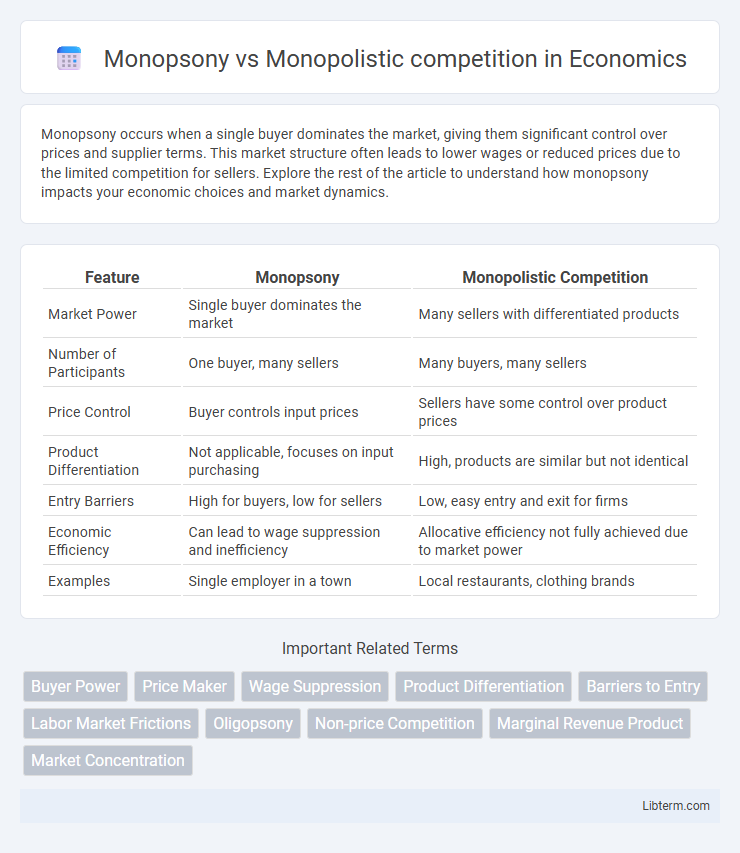

Monopsony occurs when a single buyer dominates the market, giving them significant control over prices and supplier terms. This market structure often leads to lower wages or reduced prices due to the limited competition for sellers. Explore the rest of the article to understand how monopsony impacts your economic choices and market dynamics.

Table of Comparison

| Feature | Monopsony | Monopolistic Competition |

|---|---|---|

| Market Power | Single buyer dominates the market | Many sellers with differentiated products |

| Number of Participants | One buyer, many sellers | Many buyers, many sellers |

| Price Control | Buyer controls input prices | Sellers have some control over product prices |

| Product Differentiation | Not applicable, focuses on input purchasing | High, products are similar but not identical |

| Entry Barriers | High for buyers, low for sellers | Low, easy entry and exit for firms |

| Economic Efficiency | Can lead to wage suppression and inefficiency | Allocative efficiency not fully achieved due to market power |

| Examples | Single employer in a town | Local restaurants, clothing brands |

Understanding Monopsony: Key Features

Monopsony is characterized by a single buyer dominating the market, which allows this buyer to influence prices and control supply conditions, particularly in labor or procurement markets. Key features include limited seller options, buyer market power, and wage-setting capability that often leads to lower prices compared to competitive markets. Unlike monopolistic competition, where many sellers differentiate products and compete, monopsony focuses on the buyers' dominance and market influence.

What Is Monopolistic Competition?

Monopolistic competition is a market structure characterized by many firms selling differentiated products, allowing them some degree of market power to set prices. Each firm faces a downward-sloping demand curve because their products are not perfect substitutes, leading to non-price competition through advertising and product differentiation. This contrasts with monopsony, where a single buyer dominates the market, influencing prices and quantities purchased.

Differences in Market Power

Monopsony market power is concentrated in a single buyer who controls the purchase price and quantity from multiple sellers, often leading to lower input prices and restricted supply. In monopolistic competition, market power is distributed among many sellers offering differentiated products, enabling them to influence prices but still face competition. The key difference lies in monopsony's buyer-dominated power compared to the seller-driven pricing flexibility within monopolistic competition.

Pricing Strategies: Monopsony vs. Monopolistic Competition

Monopsony pricing strategies center on a single dominant buyer controlling input prices, often driving costs down by leveraging market power to negotiate lower supplier prices. In contrast, monopolistic competition features numerous sellers offering differentiated products, allowing firms to set prices based on product uniqueness and consumer preferences within a competitive range. Price elasticity is a key factor in monopolistic competition, where firms possess some pricing power but must consider rivals' responses, unlike the monopsony's focus on buyer-side price control.

Impact on Consumer Choice

Monopsony limits consumer choice by allowing a single buyer to control market prices and reduce the diversity of products available, often resulting in fewer options and lower quality. Monopolistic competition, characterized by many sellers offering differentiated products, enhances consumer choice by providing a wide variety of goods and services with varying features and price points. The increased competition in monopolistic markets drives innovation and quality improvements, benefiting consumers with greater selection and tailored options.

Effects on Wages and Employment

Monopsony in labor markets results in lower wages and reduced employment levels due to the employer's market power to set wages below competitive equilibrium. Monopolistic competition features many firms offering differentiated products, leading to relatively higher wages and greater employment opportunities as firms compete for workers. Wage rigidity is more pronounced in monopsony, whereas wage flexibility characterizes monopolistic competition, impacting labor market dynamics distinctly.

Efficiency and Market Outcomes

Monopsony markets exhibit allocative inefficiency due to a single buyer's market power, resulting in lower input quantities and suppressed prices compared to competitive levels, which reduces overall welfare. In contrast, monopolistic competition features product differentiation and many sellers, leading to excess capacity and higher prices than perfect competition but greater product variety and innovation. While monopsony underallocates resources, monopolistic competition achieves more efficient output levels but incurs deadweight loss from pricing above marginal cost.

Real-World Examples of Monopsony

Monopsony markets feature a single dominant buyer exerting substantial control over suppliers, as seen in the U.S. defense industry where the Department of Defense is the primary purchaser of military equipment and services. Agricultural sectors often exhibit monopsony characteristics, particularly in cattle and poultry farming, where a few large processors like Tyson Foods or JBS act as dominant buyers influencing prices and contract terms for farmers. Sports leagues such as the NFL and NBA also demonstrate monopsony traits by controlling player contracts and salaries through draft systems and collective bargaining agreements.

Notable Cases of Monopolistic Competition

Monopolistic competition is characterized by many firms selling differentiated products, with notable cases including the fast-food industry where chains like McDonald's, Burger King, and Wendy's compete by offering unique menus and branding. The retail clothing market also exemplifies this structure, with numerous brands such as Zara, H&M, and Forever 21 providing similar but distinct apparel styles. These markets highlight how product differentiation and brand loyalty drive competition despite the presence of many sellers.

Policy Implications and Regulatory Challenges

Monopsony markets, characterized by a single dominant buyer, often require regulatory policies aimed at preventing buyer exploitation and ensuring fair wages, such as labor market interventions or antitrust enforcement. Monopolistic competition, with many firms offering differentiated products, challenges regulators to balance promoting market entry and innovation while preventing anti-competitive practices like collusion or deceptive advertising. Policymakers must tailor interventions to address market power concentration in monopsonies versus dynamic competition issues in monopolistic competition, carefully designing rules that foster efficiency and consumer welfare.

Monopsony Infographic

libterm.com

libterm.com