A policy anchor serves as a fundamental principle or framework that guides the formulation and implementation of policies within an organization or government. It ensures consistency, stability, and alignment with long-term goals, making decision-making more coherent and predictable. Explore the rest of the article to understand how establishing a strong policy anchor can benefit your strategic planning and governance.

Table of Comparison

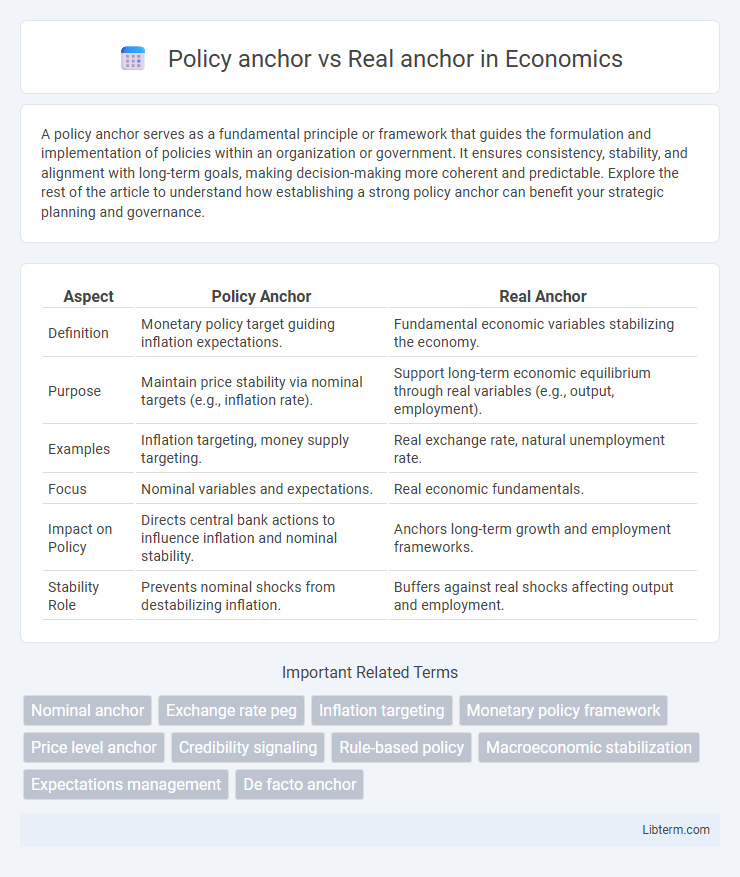

| Aspect | Policy Anchor | Real Anchor |

|---|---|---|

| Definition | Monetary policy target guiding inflation expectations. | Fundamental economic variables stabilizing the economy. |

| Purpose | Maintain price stability via nominal targets (e.g., inflation rate). | Support long-term economic equilibrium through real variables (e.g., output, employment). |

| Examples | Inflation targeting, money supply targeting. | Real exchange rate, natural unemployment rate. |

| Focus | Nominal variables and expectations. | Real economic fundamentals. |

| Impact on Policy | Directs central bank actions to influence inflation and nominal stability. | Anchors long-term growth and employment frameworks. |

| Stability Role | Prevents nominal shocks from destabilizing inflation. | Buffers against real shocks affecting output and employment. |

Introduction to Policy Anchor and Real Anchor

Policy anchor refers to a strategic framework used by central banks to guide monetary policy by targeting inflation rates, ensuring price stability and managing inflation expectations. Real anchor, on the other hand, is based on tangible economic variables such as exchange rates or money supply, providing a concrete reference point for economic agents in stabilizing the economy. Understanding both anchors is essential for effective monetary policy design and achieving macroeconomic stability.

Defining Policy Anchor: Concept and Importance

A policy anchor serves as a target or benchmark guiding central banks in maintaining economic stability by controlling inflation, interest rates, or money supply. It provides a clear framework for monetary policy decisions, ensuring predictability and credibility in economic management. Unlike a real anchor, which relies on tangible economic variables like exchange rates or commodity prices, the policy anchor emphasizes a strategic commitment to specific policy goals.

