A floating exchange rate fluctuates based on supply and demand in the foreign exchange market without direct government intervention. This system allows currencies to adjust naturally to economic conditions, impacting trade balances and investment flows. Explore the rest of the article to understand how floating exchange rates influence your financial decisions.

Table of Comparison

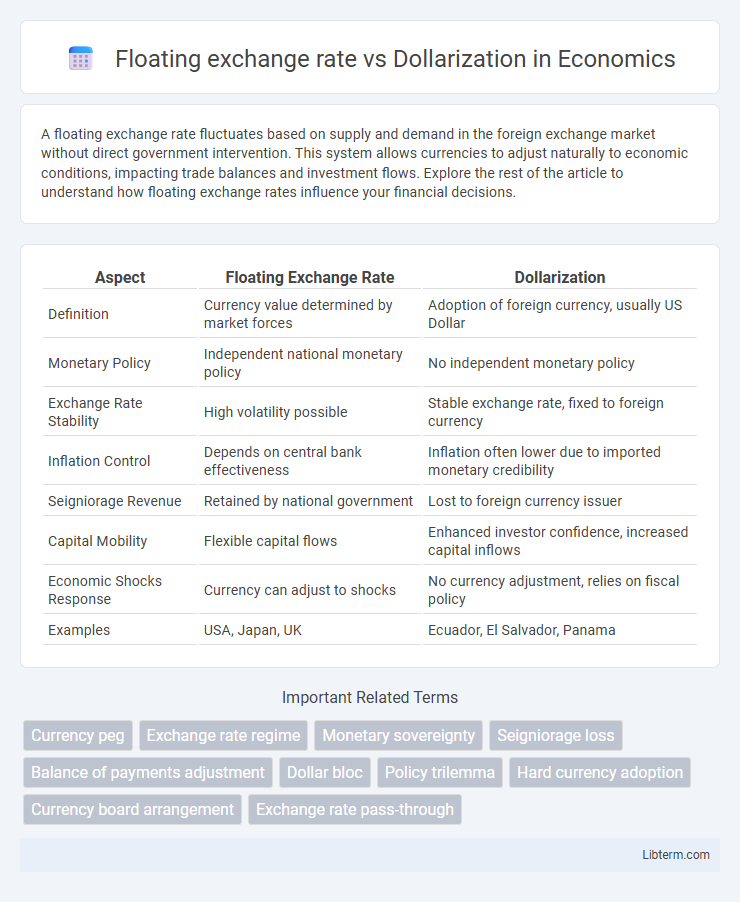

| Aspect | Floating Exchange Rate | Dollarization |

|---|---|---|

| Definition | Currency value determined by market forces | Adoption of foreign currency, usually US Dollar |

| Monetary Policy | Independent national monetary policy | No independent monetary policy |

| Exchange Rate Stability | High volatility possible | Stable exchange rate, fixed to foreign currency |

| Inflation Control | Depends on central bank effectiveness | Inflation often lower due to imported monetary credibility |

| Seigniorage Revenue | Retained by national government | Lost to foreign currency issuer |

| Capital Mobility | Flexible capital flows | Enhanced investor confidence, increased capital inflows |

| Economic Shocks Response | Currency can adjust to shocks | No currency adjustment, relies on fiscal policy |

| Examples | USA, Japan, UK | Ecuador, El Salvador, Panama |

Introduction to Exchange Rate Regimes

Floating exchange rate regimes allow currency values to fluctuate according to foreign exchange market forces, providing flexibility in response to economic conditions. Dollarization occurs when a country adopts a foreign currency, such as the US dollar, as its official legal tender, stabilizing inflation and exchange rate volatility but sacrificing independent monetary policy. Understanding these exchange rate regimes is crucial for analyzing how countries manage currency stability, control inflation, and influence international trade dynamics.

What is a Floating Exchange Rate?

