Interest rate parity ensures that the difference in interest rates between two countries is equal to the expected change in exchange rates, preventing arbitrage opportunities in the forex markets. It connects spot exchange rates, forward exchange rates, and interest rates, helping you understand currency valuation dynamics. Explore the rest of the article to dive deeper into how interest rate parity influences global investments and forex trading strategies.

Table of Comparison

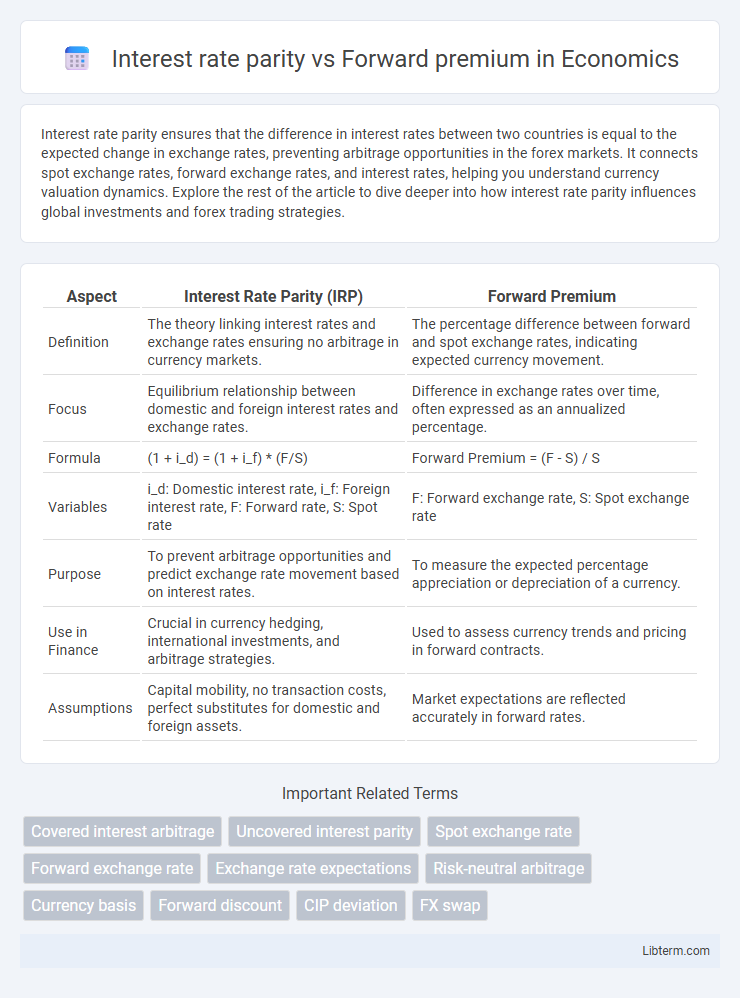

| Aspect | Interest Rate Parity (IRP) | Forward Premium |

|---|---|---|

| Definition | The theory linking interest rates and exchange rates ensuring no arbitrage in currency markets. | The percentage difference between forward and spot exchange rates, indicating expected currency movement. |

| Focus | Equilibrium relationship between domestic and foreign interest rates and exchange rates. | Difference in exchange rates over time, often expressed as an annualized percentage. |

| Formula | (1 + i_d) = (1 + i_f) * (F/S) | Forward Premium = (F - S) / S |

| Variables | i_d: Domestic interest rate, i_f: Foreign interest rate, F: Forward rate, S: Spot rate | F: Forward exchange rate, S: Spot exchange rate |

| Purpose | To prevent arbitrage opportunities and predict exchange rate movement based on interest rates. | To measure the expected percentage appreciation or depreciation of a currency. |

| Use in Finance | Crucial in currency hedging, international investments, and arbitrage strategies. | Used to assess currency trends and pricing in forward contracts. |

| Assumptions | Capital mobility, no transaction costs, perfect substitutes for domestic and foreign assets. | Market expectations are reflected accurately in forward rates. |

Understanding Interest Rate Parity (IRP)

Interest Rate Parity (IRP) explains the relationship between interest rates and currency exchange rates, ensuring no arbitrage opportunities exist in the foreign exchange market. It states that the difference in nominal interest rates between two countries equals the forward premium or discount on their currencies, linking spot and forward exchange rates with interest rate differentials. Understanding IRP helps investors and traders predict currency movements and hedge foreign exchange risk effectively.

