Speculative capital drives investments aimed at rapid financial gains by exploiting market fluctuations rather than long-term value creation. This type of capital can increase market volatility and impact asset prices significantly, often influencing economic stability. Discover how speculative capital shapes financial markets and affects your investment strategies in the rest of this article.

Table of Comparison

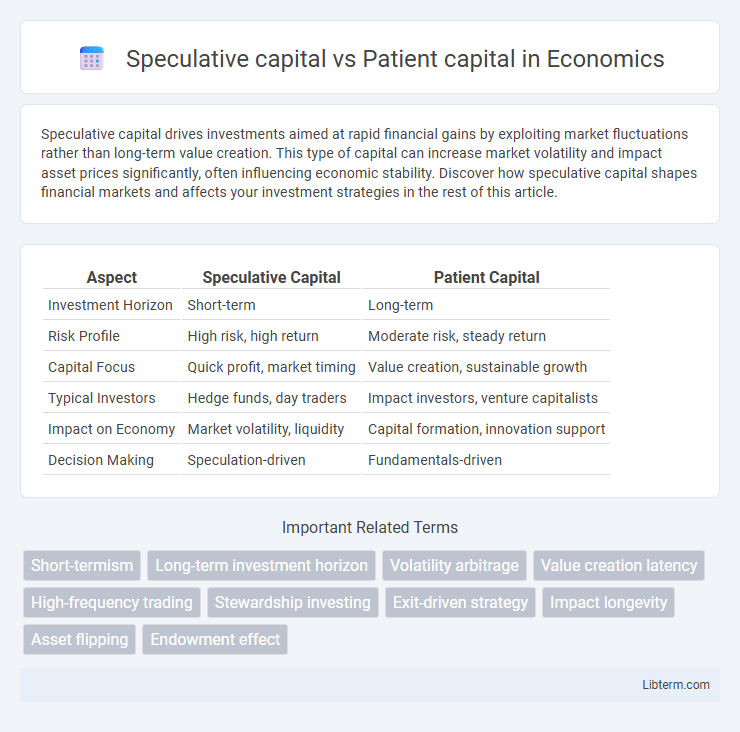

| Aspect | Speculative Capital | Patient Capital |

|---|---|---|

| Investment Horizon | Short-term | Long-term |

| Risk Profile | High risk, high return | Moderate risk, steady return |

| Capital Focus | Quick profit, market timing | Value creation, sustainable growth |

| Typical Investors | Hedge funds, day traders | Impact investors, venture capitalists |

| Impact on Economy | Market volatility, liquidity | Capital formation, innovation support |

| Decision Making | Speculation-driven | Fundamentals-driven |

Introduction to Speculative Capital and Patient Capital

Speculative capital refers to investments made with high-risk and short-term horizons, aiming for rapid financial returns through market fluctuations. Patient capital involves long-term investment strategies that prioritize sustainable growth and social impact over immediate profits. Understanding the contrast between speculative and patient capital highlights differing priorities in risk tolerance, investment duration, and value creation.

Defining Speculative Capital

Speculative capital refers to investments made with the expectation of high returns in a short period, often involving high risk and volatility. This type of capital is typically driven by market timing, price fluctuations, and rapid asset turnover, aiming to capitalize on immediate opportunities rather than long-term growth. Unlike patient capital, which supports sustainable development and long-term value creation, speculative capital prioritizes quick profit from market speculation.

Understanding Patient Capital

Patient capital refers to long-term investment funds characterized by extended time horizons and tolerance for delayed returns, often supporting startups and social enterprises focused on sustainable growth and impact. Unlike speculative capital, which seeks quick profits through high-risk ventures and short-term market movements, patient capital prioritizes stability, innovation, and societal benefits over immediate financial gains. Understanding patient capital is crucial for fostering economic development and funding ventures that require time to mature and realize their full potential.

Key Differences Between Speculative and Patient Capital

Speculative capital targets short-term, high-risk investments with the goal of quick returns, often within volatile markets or emerging sectors. Patient capital emphasizes long-term investment horizons, prioritizing sustainable growth and value creation over immediate profits in industries such as infrastructure, healthcare, and technology innovation. Key differences lie in risk tolerance, time frame, and investment objectives, with speculative capital favoring rapid gains and patient capital supporting enduring business development.

Risk Appetite and Investment Horizon

Speculative capital targets high-risk, short-term investments aiming for rapid returns, often within months or a few years, reflecting a high risk appetite. Patient capital prioritizes long-term investments with lower risk, supporting sustained growth over extended horizons typically spanning decades. The stark contrast between rapid liquidity needs and enduring commitment defines their strategic deployment in financial markets.

Impact on Economic Growth and Stability

Speculative capital, driven by short-term gains and high liquidity, often leads to increased market volatility and financial instability, potentially causing economic bubbles and abrupt downturns. In contrast, patient capital supports long-term investments in infrastructure, technology, and human capital, fostering sustainable economic growth and enhancing stability by promoting steady job creation and innovation. Economies reliant on patient capital typically experience resilient development with lower risk of financial crises, whereas those dominated by speculative capital face heightened vulnerability to economic shocks.

Examples of Speculative Capital in Action

Speculative capital often manifests in rapid cryptocurrency trading, where investors seek quick returns from volatile price swings. Venture capital funding in early-stage tech startups also exemplifies speculative capital, driven by high-risk bets on unproven business models. Hedge funds engaging in short-term stock speculation further illustrate speculative capital's pursuit of immediate profits rather than long-term growth.

Successful Patient Capital Strategies

Successful patient capital strategies emphasize long-term value creation by investing in sustainable business models and fostering innovation over immediate financial returns. Companies leveraging patient capital often prioritize steady growth, reinvestment in research and development, and strong stakeholder relationships to build resilient competitive advantages. This approach contrasts with speculative capital's focus on short-term gains driven by rapid market movements and high-risk bets.

The Role of Policy in Shaping Investment Behavior

Policy frameworks influence investment behavior by creating incentives that distinguish speculative capital, which seeks quick returns through high-risk ventures, from patient capital that emphasizes long-term value creation and social impact. Regulatory measures such as tax benefits, subsidies, and impact investing mandates encourage patient capital to support sustainable projects and infrastructure development. Well-designed policies reduce market uncertainties, fostering an investment climate where long-term commitments are prioritized over short-term speculation.

Choosing Between Speculative and Patient Capital

Choosing between speculative capital and patient capital depends on a company's growth stage, risk tolerance, and long-term objectives. Speculative capital suits startups seeking rapid expansion and high-risk, high-reward opportunities, while patient capital benefits established firms focused on sustainable growth and value creation over time. Investors weigh factors such as desired exit timelines, market volatility, and strategic vision to align funding type with business goals.

Speculative capital Infographic

libterm.com

libterm.com