Risk shifting occurs when a company or individual transfers financial risks to another party, often through mechanisms like insurance, hedging, or outsourcing. This strategy helps manage uncertainty and protects Your assets from potential losses, but it may also introduce new risks or costs depending on the terms and conditions. Explore the rest of the article to understand how risk shifting impacts financial stability and decision-making.

Table of Comparison

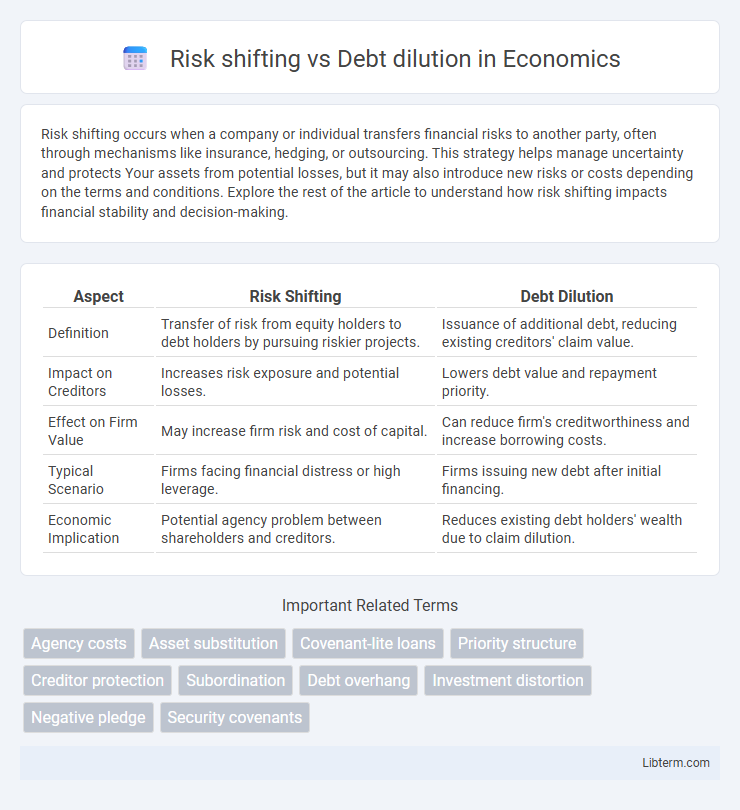

| Aspect | Risk Shifting | Debt Dilution |

|---|---|---|

| Definition | Transfer of risk from equity holders to debt holders by pursuing riskier projects. | Issuance of additional debt, reducing existing creditors' claim value. |

| Impact on Creditors | Increases risk exposure and potential losses. | Lowers debt value and repayment priority. |

| Effect on Firm Value | May increase firm risk and cost of capital. | Can reduce firm's creditworthiness and increase borrowing costs. |

| Typical Scenario | Firms facing financial distress or high leverage. | Firms issuing new debt after initial financing. |

| Economic Implication | Potential agency problem between shareholders and creditors. | Reduces existing debt holders' wealth due to claim dilution. |

Introduction to Risk Shifting and Debt Dilution

Risk shifting occurs when a company's management pursues high-risk projects that benefit equity holders but increase the likelihood of default, potentially harming debt holders. Debt dilution refers to the reduction in the value of existing debt due to the issuance of additional debt, which elevates the company's overall leverage and financial risk. Both mechanisms affect the distribution of risk and returns between equity and debt investors, influencing capital structure decisions and creditor protection strategies.

Defining Risk Shifting in Corporate Finance

Risk shifting in corporate finance occurs when shareholders pursue high-risk projects that potentially increase company value but also amplify the risk borne by debt holders. This behavior arises because equity holders benefit from upside gains while debt holders face downside losses, leading to a conflict of interest. Unlike debt dilution, which involves issuing new equity that reduces existing shareholders' ownership, risk shifting specifically addresses the strategic alteration of a firm's risk profile at the expense of creditors.

Understanding Debt Dilution: Key Concepts

Debt dilution occurs when a company issues additional debt or equity, reducing the ownership percentage and value of existing shareholders' stakes. This process can decrease the control and earnings per share for current investors while potentially lowering the company's overall creditworthiness and increasing financial risk. Understanding debt dilution is crucial for assessing the impact of new financing on shareholder value and the long-term capital structure of a firm.

Mechanisms of Risk Shifting in Practice

Risk shifting occurs when shareholders prefer riskier projects to increase potential returns at the expense of debtholders, exploiting the asymmetric payoff structure between equity and debt. Mechanisms include the issuance of new debt to finance high-risk investments and dividend payouts that reduce asset value cushioning for creditors. Debt dilution involves issuing additional debt or equity, decreasing existing creditors' claims and exacerbating conflicts of interest by increasing the probability of default.

How Debt Dilution Impacts Lenders

Debt dilution reduces existing lenders' ownership stakes by increasing the total amount of outstanding debt, often through new debt issuance with senior or equal priority. This dilution diminishes the value and control lenders have over collateral and repayment claims, heightening their credit risk exposure. Consequently, lenders may demand higher interest rates or stricter covenants to compensate for the increased risk of loss or default.

Risk Shifting vs Debt Dilution: Core Differences

Risk shifting occurs when equity holders take on higher risk projects to increase potential returns, often at the expense of debt holders who face greater default risk. Debt dilution involves issuing new debt or equity that reduces existing creditors' or shareholders' claims, impacting their control or repayment prioritization. Core differences lie in risk transfer dynamics for risk shifting versus claim dilution effects in debt dilution scenarios.

Implications for Shareholders and Creditors

Risk shifting occurs when shareholders prefer riskier projects that increase the potential upside for equity holders while potentially harming creditors by raising default risk. Debt dilution arises when issuing new debt reduces existing creditors' claims, weakening their position and possibly increasing borrowing costs. Both mechanisms alter the balance of power between shareholders and creditors, impacting the firm's capital structure and investment strategies.

Legal and Contractual Safeguards

Risk shifting occurs when creditors adjust their behavior due to changes in a borrower's financial position, potentially increasing the likelihood of default, while debt dilution involves the issuance of new debt or equity that diminishes existing creditors' claims. Legal safeguards like covenants restrict borrowers from taking actions that escalate risk or dilute debt, ensuring protection for creditors by limiting additional indebtedness and asset sales. Contractual protections often include anti-dilution clauses and priority provisions that preserve creditor rights and mitigate the adverse effects of risk shifting and debt dilution.

Real-World Examples of Risk Shifting and Debt Dilution

Risk shifting occurs when shareholders encourage companies to take on high-risk projects that benefit equity holders at the expense of debt holders, such as during the 2008 financial crisis when banks pursued risky mortgage-backed securities. Debt dilution refers to the reduction in existing debt holders' claims due to the issuance of new debt with more favorable terms for the issuer, exemplified by Greece's sovereign debt restructuring in 2012 which involved haircuts on existing bondholders. Both mechanisms impact creditor returns and corporate financial stability, highlighting the tension between equity incentives and creditor protection in distressed situations.

Strategies to Mitigate Agency Problems

Risk shifting and debt dilution represent key agency problems where managers prioritize personal benefits over shareholders' interests. Implementing strategies such as aligning managerial incentives with shareholder value through performance-based compensation and enforcing covenants in debt contracts effectively mitigates these risks. Monitoring mechanisms like board oversight and transparent financial reporting further reduce information asymmetry and limit opportunistic behaviors.

Risk shifting Infographic

libterm.com

libterm.com