Price level reflects the average prices of goods and services in an economy, influencing purchasing power and inflation rates. Understanding how price levels fluctuate helps you make informed financial decisions and anticipate market trends. Explore the rest of the article to learn how price levels impact your economic environment and personal finances.

Table of Comparison

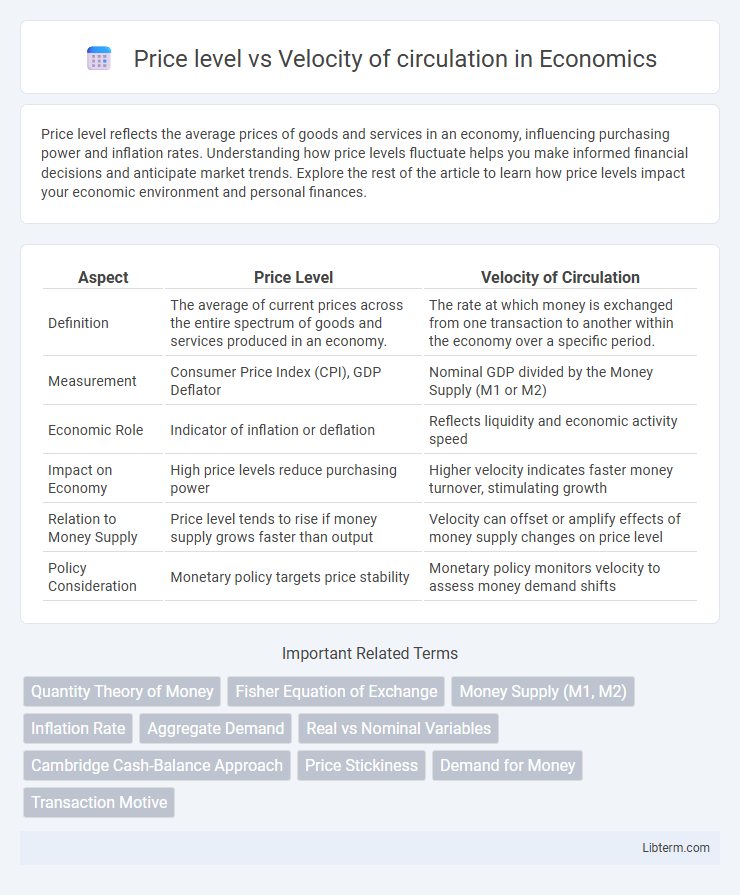

| Aspect | Price Level | Velocity of Circulation |

|---|---|---|

| Definition | The average of current prices across the entire spectrum of goods and services produced in an economy. | The rate at which money is exchanged from one transaction to another within the economy over a specific period. |

| Measurement | Consumer Price Index (CPI), GDP Deflator | Nominal GDP divided by the Money Supply (M1 or M2) |

| Economic Role | Indicator of inflation or deflation | Reflects liquidity and economic activity speed |

| Impact on Economy | High price levels reduce purchasing power | Higher velocity indicates faster money turnover, stimulating growth |

| Relation to Money Supply | Price level tends to rise if money supply grows faster than output | Velocity can offset or amplify effects of money supply changes on price level |

| Policy Consideration | Monetary policy targets price stability | Monetary policy monitors velocity to assess money demand shifts |

Introduction to Price Level and Velocity of Circulation

Price level refers to the average of current prices across the entire spectrum of goods and services produced in the economy, serving as a key indicator of inflation or deflation trends. Velocity of circulation measures the frequency at which a unit of currency is used to purchase goods and services within a given time period, reflecting the rate of economic activity. Understanding the interaction between price level and velocity of circulation is essential for analyzing monetary policy effects and predicting inflation dynamics.

Defining Price Level in Economics

Price level in economics refers to the average of current prices across the entire spectrum of goods and services produced in an economy, often measured by indices such as the Consumer Price Index (CPI) or the GDP deflator. The velocity of circulation quantifies the rate at which money changes hands within the economy, influencing overall demand and price movements. A higher velocity of circulation can lead to increases in the price level if the money supply remains constant, reflecting the dynamic relationship between monetary activity and inflation.

Understanding Velocity of Circulation

Velocity of circulation refers to the frequency at which a unit of currency is used to purchase goods and services within a specific time frame, directly influencing monetary transactions in an economy. Higher velocity indicates that money is rapidly changing hands, often correlating with increased economic activity and potentially higher price levels if the money supply remains constant. Understanding this concept is crucial for analyzing inflationary pressures and the effectiveness of monetary policy in controlling price stability.

The Quantity Theory of Money Explained

The Quantity Theory of Money explains that the price level is directly proportional to the money supply when the velocity of circulation and real output remain constant. Velocity of circulation refers to the frequency at which one unit of currency is used to purchase goods and services within a specific period. Changes in velocity can offset or amplify the effects of changes in money supply on overall price levels, highlighting its critical role in monetary economics.

Factors Influencing Price Level Changes

Price level changes are significantly influenced by the velocity of circulation, which represents the frequency at which money exchanges hands in the economy. When the velocity of circulation increases, it often leads to higher demand for goods and services, thereby pushing the price level upward due to greater spending pressure with the same money supply. Other factors impacting price level changes include money supply, aggregate demand, and production costs, but the velocity of circulation directly affects inflation by altering how quickly money moves and stimulates economic activity.

Drivers Behind Velocity of Circulation Fluctuations

Velocity of circulation fluctuates primarily due to changes in payment technologies, frequency of transactions, and consumer confidence. Innovations like mobile payments and digital wallets accelerate transaction speeds, thus increasing velocity, while economic uncertainty often slows spending, reducing velocity. Monetary policy and interest rates indirectly influence velocity by affecting the opportunity cost of holding money and incentivizing faster or slower circulation.

Relationship between Price Level and Velocity of Circulation

The relationship between price level and velocity of circulation is integral to the quantity theory of money, where velocity represents how often money changes hands within an economy. When velocity increases, it indicates faster spending, which often leads to higher demand and subsequently raises the price level if the money supply and output remain constant. Conversely, a decline in velocity reduces demand pressure, potentially lowering the price level or slowing inflationary trends.

Real-World Examples: Inflation and Velocity Dynamics

During hyperinflation in Zimbabwe, soaring price levels coincided with a sharp increase in the velocity of money as consumers and businesses spent cash rapidly before it lost value. In the United States during the 2008 financial crisis, despite aggressive monetary easing by the Federal Reserve, velocity of circulation declined substantially, suppressing inflation despite increased money supply. Venezuela's economic collapse illustrates how hyperinflation can trigger a feedback loop where rising prices prompt faster spending, compounding inflationary pressures through increased velocity.

Implications for Monetary Policy and Economic Stability

Price level fluctuations directly impact the velocity of circulation, with higher price levels often reducing money's purchasing power and potentially increasing spending velocity as consumers seek to maintain real balances. Central banks monitor this relationship to calibrate monetary policy, targeting inflation control without causing excessive velocity shifts that could destabilize economic growth. Understanding the dynamic interplay between price level and velocity helps policymakers implement measures that ensure economic stability by balancing money supply adjustments with demand-side factors.

Conclusion: Balancing Price Level and Velocity in Economic Management

Effective economic management requires carefully balancing the price level and the velocity of circulation to maintain stable inflation and promote sustainable growth. High velocity of circulation often signals increased spending activity, which can drive up the price level if not matched by adequate supply. Policymakers must monitor these variables concurrently, adjusting monetary policies to prevent runaway inflation or economic stagnation caused by sluggish money movement.

Price level Infographic

libterm.com

libterm.com