Fiscal policy involves government decisions on taxation and public spending to influence the economy, control inflation, and promote growth. Effective fiscal policy balances budget deficits and surpluses to stabilize economic fluctuations and support sustainable development. Explore the rest of the article to understand how fiscal policy impacts Your financial future and national economic health.

Table of Comparison

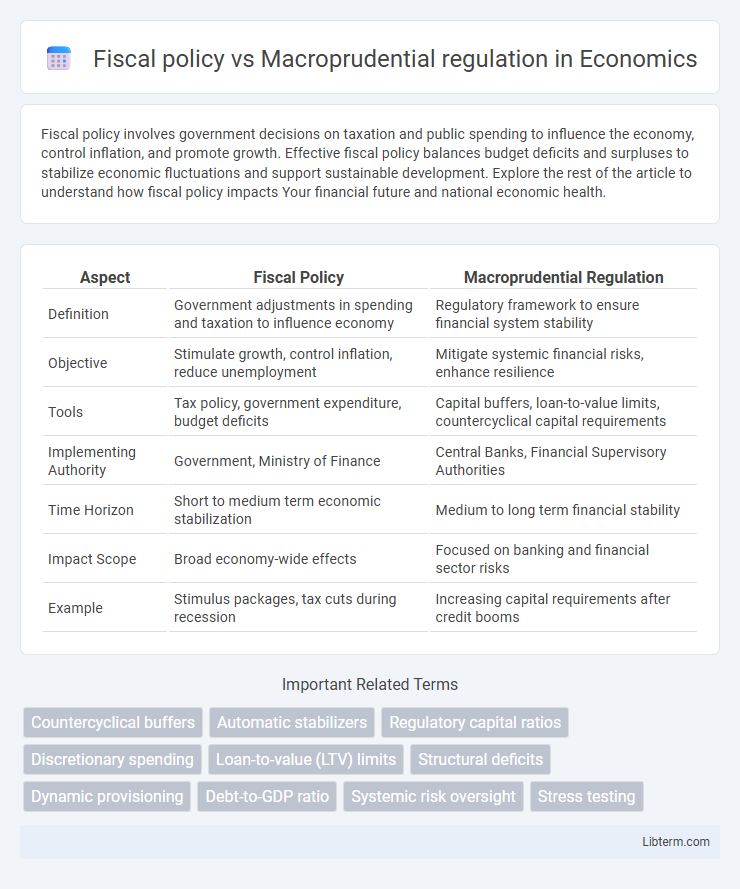

| Aspect | Fiscal Policy | Macroprudential Regulation |

|---|---|---|

| Definition | Government adjustments in spending and taxation to influence economy | Regulatory framework to ensure financial system stability |

| Objective | Stimulate growth, control inflation, reduce unemployment | Mitigate systemic financial risks, enhance resilience |

| Tools | Tax policy, government expenditure, budget deficits | Capital buffers, loan-to-value limits, countercyclical capital requirements |

| Implementing Authority | Government, Ministry of Finance | Central Banks, Financial Supervisory Authorities |

| Time Horizon | Short to medium term economic stabilization | Medium to long term financial stability |

| Impact Scope | Broad economy-wide effects | Focused on banking and financial sector risks |

| Example | Stimulus packages, tax cuts during recession | Increasing capital requirements after credit booms |

Understanding Fiscal Policy: Definition and Objectives

Fiscal policy involves government adjustments to spending levels and tax rates to influence a nation's economy, aiming to achieve objectives such as economic growth, employment, and price stability. It is a primary tool for managing aggregate demand and addressing business cycle fluctuations by implementing expansionary or contractionary measures. The ultimate goals include stabilizing output, reducing unemployment, and maintaining sustainable public debt levels.

Macroprudential Regulation Explained

Macroprudential regulation focuses on safeguarding the financial system's stability by identifying and mitigating systemic risks that threaten economic resilience. It employs tools such as countercyclical capital buffers, stress testing, and loan-to-value limits to prevent financial crises and reduce the impact of economic shocks. This regulatory approach complements fiscal policy by targeting financial sector vulnerabilities rather than directly influencing aggregate demand or government spending.

