The Overlapping Generations (OLG) model offers a dynamic framework for analyzing economic behavior across different age cohorts, capturing intertemporal choices related to savings, consumption, and investment. It provides valuable insights into issues like public debt sustainability, social security, and economic growth by illustrating how decisions of current generations impact future ones. Explore the article to understand how the OLG model can enhance your grasp of macroeconomic policies and intergenerational equity.

Table of Comparison

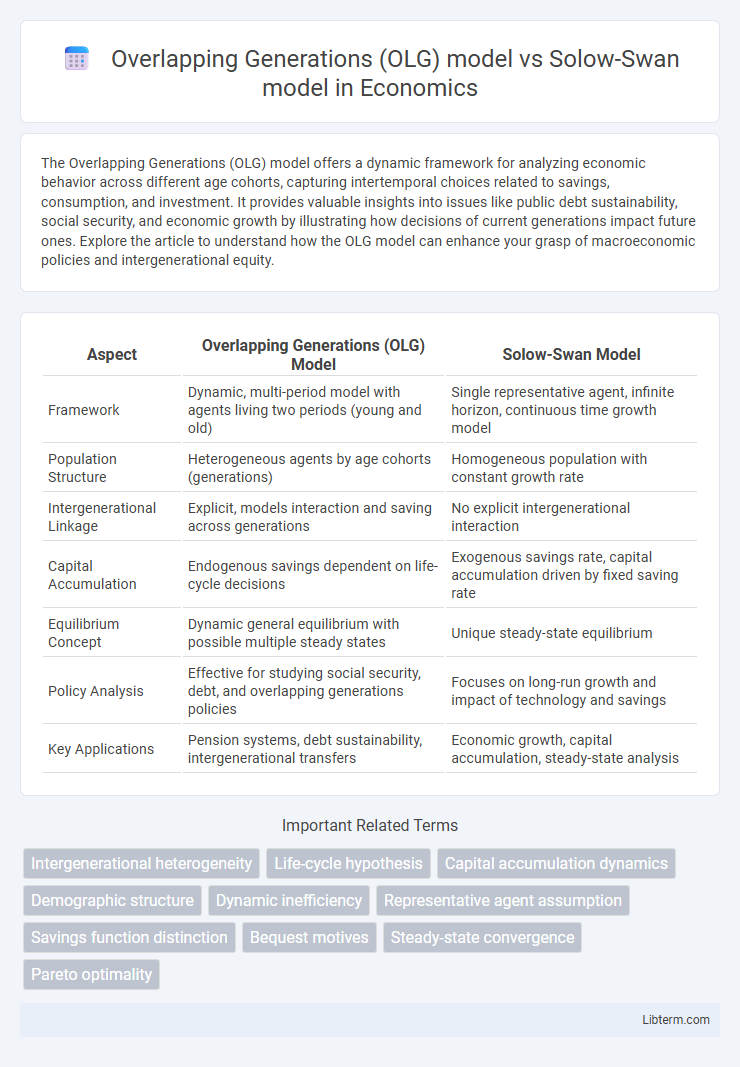

| Aspect | Overlapping Generations (OLG) Model | Solow-Swan Model |

|---|---|---|

| Framework | Dynamic, multi-period model with agents living two periods (young and old) | Single representative agent, infinite horizon, continuous time growth model |

| Population Structure | Heterogeneous agents by age cohorts (generations) | Homogeneous population with constant growth rate |

| Intergenerational Linkage | Explicit, models interaction and saving across generations | No explicit intergenerational interaction |

| Capital Accumulation | Endogenous savings dependent on life-cycle decisions | Exogenous savings rate, capital accumulation driven by fixed saving rate |

| Equilibrium Concept | Dynamic general equilibrium with possible multiple steady states | Unique steady-state equilibrium |

| Policy Analysis | Effective for studying social security, debt, and overlapping generations policies | Focuses on long-run growth and impact of technology and savings |

| Key Applications | Pension systems, debt sustainability, intergenerational transfers | Economic growth, capital accumulation, steady-state analysis |

Introduction to OLG and Solow-Swan Models

The Overlapping Generations (OLG) model captures intertemporal economic decisions by representing multiple cohorts coexisting and making consumption and saving choices across different life stages, providing insights into capital accumulation and generational wealth distribution. The Solow-Swan model emphasizes long-term economic growth driven by capital accumulation, labor growth, and technological progress, assuming a representative agent with a focus on steady-state equilibrium. Unlike the Solow-Swan framework, the OLG model incorporates heterogeneity across generations and analyzes dynamic paths of savings, capital, and pensions without relying on a steady-state assumption.

Historical Development and Foundations

The Overlapping Generations (OLG) model was developed in the 1960s by Paul Samuelson and Peter Diamond to address limitations in the Solow-Swan model, particularly its inability to account for intergenerational economic interactions. The Solow-Swan model, formulated independently by Robert Solow and Trevor Swan in the 1950s, laid the foundation for neoclassical growth theory by emphasizing capital accumulation, labor growth, and technological progress as key drivers of long-term economic growth. While the Solow-Swan model assumes a representative infinitely-lived agent, the OLG model incorporates finite lifespans and multiple cohorts coexisting, enabling deeper analysis of savings, pensions, and fiscal policy impacts across generations.

