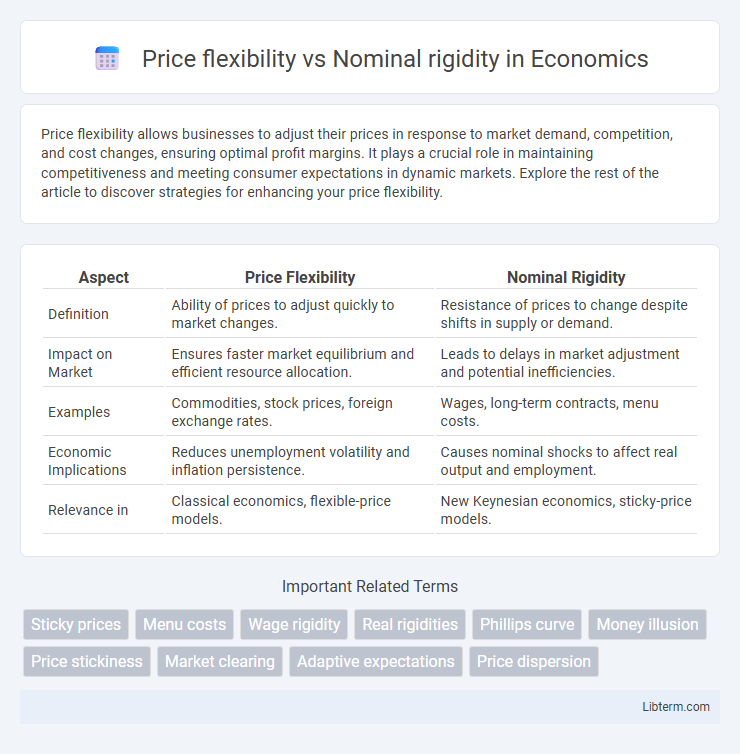

Price flexibility allows businesses to adjust their prices in response to market demand, competition, and cost changes, ensuring optimal profit margins. It plays a crucial role in maintaining competitiveness and meeting consumer expectations in dynamic markets. Explore the rest of the article to discover strategies for enhancing your price flexibility.

Table of Comparison

| Aspect | Price Flexibility | Nominal Rigidity |

|---|---|---|

| Definition | Ability of prices to adjust quickly to market changes. | Resistance of prices to change despite shifts in supply or demand. |

| Impact on Market | Ensures faster market equilibrium and efficient resource allocation. | Leads to delays in market adjustment and potential inefficiencies. |

| Examples | Commodities, stock prices, foreign exchange rates. | Wages, long-term contracts, menu costs. |

| Economic Implications | Reduces unemployment volatility and inflation persistence. | Causes nominal shocks to affect real output and employment. |

| Relevance in | Classical economics, flexible-price models. | New Keynesian economics, sticky-price models. |

Understanding Price Flexibility and Nominal Rigidity

Price flexibility refers to the ability of prices to adjust quickly in response to changes in supply and demand, ensuring market equilibrium. Nominal rigidity, or price stickiness, occurs when prices are slow to change due to menu costs, contracts, or institutional constraints, leading to delays in economic adjustment. Understanding these concepts is crucial for analyzing inflation dynamics, wage setting, and monetary policy effectiveness in real-world markets.

Key Differences Between Flexible and Rigid Prices

Flexible prices adjust quickly to changes in supply and demand, allowing markets to reach equilibrium efficiently, while nominal rigidities cause prices to remain fixed or slow to change despite economic shifts. Key differences include the speed of adjustment--flexible prices respond immediately, rigid prices exhibit inertia--and the impact on unemployment and output, where rigidity can lead to prolonged imbalances. The presence of menu costs, contracts, and wage-setting institutions often explains the persistence of nominal rigidities compared to the fluidity of flexible prices.

Theoretical Foundations in Macroeconomics

Price flexibility refers to the ability of prices to adjust rapidly in response to changes in supply and demand, facilitating market equilibrium. Nominal rigidity, or price stickiness, occurs when prices remain fixed in the short term despite economic fluctuations, often due to menu costs or wage contracts. Theoretical foundations in macroeconomics highlight that nominal rigidity can cause unemployment and output gaps, justifying the need for monetary and fiscal policy interventions to stabilize the economy.

Causes of Nominal Price Rigidity

Nominal price rigidity occurs due to menu costs, which are the expenses firms face when changing prices, such as updating labels or advertising. Firms may also avoid frequent price adjustments to maintain stable customer relationships and reduce uncertainty in demand. Additionally, contracts and wage agreements often fix prices or wages for certain periods, preventing immediate price flexibility in response to economic changes.

Economic Implications of Price Flexibility

Price flexibility allows markets to adjust quickly to supply and demand changes, promoting efficient resource allocation and minimizing unemployment during economic shocks. Nominal rigidity, where prices are slow to change, can lead to prolonged periods of disequilibrium, causing output gaps and increased inflation volatility. The economic implications of price flexibility include enhanced monetary policy effectiveness and faster recovery from recessions.

Real-World Examples of Price Stickiness

Price flexibility allows businesses to adjust prices rapidly in response to market changes, seen in commodities like oil where prices fluctuate daily. Nominal rigidity, or price stickiness, occurs in sectors such as retail and labor markets where wages and prices remain stable despite economic shifts, exemplified by long-term contracts and menu costs. Real-world examples include sticky wages during recessions and fixed utility rates that resist frequent changes due to regulatory constraints and consumer resistance.

Policy Responses to Nominal Rigidity

Policy responses to nominal rigidity often involve implementing forward-looking monetary policies to anchor inflation expectations and enhance price adaptability. Central banks may use inflation targeting and supply-side reforms to reduce nominal wage and price stickiness, fostering a more responsive economic environment. Fiscal interventions, such as temporary subsidies or tax adjustments, can also alleviate short-term rigidities by supporting demand without triggering persistent inflation.

Impact on Inflation and Unemployment

Price flexibility allows markets to adjust quickly to shocks, stabilizing inflation and reducing unemployment by enabling wages and prices to reflect supply and demand changes. Nominal rigidity, characterized by sticky prices and wages, slows this adjustment process, often leading to prolonged periods of unemployment and persistent inflation or deflation. The presence of nominal rigidities makes monetary policy less effective in controlling inflation and can exacerbate economic downturns by preventing efficient labor market adjustments.

Price Flexibility in Different Market Structures

Price flexibility varies significantly across market structures, with perfect competition exhibiting the highest degree of price adjustment due to numerous firms and homogeneous products. In monopolistic competition, firms have some pricing power allowing moderate flexibility influenced by product differentiation. Conversely, monopolies and oligopolies demonstrate nominal rigidity as fewer firms and strategic interactions cause prices to remain stable despite shifts in supply or demand.

Future Trends: Technology and Price Adjustments

Advancements in artificial intelligence and real-time data analytics are enhancing price flexibility by enabling dynamic pricing models that adjust swiftly to market demand and consumer behavior. E-commerce platforms and automated pricing algorithms reduce nominal rigidity by minimizing delays in price changes compared to traditional retail settings. Future trends indicate a growing integration of blockchain technology to ensure transparent and instantaneous price adjustments, further diminishing nominal rigidity in various industries.

Price flexibility Infographic

libterm.com

libterm.com