Structural deficit occurs when a government's underlying budget deficit exists even after adjusting for economic fluctuations, indicating persistent imbalance between revenues and expenditures. This fiscal challenge can lead to increased public debt and limit the government's ability to respond to economic crises. Discover how addressing structural deficits is crucial for your country's long-term economic stability in the rest of this article.

Table of Comparison

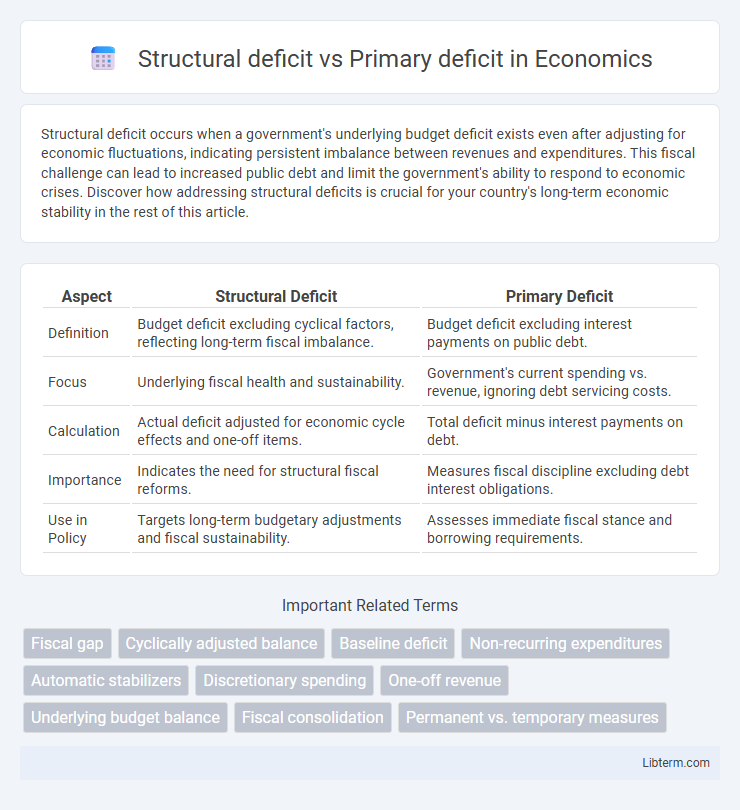

| Aspect | Structural Deficit | Primary Deficit |

|---|---|---|

| Definition | Budget deficit excluding cyclical factors, reflecting long-term fiscal imbalance. | Budget deficit excluding interest payments on public debt. |

| Focus | Underlying fiscal health and sustainability. | Government's current spending vs. revenue, ignoring debt servicing costs. |

| Calculation | Actual deficit adjusted for economic cycle effects and one-off items. | Total deficit minus interest payments on debt. |

| Importance | Indicates the need for structural fiscal reforms. | Measures fiscal discipline excluding debt interest obligations. |

| Use in Policy | Targets long-term budgetary adjustments and fiscal sustainability. | Assesses immediate fiscal stance and borrowing requirements. |

Understanding Fiscal Deficits: An Overview

Structural deficit refers to the portion of a government's fiscal deficit that exists even when the economy is operating at its full potential, reflecting long-term imbalances between revenues and expenditures. Primary deficit measures the fiscal deficit excluding interest payments on existing debt, indicating the government's current fiscal stance on revenue and expenditure management. Understanding these distinctions is crucial for effective fiscal policy, as structural deficits require policy adjustments to restore fiscal sustainability, while primary deficits highlight immediate borrowing needs.

Defining Structural Deficit

Structural deficit refers to the portion of a government's budget deficit that persists across the economic cycle, representing a fundamental imbalance between revenues and expenditures excluding temporary economic factors. It indicates underlying fiscal imbalances caused by policy decisions, demographic trends, or long-term obligations rather than short-term economic fluctuations. Unlike the primary deficit, which excludes interest payments on debt, the structural deficit highlights chronic fiscal gaps that require policy adjustments to achieve sustainable public finances.