Key Differences Between Fiscal Policy and Macroprudential Regulation

Fiscal policy involves government decisions on taxation and public spending aimed at influencing economic growth, unemployment, and inflation. Macroprudential regulation focuses on safeguarding the stability of the financial system by addressing systemic risks through tools such as capital requirements, countercyclical buffers, and loan-to-value ratios. The key differences lie in their objectives--fiscal policy targets overall economic performance, while macroprudential regulation aims to prevent financial crises and ensure banking sector resilience.

Tools and Instruments of Fiscal Policy

Fiscal policy utilizes government spending, taxation, and budgetary measures to influence economic activity, targeting aggregate demand, employment, and inflation control. Key instruments include public expenditure programs, tax rate adjustments, and transfer payments, which directly affect disposable income and consumption patterns. Unlike macroprudential regulation, which focuses on financial system stability through capital requirements and risk controls, fiscal policy leverages budgetary tools to steer overall economic growth and cyclical fluctuations.

Macroprudential Policy Tools and Mechanisms

Macroprudential policy tools encompass countercyclical capital buffers, loan-to-value (LTV) ratio limits, and debt-to-income (DTI) ratio restrictions designed to mitigate systemic financial risks. These mechanisms aim to enhance the resilience of the financial system by addressing vulnerabilities such as credit booms and asset price bubbles, thereby reducing the likelihood of widespread economic disruptions. By targeting specific sectors or institutions, macroprudential regulation complements fiscal policy, fostering financial stability without directly influencing aggregate demand.

Impact on Economic Stability: Fiscal vs Macroprudential Approaches

Fiscal policy influences economic stability by adjusting government spending and taxation to manage aggregate demand, thereby stabilizing growth and controlling inflation. Macroprudential regulation targets systemic risks in the financial sector through tools like capital requirements and counter-cyclical buffers to enhance resilience against financial crises. While fiscal policy addresses broad economic conditions, macroprudential measures specifically mitigate vulnerabilities that threaten the stability of the financial system.

Complementary Roles in Managing Financial Crises

Fiscal policy and macroprudential regulation serve complementary roles in managing financial crises by addressing different aspects of economic stability. Fiscal policy provides broad economic stimulus or restraint through government spending and taxation to influence aggregate demand and support economic recovery. Macroprudential regulation targets financial system risks by implementing measures such as capital requirements and leverage limits to enhance financial resilience and prevent systemic failures.

Case Studies: Fiscal Policy and Macroprudential Regulation in Action

Case studies such as South Korea's response to the 1997 Asian Financial Crisis illustrate the effectiveness of fiscal policy in stimulating economic recovery through targeted government spending and tax relief, while simultaneously using macroprudential regulation to enhance banking sector resilience. The United Kingdom's post-2008 financial reforms combined fiscal stimulus measures with macroprudential tools like countercyclical capital buffers to mitigate systemic risk and stabilize credit growth. These examples demonstrate how coordinated use of fiscal policy and macroprudential regulation can address economic downturns and financial vulnerabilities effectively.

Challenges and Limitations of Each Approach

Fiscal policy faces challenges such as timing lags, political constraints, and difficulty targeting specific sectors without causing unintended economic distortions. Macroprudential regulation is limited by data availability, regulatory arbitrage, and the complexity of measuring systemic risk across interconnected financial institutions. Both approaches must navigate trade-offs between short-term economic stabilization and long-term financial stability while adapting to evolving economic conditions and market behaviors.

Future Trends in Fiscal and Macroprudential Policy Coordination

Future trends in fiscal and macroprudential policy coordination emphasize enhanced data integration and real-time monitoring using advanced AI analytics to detect systemic risks more swiftly. Increased collaboration between central banks and finance ministries aims to synchronize countercyclical fiscal measures with macroprudential tools, optimizing economic stability and financial resilience. Emerging frameworks advocate for harmonized stress testing protocols and shared policy dashboards to promote transparency and adaptive response mechanisms in evolving economic environments.

Fiscal policy Infographic

libterm.com

libterm.com