Core Assumptions: OLG vs Solow-Swan

The Overlapping Generations (OLG) model incorporates multiple cohorts coexisting and interacting economically, emphasizing intergenerational transfers and lifecycle behavior, unlike the Solow-Swan model, which assumes a single representative agent optimizing over infinite horizons. The OLG model assumes heterogeneous agents with finite lifespans, incorporating demographic dynamics and savings decisions spread over generations, while the Solow-Swan model relies on exogenous savings rates and population growth to drive capital accumulation. Core assumptions in the Solow-Swan model include constant returns to scale, exogenous technological progress, and perfect competition, contrasting with the OLG model's focus on endogenous saving behavior and the absence of perfect foresight across overlapping cohorts.

Treatment of Time and Generations

The Overlapping Generations (OLG) model explicitly incorporates multiple generations coexisting at different life stages, allowing for intertemporal decision-making and the analysis of intergenerational transfers, which introduces a dynamic structure of agents born at different times. In contrast, the Solow-Swan model assumes a representative agent framework with an infinitely lived planner, simplifying time treatment by focusing on aggregate capital accumulation and steady-state growth without distinguishing between individual generations. The OLG model's discrete generational approach captures lifecycle behavior and borrowing constraints, while the Solow-Swan model's continuous time aggregation emphasizes long-run economic growth driven by technological progress and exogenous savings rates.

Savings and Consumption Behavior

The Overlapping Generations (OLG) model captures individual life-cycle savings and consumption decisions by modeling multiple cohorts coexisting, allowing for intertemporal optimization and heterogeneous saving motives. In contrast, the Solow-Swan model treats savings as a fixed fraction of output, emphasizing aggregate capital accumulation without explicit microeconomic foundations for consumption behavior. The OLG framework provides richer insights into the dynamic interplay between demographic changes, savings rates, and economic growth, while the Solow-Swan model offers a simpler, steady-state analysis of capital accumulation and output growth.

Capital Accumulation Dynamics

The Overlapping Generations (OLG) model captures capital accumulation dynamics through intertemporal decisions of multiple cohorts, emphasizing savings behavior influenced by lifecycle considerations, which can lead to multiple equilibria and dynamic inefficiencies. In contrast, the Solow-Swan model treats capital accumulation as a continuous, aggregate process driven by exogenous savings rates and technological progress, resulting in a unique steady-state equilibrium. The OLG framework's micro-founded approach allows for richer analysis of capital dynamics, including generational trade-offs and the possibility of overaccumulation or underaccumulation of capital beyond the Solow-Swan predictions.

Role of Population Growth

The Overlapping Generations (OLG) model explicitly incorporates population growth by modeling distinct cohorts of agents who live for multiple periods, emphasizing intergenerational dynamics and how changes in population size influence savings and capital accumulation. In contrast, the Solow-Swan model treats population growth as an exogenous factor that drives labor force expansion, which dilutes capital per worker but supports steady-state growth in output per capita. Population growth in the OLG model affects both capital formation and the equilibrium interest rate through agents' intertemporal choices, while in the Solow-Swan model it mainly alters the capital-labor ratio without directly modeling individual behavior across generations.

Policy Implications in Each Model

The Overlapping Generations (OLG) model highlights the importance of intergenerational equity and optimal savings behavior for sustainable fiscal and social security policies, addressing pension systems and public debt dynamics more explicitly than the Solow-Swan model. In contrast, the Solow-Swan model emphasizes capital accumulation, technological progress, and steady-state growth, guiding policies that foster investment, innovation, and productivity improvements to achieve long-term economic growth. Policymakers using the OLG framework must consider dynamic inefficiencies and potential multiple equilibria, while those relying on the Solow-Swan model focus on convergence and policies that enable economies to reach their steady-state capital and output levels.

Strengths and Limitations: Comparative Analysis

The Overlapping Generations (OLG) model excels in capturing intergenerational dynamics and heterogeneous agent behaviors, providing rich insights into savings, pensions, and public debt effects, which the Solow-Swan model's representative agent framework oversimplifies. However, the OLG model's complexity and computational intensity limit its analytical tractability and accessibility compared to the more straightforward, steady-state-focused Solow-Swan model. While the Solow-Swan model effectively explains long-term economic growth through capital accumulation and technological progress, it lacks the micro-founded mechanisms for generational interactions and realistic demographic changes that the OLG model robustly addresses.

Conclusion and Future Research Directions

The Overlapping Generations (OLG) model offers a dynamic framework capturing intergenerational economic behavior and addressing issues like public debt and social security, which the Solow-Swan model's representative agent framework cannot fully encompass. Future research directions involve integrating heterogeneous agents and endogenous preferences within OLG setups to improve policy relevance and exploring hybrid models combining the steady-state focus of Solow-Swan with the life-cycle dynamics of OLG. Advances in computational methods and microdata availability will further enhance the empirical validation and practical applications of these growth models.

Overlapping Generations (OLG) model Infographic

libterm.com

libterm.com