Understanding Real Anchor: Meaning and Role

Real anchor refers to a fixed point of reference in economic policy or financial markets, representing the actual value or standard that stabilizes expectations. It plays a crucial role by grounding inflation expectations and guiding monetary policy decisions to ensure long-term economic stability. Unlike a policy anchor, which is often a targeted goal or guideline, the real anchor reflects tangible factors such as the price level, currency value, or underlying economic fundamentals.

Key Differences Between Policy Anchor and Real Anchor

Policy anchor refers to a targeted economic variable, such as an inflation rate or exchange rate, set by policymakers to guide monetary policy decisions, while a real anchor involves observed economic fundamentals like productivity growth or real interest rates that stabilize expectations over the long term. The key difference lies in the policy anchor being a deliberate, often short- to medium-term, target used for signaling and credibility, whereas the real anchor reflects underlying economic realities that provide a durable foundation for macroeconomic stability. Policy anchors can change with central bank strategies, but real anchors remain relatively constant, offering more reliable guidance for sustainable economic outcomes.

Historical Context of Policy and Real Anchors in Economics

Policy anchors, such as inflation targeting or money supply rules, emerged prominently during the 1980s to stabilize economic expectations and guide monetary policy decisions. Real anchors, by contrast, are grounded in long-term economic fundamentals like output, employment levels, or the natural rate of interest, providing a stable reference unaffected by short-term policy changes. The historical development of these anchors reflects central banks' evolving strategies to balance credibility and flexibility in controlling inflation and fostering economic growth.

Advantages of Using Policy Anchor

Policy anchors provide a flexible framework for monetary policy by guiding expectations without strictly fixing exchange rates, allowing central banks to respond effectively to economic fluctuations. Their use enhances credibility in inflation targeting, stabilizes long-term interest rates, and supports sustainable economic growth. Compared to real anchors, policy anchors reduce the risk of balance of payments crises by avoiding rigid commitments that can be disrupted by external shocks.

Limitations of Relying on Real Anchor

Relying on a real anchor in economic policy often faces limitations due to external shocks and structural changes that can disrupt price stability and exchange rates. Real anchors, such as commodity prices or natural resources, may fluctuate unpredictably, leading to instability in inflation targets and reduced policy credibility. These inherent vulnerabilities restrict their effectiveness in providing a consistent framework for monetary policy compared to policy anchors like inflation targeting or exchange rate rules.

Impact on Monetary Policy and Inflation Control

Policy anchors, such as inflation targeting or exchange rate pegs, provide clear guidelines for central banks to influence expectations and stabilize inflation by anchoring monetary policy decisions. Real anchors, involving long-term economic fundamentals like productivity growth or natural interest rates, shape sustainable inflation control by grounding policy adjustments in underlying economic realities. The effectiveness of monetary policy hinges on aligning short-term policy anchors with these real anchors to prevent inflation volatility and maintain credible commitments.

Case Studies: Policy Anchor vs Real Anchor in Practice

Case studies on policy anchor versus real anchor reveal distinct impacts on economic stability and inflation control. Countries like the United States use inflation targeting as a policy anchor to guide monetary decisions, while economies such as Hong Kong rely on the real anchor of a fixed exchange rate to maintain currency stability. Empirical evidence shows that policy anchors offer flexibility in adjusting to economic shocks, whereas real anchors provide clearer expectations for price levels, influencing investor confidence differently across global markets.

Future Trends and Implications for Policymakers

Policy anchors provide governments with explicit targets, such as inflation or fiscal deficit goals, to guide macroeconomic stability, while real anchors rely on long-term structural features like natural resources or demographic trends. Future trends indicate a shift toward hybrid anchoring strategies that combine policy anchors with real anchors to enhance resilience against global shocks and technological disruptions. Policymakers must integrate data analytics and adaptive frameworks to effectively balance these anchors, improving credibility and flexibility in dynamic economic environments.

Policy anchor Infographic

libterm.com

libterm.com