Effective return strategies maximize your investment gains by minimizing risks and optimizing timing. Understanding market trends and leveraging key financial tools ensure higher profitability and smooth asset transitions. Discover how to implement these methods effectively by reading the rest of the article.

Table of Comparison

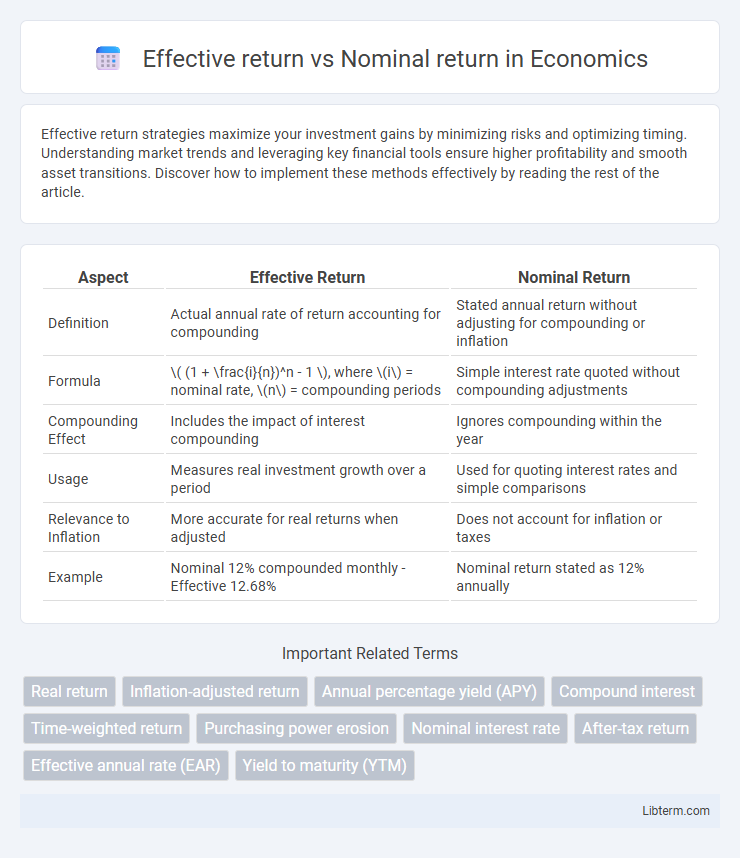

| Aspect | Effective Return | Nominal Return |

|---|---|---|

| Definition | Actual annual rate of return accounting for compounding | Stated annual return without adjusting for compounding or inflation |

| Formula | \( (1 + \frac{i}{n})^n - 1 \), where \(i\) = nominal rate, \(n\) = compounding periods | Simple interest rate quoted without compounding adjustments |

| Compounding Effect | Includes the impact of interest compounding | Ignores compounding within the year |

| Usage | Measures real investment growth over a period | Used for quoting interest rates and simple comparisons |

| Relevance to Inflation | More accurate for real returns when adjusted | Does not account for inflation or taxes |

| Example | Nominal 12% compounded monthly - Effective 12.68% | Nominal return stated as 12% annually |

Understanding Nominal Return

Nominal return represents the percentage increase in an investment's value without adjusting for inflation, reflecting the raw financial gain over a period. It differs from effective return, which accounts for compounding periods and provides a more accurate measure of actual investment growth. Understanding nominal return is crucial for comparing basic investment performance before factoring in real purchasing power changes.

Defining Effective Return

Effective return represents the actual rate of return on an investment after accounting for compounding over a specific period, providing a more accurate measure than nominal return. It reflects the true earning power by incorporating interest-on-interest effects, making it essential for comparing investments with different compounding intervals. Investors use effective return to assess the real growth of their portfolios and make informed decisions based on the actual performance rather than just stated rates.

Key Differences Between Effective and Nominal Return

Effective return measures the actual annualized rate of return on an investment, accounting for the effects of compounding during the year, while nominal return simply represents the stated interest rate without adjusting for compounding. The key difference lies in the calculation: effective return incorporates intra-year compounding periods, making it a more accurate indicator of investment performance. Nominal return can underestimate true earnings when compounding occurs more than once per year.

How Inflation Impacts Nominal and Effective Returns

Inflation reduces the purchasing power of nominal returns by eroding the actual value of earnings, making them appear higher than their real worth. Effective returns account for inflation by reflecting the true growth of an investment after adjusting for rising price levels. Investors prioritize effective returns to understand the real increase in wealth, as nominal returns can be misleading in inflationary environments.

The Role of Compounding in Effective Returns

Effective return reflects the true annual rate of growth on an investment after accounting for the effects of compounding interest, whereas nominal return represents the stated interest rate without compounding. Compounding plays a crucial role in effective returns by reinvesting earnings, leading to exponential growth over time rather than linear gains. Investors seeking accurate performance measurement focus on effective returns to capture the impact of periodic compounding on their portfolio's value.

Calculating Effective Return: Step-by-Step

Calculating effective return involves compounding nominal returns to reflect the true annual growth rate of an investment, accounting for the effects of intra-year compounding periods. The formula for effective return is \( (1 + \frac{r}{n})^n - 1 \), where \( r \) is the nominal annual interest rate and \( n \) is the number of compounding periods per year. This step-by-step approach ensures accurate comparison between investments with different compounding frequencies by capturing the impact of interest-on-interest.

Common Pitfalls in Comparing Returns

Nominal returns often overlook inflation, leading to an overestimation of investment performance compared to effective returns, which account for compounding and inflation effects. Investors commonly err by comparing nominal returns from different time periods without adjusting for inflation or compounding frequency, resulting in misleading conclusions. Accurate performance assessment requires evaluating effective returns that reflect true purchasing power and reinvestment impacts.

Tax Implications on Returns

Effective return accounts for compounding effects and provides a true measure of investment growth, while nominal return represents the stated percentage without adjusting for compounding. Tax implications significantly impact the effective return because taxes on interest, dividends, and capital gains reduce the actual profit received by investors. Understanding the difference helps investors optimize their post-tax returns by considering how various tax treatments on nominal income affect the overall effective yield.

Real-World Examples: Effective vs Nominal Return

Effective return accounts for compounding effects, providing a true measure of investment growth, while nominal return represents the stated interest without adjustment for compounding or inflation. For instance, a savings account offering a 6% nominal return compounded monthly results in an effective annual return of approximately 6.17%, demonstrating the impact of compounding. In contrast, a bond yielding a nominal 5% may have an effective return lower than expected after factoring in inflation or fees, highlighting the importance of evaluating returns in real terms.

Choosing the Right Metric for Investment Decisions

Effective return accounts for compounding periods within a year, providing a more accurate measure of an investment's true profitability than nominal return, which ignores compounding effects. Investors should prioritize effective return when comparing investment options to reflect actual earning power over time. Nominal return remains useful for simple scenarios or short-term estimates but may mislead long-term investment decisions if compounding is significant.

Effective return Infographic

libterm.com

libterm.com