Tradable permits create a market-based approach to controlling pollution by allowing companies to buy and sell allowances for emissions. This system incentivizes businesses to reduce their environmental impact cost-effectively while maintaining operational flexibility. Discover how tradable permits can align economic growth with sustainability goals by reading the rest of this article.

Table of Comparison

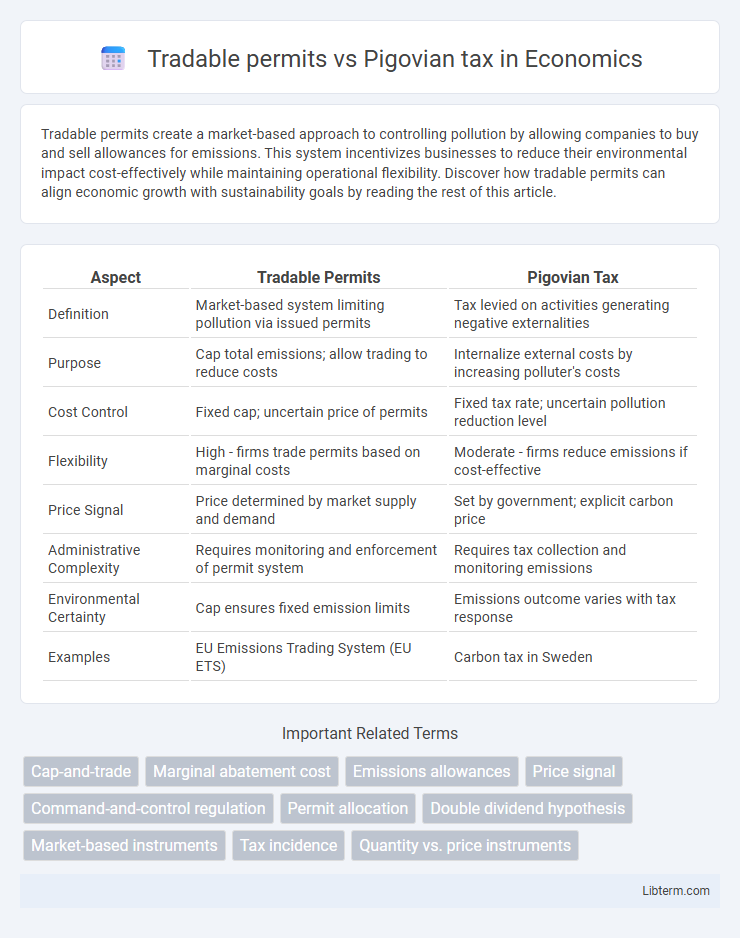

| Aspect | Tradable Permits | Pigovian Tax |

|---|---|---|

| Definition | Market-based system limiting pollution via issued permits | Tax levied on activities generating negative externalities |

| Purpose | Cap total emissions; allow trading to reduce costs | Internalize external costs by increasing polluter's costs |

| Cost Control | Fixed cap; uncertain price of permits | Fixed tax rate; uncertain pollution reduction level |

| Flexibility | High - firms trade permits based on marginal costs | Moderate - firms reduce emissions if cost-effective |

| Price Signal | Price determined by market supply and demand | Set by government; explicit carbon price |

| Administrative Complexity | Requires monitoring and enforcement of permit system | Requires tax collection and monitoring emissions |

| Environmental Certainty | Cap ensures fixed emission limits | Emissions outcome varies with tax response |

| Examples | EU Emissions Trading System (EU ETS) | Carbon tax in Sweden |

Introduction to Market-Based Environmental Policies

Market-based environmental policies leverage economic incentives to reduce pollution efficiently by internalizing external costs. Tradable permits create a cap-and-trade system that limits total emissions while allowing firms to buy and sell emission allowances, promoting cost-effective pollution reduction. Pigovian taxes impose a direct fee on pollution proportional to the environmental damage, encouraging emitters to cut emissions or pay for the social cost of their activities.

Defining Tradable Permits: Cap-and-Trade Systems

Tradable permits, also known as cap-and-trade systems, are market-based environmental policies that set a maximum limit (cap) on total emissions and allocate emissions allowances to firms. Companies can buy, sell, or trade these permits, creating financial incentives to reduce pollution efficiently. This system promotes cost-effective emission reductions by enabling firms with lower abatement costs to sell excess permits to those facing higher costs.

