Secured credit involves borrowing money backed by collateral, reducing the lender's risk and often resulting in lower interest rates. This type of credit can help you build or rebuild your credit score by demonstrating responsible repayment behavior. Explore the article to learn how secured credit works and how it can benefit your financial future.

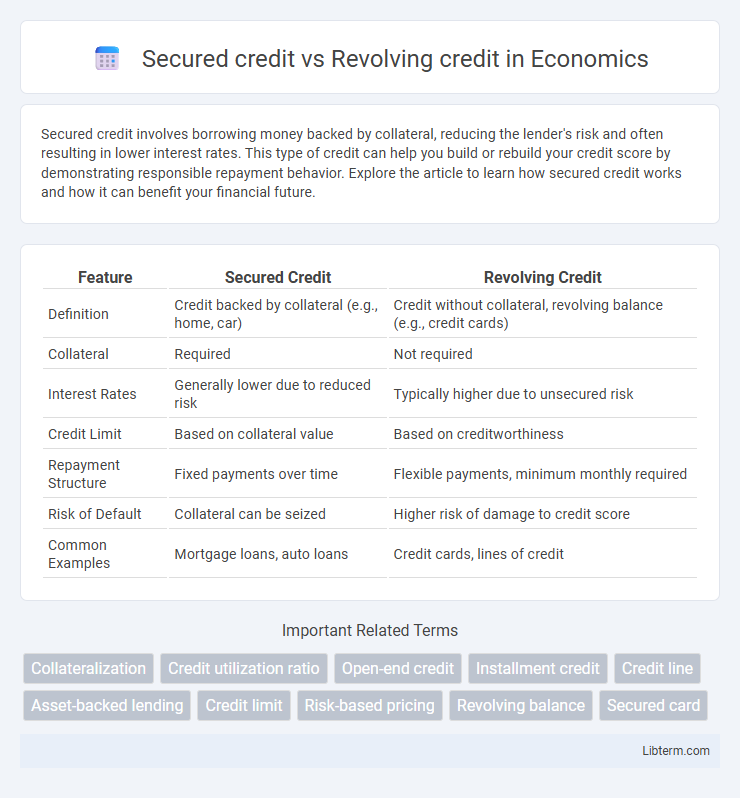

Table of Comparison

| Feature | Secured Credit | Revolving Credit |

|---|---|---|

| Definition | Credit backed by collateral (e.g., home, car) | Credit without collateral, revolving balance (e.g., credit cards) |

| Collateral | Required | Not required |

| Interest Rates | Generally lower due to reduced risk | Typically higher due to unsecured risk |

| Credit Limit | Based on collateral value | Based on creditworthiness |

| Repayment Structure | Fixed payments over time | Flexible payments, minimum monthly required |

| Risk of Default | Collateral can be seized | Higher risk of damage to credit score |

| Common Examples | Mortgage loans, auto loans | Credit cards, lines of credit |

Introduction to Secured and Revolving Credit

Secured credit requires collateral, such as a house or car, to back the borrowed amount, reducing the lender's risk and often resulting in lower interest rates. Revolving credit, like credit cards, provides a flexible borrowing limit that can be used, repaid, and reused without reapplying, making it ideal for managing ongoing expenses. Understanding the fundamental differences in risk, repayment terms, and interest rates between secured and revolving credit is crucial for effective financial planning.

Defining Secured Credit: Key Features

Secured credit is a type of borrowing backed by collateral, such as a car or home, which reduces lender risk and often results in lower interest rates. Key features include the necessity of an asset pledge, a higher likelihood of approval for borrowers with lower credit scores, and potential asset repossession upon default. This contrasts with revolving credit, which does not require collateral and offers flexible borrowing limits.

Understanding Revolving Credit Accounts

Revolving credit accounts provide flexible borrowing options by allowing users to borrow up to a preset credit limit, repay, and borrow again without reapplying. Unlike secured credit, which requires collateral, revolving credit is typically unsecured and includes products like credit cards and lines of credit. Managing revolving credit responsibly by keeping balances low relative to credit limits enhances credit scores and minimizes interest charges.

Core Differences Between Secured and Revolving Credit

Secured credit requires collateral such as a car or home, which reduces lender risk and often results in lower interest rates, whereas revolving credit offers flexible borrowing up to a credit limit without collateral, primarily seen in credit cards and lines of credit. Secured credit typically involves fixed repayment terms and amounts, contrasting with revolving credit that allows variable payments and continuous borrowing as long as the credit limit is not exceeded. The key difference lies in risk and structure: secured credit ties loans to tangible assets and fixed schedules, while revolving credit provides ongoing access to funds with variable balances and interest based on usage.

Pros and Cons of Secured Credit

Secured credit requires collateral, lowering lender risk and often resulting in lower interest rates compared to unsecured revolving credit. The main advantage of secured credit is easier approval and higher credit limits due to the backing asset, while the downside includes the risk of asset loss if payments are missed. Unlike revolving credit, secured credit typically does not offer the flexibility of repeated borrowing within a credit limit, limiting ongoing access to funds.

Benefits and Drawbacks of Revolving Credit

Revolving credit offers flexibility by allowing borrowers to access funds repeatedly up to a set credit limit, with payments based on the current outstanding balance, promoting convenient cash flow management. Its benefits include improved credit score through responsible usage and immediate access to funds for emergencies or purchases. Drawbacks involve higher interest rates compared to secured credit, risk of accumulating debt due to overspending, and potential negative impact on credit score if payments are missed or balances remain high.

Credit Score Impact: Secured vs. Revolving Credit

Secured credit, such as secured credit cards or auto loans, often leads to a positive credit score impact when payments are made on time, as it demonstrates reliable credit management with collateral backing. Revolving credit, like credit cards and lines of credit, influences credit scores through credit utilization ratios alongside payment history, where lower utilization generally boosts scores. Both types affect credit mix and payment history, essential factors in credit scoring models, but secured credit can be more accessible for individuals building or rebuilding credit.

Which Option is Best for Building Credit?

Secured credit cards require a cash deposit as collateral, making them ideal for individuals with limited or poor credit history seeking to build credit safely. Revolving credit, such as traditional credit cards, offers a credit limit without collateral and allows for flexible repayment, but approval often depends on established credit scores. For building credit, secured credit is generally the best option because it reduces risk for lenders and helps borrowers demonstrate responsible credit management.

Factors to Consider When Choosing Credit Types

When choosing between secured credit and revolving credit, consider factors such as interest rates, credit limits, and risk of collateral loss. Secured credit often offers lower interest rates due to collateral requirements, while revolving credit provides more flexibility but typically at higher rates. Assess your financial stability, repayment ability, and the purpose of credit to determine which type aligns with your needs and minimizes financial risk.

Conclusion: Choosing the Right Credit for Your Needs

Secured credit offers lower interest rates and easier approval due to collateral, making it ideal for individuals rebuilding credit or needing larger loan amounts. Revolving credit provides flexibility with ongoing access to funds and variable balances, suitable for managing everyday expenses and short-term borrowing. Assess your financial goals, credit history, and repayment ability to select the credit type that aligns best with your needs and risk tolerance.

Secured credit Infographic

libterm.com

libterm.com