Cournot competition describes a market structure where firms simultaneously choose quantities to maximize profits, influencing the market price based on their combined output. It highlights strategic interdependence, where each firm's optimal production depends on competitors' decisions. Explore the rest of this article to understand how Cournot competition shapes market dynamics and your strategic choices.

Table of Comparison

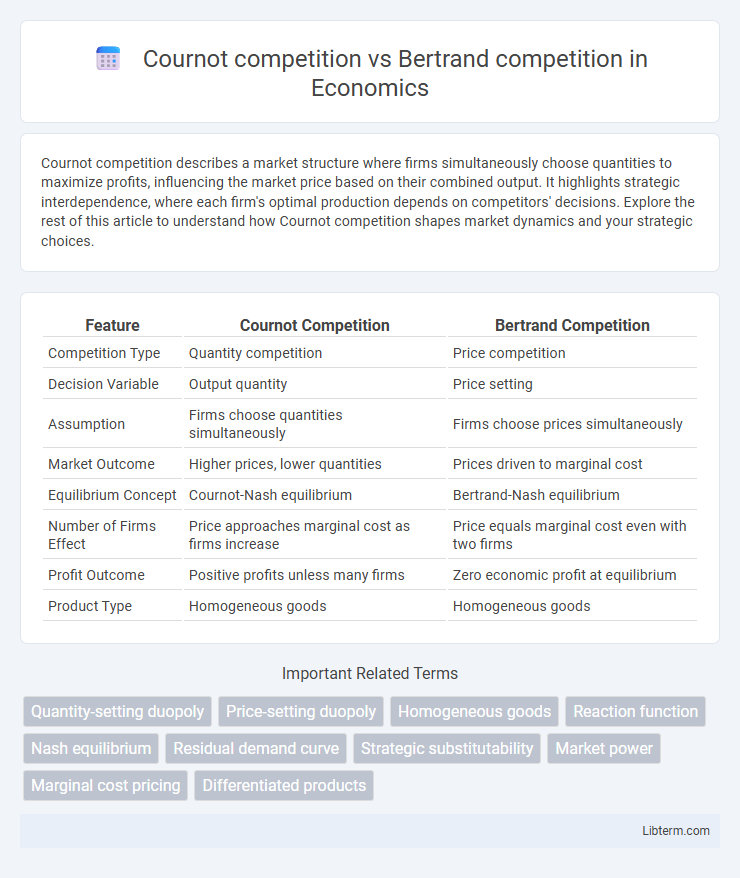

| Feature | Cournot Competition | Bertrand Competition |

|---|---|---|

| Competition Type | Quantity competition | Price competition |

| Decision Variable | Output quantity | Price setting |

| Assumption | Firms choose quantities simultaneously | Firms choose prices simultaneously |

| Market Outcome | Higher prices, lower quantities | Prices driven to marginal cost |

| Equilibrium Concept | Cournot-Nash equilibrium | Bertrand-Nash equilibrium |

| Number of Firms Effect | Price approaches marginal cost as firms increase | Price equals marginal cost even with two firms |

| Profit Outcome | Positive profits unless many firms | Zero economic profit at equilibrium |

| Product Type | Homogeneous goods | Homogeneous goods |

Introduction to Cournot and Bertrand Competition

Cournot competition models oligopolistic markets where firms choose quantities simultaneously to maximize profits based on competitors' output decisions, leading to equilibrium quantities and prices. Bertrand competition assumes firms compete by setting prices simultaneously, with consumers buying from the lowest-priced firm, often driving prices down to marginal cost in equilibrium. These foundational models illustrate strategic firm behavior under quantity and price competition frameworks in microeconomic theory.

Historical Background and Economic Foundations

Cournot competition, introduced by Antoine Augustin Cournot in 1838, models firms competing on output quantities, assuming rivals' quantities remain fixed, reflecting oligopolistic market behavior with limited strategic interactions. Bertrand competition, proposed by Joseph Bertrand in 1883, emphasizes price-setting among firms producing homogeneous goods, predicting price equals marginal cost due to firms undercutting each other. Both frameworks establish foundational economic theories on oligopoly, contrasting quantity and price competition and shaping subsequent industrial organization analysis.