Understanding Pigovian Taxes: Taxing Externalities

Pigovian taxes impose a direct cost on negative externalities by charging producers a fee equal to the social cost of their harmful activities, effectively incentivizing pollution reduction. These taxes create a financial motive for firms to internalize environmental costs, promoting efficient resource allocation without rigid limits. Unlike tradable permits, Pigovian taxes provide price certainty and continuous incentives for innovation in reducing externalities.

Economic Efficiency: Comparing Cost-Effectiveness

Tradable permits and Pigovian taxes both aim to reduce negative externalities by internalizing social costs, but tradable permits provide economic efficiency through a fixed pollution cap ensuring environmental targets, while allowing firms to trade allowances and minimize abatement costs. Pigovian taxes impose a price on emissions, incentivizing reductions where marginal abatement costs are lowest, but the total pollution quantity remains uncertain, potentially leading to inefficient outcomes if tax levels are miscalibrated. Market-based flexibility makes tradable permits more cost-effective in achieving precise pollution limits, while Pigovian taxes offer simplicity and adaptability when external cost estimates are reliable.

Flexibility and Market Responses

Tradable permits offer flexibility by allowing firms to buy and sell emissions allowances, enabling cost-effective pollution reduction tailored to individual needs. Pigovian taxes provide a fixed price incentive, influencing firms to reduce emissions based on their marginal abatement costs but less adaptable to fluctuating market conditions. Market responses to tradable permits often lead to dynamic permit prices and innovative emission strategies, while Pigovian taxes create predictable revenue streams but limited variability in firm-level behavior.

Revenue Generation and Utilization

Tradable permits create revenue through the auction or sale of emission allowances, providing a direct financial incentive for companies to reduce pollution while generating funds that governments can allocate to environmental projects or public goods. Pigovian taxes generate government revenue by imposing a fee equivalent to the social cost of pollution, which can be utilized to subsidize clean technologies, support environmental restoration, or offset other taxes. Both mechanisms incentivize pollution reduction but differ in the stability and predictability of revenues, with taxes offering consistent income and tradable permits revenue fluctuating based on market demand.

Addressing Implementation Challenges

Tradable permits and Pigovian taxes both address environmental externalities but differ in implementation complexity and effectiveness. Tradable permits require establishing a clear cap and monitoring system to ensure compliance, with market fluctuations potentially impacting permit prices and overall emissions reductions. Pigovian taxes rely on precise tax rate calibration to reflect the social cost of pollution, demanding robust data and enforcement mechanisms to prevent evasion and ensure pollution levels decrease as intended.

Environmental Outcomes and Certainty

Tradable permits create a fixed cap on total emissions, ensuring a specific environmental outcome by limiting pollution levels, while the market sets the price of pollution permits based on supply and demand. Pigovian taxes set a fixed price on emissions, providing cost certainty for firms but leaving total emission reductions uncertain since the market determines the pollution quantity. Tradable permits offer greater environmental certainty by guaranteeing emission limits, whereas Pigovian taxes offer price predictability but less control over the overall environmental impact.

Political Feasibility and Public Acceptance

Tradable permits often gain higher political feasibility due to their clear emission limits and potential for market-driven cost savings, appealing to both regulators and industry stakeholders. Public acceptance tends to favor Tradable permits when allowances are initially allocated fairly or revenues fund popular projects, whereas Pigovian taxes face resistance because they are perceived as direct costs without explicit benefits. The flexibility and perceived economic efficiency of Tradable permits create broader support in diverse political environments compared to the more rigid and often unpopular Pigovian tax approach.

Conclusion: Choosing the Optimal Policy Approach

Choosing between tradable permits and Pigovian taxes depends on the specific environmental and economic context, as tradable permits set a precise emissions cap while Pigovian taxes provide cost certainty. Tradable permits are optimal for achieving exact environmental targets with market-driven flexibility, whereas Pigovian taxes incentivize continuous innovation by internalizing external costs directly into production choices. Policymakers must evaluate factors such as emission volatility, administrative feasibility, and political acceptability to determine the most effective regulatory instrument for sustainable environmental management.

Tradable permits Infographic

libterm.com

libterm.com