP and CIP

Uncovered Interest Parity (UIP) assumes that investors face no arbitrage opportunities but accept exchange rate risk due to uncertain future spot rates, relying on the expectation that currency depreciation or appreciation offsets interest rate differentials. Covered Interest Parity (CIP) is based on the premise that forward exchange rates are arbitrage-free due to the use of forward contracts, which eliminate exchange rate risk, ensuring interest rate differentials are offset by forward premium or discount. The key distinction lies in UIP's dependence on expected spot rates and risk neutrality, while CIP assumes perfect capital mobility, no transaction costs, and riskless hedging through forward contracts.

Real-World Applications of UIP and CIP

Uncovered interest parity (UIP) and covered interest parity (CIP) are fundamental concepts in foreign exchange markets used to explain the relationship between interest rates and exchange rates. UIP is primarily applied in forecasting future spot exchange rates and assessing currency risk in international investment decisions without the use of forward contracts, influencing portfolio management and speculative strategies. CIP is crucial in arbitrage operations and hedging practices, as it ensures no riskless profit opportunities via covered forward contracts, maintaining equilibrium in global money markets and supporting corporate risk management in currency exposure.

Factors Leading to Deviations from Parity

Uncovered Interest Parity (UIP) often deviates due to exchange rate risk, investor risk aversion, and differences in expected inflation rates between countries, causing returns on foreign investments to appear higher or lower than predicted. Covered Interest Parity (CIP), typically holding in efficient markets, can face deviations due to transaction costs, capital controls, and market segmentation, which hinder the ability to perfectly hedge currency risk via forward contracts. Macro-financial shocks and liquidity constraints also contribute to CIP deviations by disrupting arbitrage mechanisms that usually enforce parity conditions.

UIP vs CIP: Major Differences

Uncovered Interest Parity (UIP) assumes no arbitrage opportunities exist in foreign exchange markets without using forward contracts, highlighting expected future spot rate adjustments based on interest rate differentials. Covered Interest Parity (CIP) enforces arbitrage conditions by incorporating forward contracts, ensuring the interest rate differential equals the forward premium or discount, eliminating risk. UIP reflects currency risk exposure and expectations, while CIP guarantees risk-free arbitrage opportunities, making CIP a stricter form of interest rate parity used in practical arbitrage strategies.

Empirical Evidence and Case Studies

Empirical evidence on Uncovered Interest Parity (UIP) reveals frequent deviations due to exchange rate volatility and risk premiums, with studies such as Fama (1984) highlighting its limited predictive power in short-term currency forecasting. In contrast, Covered Interest Parity (CIP) consistently holds in developed markets, supported by arbitrage mechanisms that ensure no riskless profit opportunities, as demonstrated in case studies during stable economic conditions before the 2008 financial crisis. Post-crisis research, including studies by Du et al. (2018), showed occasional CIP violations linked to funding liquidity constraints and regulatory changes, emphasizing the importance of credit risk and market frictions in real-world foreign exchange markets.

Conclusion: Implications for Forex Markets

Uncovered interest parity (UIP) suggests that expected changes in exchange rates offset interest rate differentials, implying no arbitrage opportunities in forex markets. Covered interest parity (CIP) enforces a no-arbitrage condition through forward contracts, ensuring forward exchange rates reflect interest rate differentials precisely. In practice, CIP holds tightly due to arbitrage by institutional investors, while UIP often deviates because of currency risk premia and market expectations, affecting forex trading strategies and hedging decisions.

Uncovered interest parity Infographic

libterm.com

libterm.com