A floating exchange rate is a currency valuation method where the value of a country's currency fluctuates based on foreign exchange market dynamics, influenced by supply and demand factors without direct government or central bank intervention. This system contrasts with dollarization, where a country adopts a foreign currency, typically the US dollar, as its official medium of exchange, eliminating the use of its own currency and associated exchange rate volatility. Floating exchange rates allow for automatic adjustment to economic conditions, impacting trade balances, inflation, and monetary policy effectiveness.

Understanding Dollarization

Dollarization occurs when a country adopts a foreign currency, typically the US dollar, as its official medium of exchange, bypassing its own floating exchange rate system. This process reduces currency risk and inflation volatility but limits monetary policy autonomy and the ability to respond to economic shocks. Countries like Ecuador and El Salvador experienced increased stability through dollarization, although they sacrifice independent control of interest rates and currency supply.

Key Differences Between Floating and Dollarized Economies

Floating exchange rate economies allow currency values to fluctuate based on foreign exchange market dynamics, providing monetary policy flexibility and controlled inflation targeting. Dollarized economies adopt a foreign currency, often the US dollar, which stabilizes prices and reduces currency risk but sacrifices independent monetary policy control. The key difference lies in sovereignty over monetary tools, with floating regimes managing exchange rates actively, while dollarized systems rely fully on the anchor currency's central bank decisions.

Advantages of a Floating Exchange Rate

A floating exchange rate allows automatic adjustment to economic conditions, helping to stabilize a country's balance of payments and control inflation. It provides monetary policy autonomy, enabling central banks to focus on domestic economic goals without the constraints of maintaining a fixed rate. Unlike dollarization, which limits monetary flexibility, a floating exchange rate promotes competitiveness by allowing currency depreciation or appreciation based on market forces.

Pros and Cons of Dollarization

Dollarization stabilizes an economy by eliminating currency risk and inflation volatility associated with floating exchange rates, fostering investor confidence and reducing interest rates. However, it limits monetary policy autonomy, as the country cannot adjust money supply or interest rates independently, making it vulnerable to external economic shocks and relying heavily on the U.S. Federal Reserve's decisions. This loss of seigniorage revenue and inability to act as a lender of last resort presents significant constraints for economic flexibility and crisis management.

Economic Stability: Floating vs. Dollarization

Floating exchange rates provide countries with monetary policy autonomy, allowing adjustments to external shocks and supporting economic stability by absorbing currency fluctuations. In contrast, dollarization eliminates exchange rate volatility but sacrifices independent monetary policy, limiting a country's ability to respond to economic crises. Empirical studies indicate that while dollarization can reduce inflation and interest rates, floating rates offer greater flexibility to maintain economic stability in the face of global financial turbulence.

Impact on Monetary Policy Independence

Floating exchange rate regimes enhance monetary policy independence by allowing central banks to adjust interest rates and control money supply without direct constraints from fixed exchange rate targets. In contrast, dollarization severely limits monetary policy autonomy as the domestic currency is replaced or pegged to the US dollar, tying policy decisions closely to the Federal Reserve's agenda. This loss of independent monetary control can hinder a country's ability to respond effectively to local economic conditions and shocks.

Case Studies: Countries Adopting Each System

Argentina exemplifies the challenges of a floating exchange rate, facing high volatility and inflation despite policy adjustments. Ecuador's dollarization stabilized its economy by adopting the US dollar, reducing inflation and attracting foreign investment. Zimbabwe's transition to dollarization ended hyperinflation, but limited monetary policy flexibility to address economic shocks.

Choosing the Right System: Factors and Considerations

Choosing between a floating exchange rate and dollarization depends on economic stability, inflation control, and monetary policy autonomy. Countries with volatile economies often prefer dollarization to anchor inflation and gain investor confidence, while economies seeking independent monetary tools opt for floating exchange rates to adjust to market conditions. Key factors include trade exposure, inflation history, fiscal discipline, and the central bank's credibility in managing currency fluctuations.

Floating exchange rate Infographic

libterm.com

libterm.com