Key Assumptions in Cournot and Bertrand Models

Cournot competition assumes firms choose quantities simultaneously, with each firm's output decision affecting the market price, based on the residual demand curve. Bertrand competition assumes firms set prices simultaneously, with consumers purchasing from the firm offering the lowest price, leading to price equalization under homogeneous products. Key assumptions in Cournot include strategic quantity-setting behavior and market equilibrium through quantity adjustment, while Bertrand assumes price-setting behavior and perfect substitutability of products driving prices to marginal cost.

Market Structure and Firm Behavior

Cournot competition models firms competing on output quantities, leading to a market equilibrium where each firm chooses its production level assuming rivals' quantities are fixed, resulting in intermediate prices between monopoly and perfect competition. Bertrand competition centers on price-setting behavior, with firms simultaneously choosing prices, often driving prices down to marginal cost in markets with homogeneous products and enabling aggressive price undercutting. Market structure under Cournot implies limited strategic interaction in quantities, while Bertrand reflects intense price rivalry, influencing firms' strategies based on product differentiation and cost conditions.

Price vs. Quantity: Strategic Choices Explained

Cournot competition models firms competing by choosing output quantities, leading to equilibrium prices determined by aggregate supply and demand, while Bertrand competition involves firms setting prices directly, often resulting in prices driven down to marginal cost under homogenous products. In Cournot's quantity-setting framework, firms strategically adjust production levels to influence market prices, whereas Bertrand's price-setting approach causes firms to undercut competitors to capture market share. The fundamental difference lies in strategic variables: Cournot emphasizes quantity adjustments impacting price, whereas Bertrand focuses on price competition shaping quantity sold.

Equilibrium Outcomes in Cournot and Bertrand Competition

In Cournot competition, firms choose quantities simultaneously, resulting in an equilibrium where each firm's output decision influences the market price, typically leading to higher prices and lower quantities compared to perfect competition. Bertrand competition involves firms competing on prices, driving the market price down to marginal cost in equilibrium, which results in zero economic profits similar to a perfectly competitive market. The fundamental difference in equilibrium outcomes is that Cournot equilibrium prices remain above marginal cost while Bertrand equilibrium prices equal marginal cost.

Implications for Market Prices and Consumer Welfare

Cournot competition results in higher market prices compared to Bertrand competition due to firms competing on quantities rather than prices, leading to less aggressive price cuts and reduced consumer surplus. In contrast, Bertrand competition drives prices down to marginal cost levels, maximizing consumer welfare by promoting lower prices and greater market efficiency. The stark difference in pricing outcomes highlights how the strategic variable--quantity in Cournot versus price in Bertrand--fundamentally shapes market dynamics and consumer benefits.

Real-World Applications and Industry Examples

Cournot competition is commonly observed in industries with limited firms producing homogeneous products, such as the oil and steel sectors, where firms decide quantities to maximize profits given competitors' output. In contrast, Bertrand competition frequently appears in markets like telecommunications and retail gasoline, where companies compete primarily on price while offering similar or identical products. Understanding these models helps explain pricing strategies and market behaviors in oligopolistic industries, influencing regulatory policies and business tactics.

Limitations and Criticisms of Each Model

Cournot competition is limited by its assumption that firms compete solely on quantity, which oversimplifies real-world strategic interactions where price and quality also matter. Bertrand competition, while focusing on price under identical products, often predicts unrealistic outcomes like zero-profit equilibria, ignoring product differentiation and capacity constraints. Both models face criticism for their static nature and inability to capture dynamic market behaviors and strategic complexities in oligopolistic industries.

Conclusion: Comparing Cournot and Bertrand Competition

Cournot competition models firms competing on quantity, resulting in higher prices and lower output compared to Bertrand competition, where firms compete on price leading to prices closer to marginal cost and higher consumer surplus. Cournot equilibrium reflects strategic quantity choices influencing market power, while Bertrand equilibrium drives aggressive price undercutting and minimal profits. Understanding these distinctions is crucial for analyzing oligopoly market structures and predicting firm behavior in different competitive environments.

Cournot competition Infographic

libterm.com

libterm.com