What is a Primary Deficit?

A primary deficit occurs when a government's current expenditures exceed its revenues, excluding interest payments on outstanding debt, highlighting the fiscal imbalance from regular operations. It provides a clearer picture of the government's underlying fiscal health by isolating non-interest spending gaps. This measure is critical for assessing fiscal sustainability and guiding budgetary policy decisions.

Key Differences Between Structural and Primary Deficits

Structural deficit refers to the portion of a government's budget deficit that exists even when the economy is operating at its full potential, indicating a fundamental imbalance in fiscal policy. Primary deficit, on the other hand, excludes interest payments on the public debt and measures the shortfall between government revenues and non-interest expenditures. The key difference lies in that structural deficit highlights underlying fiscal sustainability issues, while primary deficit focuses on current fiscal operational efficiency before debt servicing costs.

Causes of Structural Deficits

Structural deficits arise from fundamental imbalances in government revenues and expenditures that persist regardless of the economic cycle, often caused by rigid fiscal policies, entitlement growth, and inadequate tax base expansion. In contrast, primary deficits exclude interest payments on debt and primarily reflect current fiscal operations without financing costs. Structural deficits are driven by long-term factors such as demographic changes, inefficient public spending, and structural unemployment, which inhibit automatic fiscal correction during economic fluctuations.

Factors Influencing Primary Deficits

Primary deficits are driven by government spending exceeding revenue, excluding interest payments on debt, influenced heavily by cyclical economic conditions, fiscal policies, and revenue collection efficiency. Structural deficits represent the portion of the deficit that remains across economic cycles after adjusting for temporary factors like economic booms or recessions. Key factors influencing primary deficits include tax policy changes, public expenditure priorities, and economic growth rates affecting government revenue streams.

Measuring Structural vs. Primary Deficits

Measuring structural deficits involves estimating the budget imbalance adjusted for the economic cycle and one-off factors, reflecting the underlying fiscal position independent of temporary fluctuations in GDP or interest rates. Primary deficits measure the fiscal shortfall excluding interest payments on government debt, providing insight into the government's current fiscal policy stance without debt servicing costs. Accurate differentiation requires analyzing cyclically adjusted budget balances and separating debt interest obligations to assess sustainable fiscal health effectively.

Economic Implications of Structural Deficits

Structural deficits represent the portion of a government budget deficit that persists regardless of the economic cycle, reflecting fundamental imbalances between revenues and expenditures. Primary deficits, on the other hand, exclude interest payments on debt, highlighting the immediate fiscal gap before financing costs. Persistent structural deficits lead to unsustainable debt accumulation, reduce fiscal flexibility, and increase borrowing costs, ultimately constraining public investment and long-term economic growth.

Fiscal Policy Strategies for Managing Deficits

Structural deficit represents the portion of a budget deficit that persists even when the economy operates at full potential, reflecting long-term imbalances between government revenues and expenditures. Primary deficit excludes interest payments on public debt, highlighting the fiscal gap from current spending and revenue policies before debt servicing costs. Effective fiscal policy strategies for managing these deficits include adjusting tax rates, controlling public spending, and implementing structural reforms to enhance revenue generation and economic growth while ensuring debt sustainability.

Structural Deficit vs. Primary Deficit: Which Matters More?

Structural deficit reflects the portion of a government's budget shortfall that remains after adjusting for economic fluctuations, offering insight into underlying fiscal imbalances. Primary deficit excludes interest payments on debt, highlighting the government's current fiscal policy and its ability to manage expenditures versus revenues. Structural deficit matters more for long-term fiscal sustainability since it reveals persistent budget issues, while primary deficit is crucial for understanding short-term borrowing needs and debt dynamics.

Structural deficit Infographic

libterm.com

libterm.com