Defining Forward Premium in Foreign Exchange

Forward premium in foreign exchange refers to the percentage difference between the forward exchange rate and the spot exchange rate, indicating the market's expectation of currency value changes over time. It reflects the cost or benefit of locking in a currency exchange rate for a future date compared to the current spot rate. Interest rate parity theory predicts that the forward premium corresponds to the interest rate differential between two countries, ensuring no arbitrage opportunities in the forex market.

Theoretical Foundations: IRP vs Forward Premium

Interest rate parity (IRP) is a fundamental financial theory stating that the difference in interest rates between two countries is equal to the forward premium or discount on their currencies, ensuring no arbitrage opportunities in the foreign exchange markets. Forward premium reflects the expected change in exchange rates over time and is derived from the spot rate adjusted by the interest rate differential. While IRP emphasizes equilibrium conditions linking interest rates and exchange rates, forward premium serves as the market's forecast embedded in forward contracts, both underpinned by the assumptions of efficient markets and unbiased expectations.

Calculating Interest Rate Parity

Interest Rate Parity (IRP) calculates the relationship between spot exchange rates, forward exchange rates, and interest rates of two countries to prevent arbitrage opportunities in foreign exchange markets. The formula for IRP is Forward Rate / Spot Rate = (1 + Domestic Interest Rate) / (1 + Foreign Interest Rate), enabling calculation of the expected forward exchange rate based on interest differentials. This equation ensures that the forward premium or discount reflects the interest rate gap, maintaining equilibrium between currency markets.

How Forward Premiums are Determined

Forward premiums are determined primarily by the interest rate differentials between two countries, reflecting the cost of borrowing and lending in respective currencies. The forward exchange rate adjusts to eliminate arbitrage opportunities, aligning with the concept of interest rate parity. Market expectations, inflation differentials, and currency risk premiums also influence the size and direction of the forward premium.

Real-World Examples: IRP and Forward Premium

Interest rate parity (IRP) and forward premium are fundamental concepts in foreign exchange markets, illustrating the relationship between interest rates and currency forward rates. For example, if the US interest rate is 2% while the Eurozone rate is 0.5%, the euro typically trades at a forward premium relative to the dollar, reflecting the interest differential under covered interest rate parity. Real-world deviations often occur due to transaction costs, capital controls, and market expectations, as seen during the 2020 COVID-19 pandemic when forward premiums diverged significantly from predicted IRP values.

Factors Influencing IRP and Forward Premium

Interest rate parity (IRP) and forward premium are influenced by key factors such as interest rate differentials between two countries, expected changes in exchange rates, and market expectations of inflation. The IRP condition depends on the interest rates set by central banks and risk premiums, while the forward premium reflects traders' outlook on currency depreciation or appreciation based on macroeconomic indicators and geopolitical stability. Both concepts integrate these elements to maintain equilibrium in foreign exchange markets and prevent arbitrage opportunities.

Practical Implications for Investors and Traders

Interest rate parity (IRP) ensures that the difference in interest rates between two countries is reflected in the forward exchange rate, preventing arbitrage opportunities and guiding investors in hedging currency risk effectively. The forward premium or discount indicates expected currency depreciation or appreciation, serving as a critical signal for traders in forming strategies for forex and international investments. Understanding the interplay between IRP and forward premiums allows investors to make informed decisions on carry trades, risk management, and speculative positions in global markets.

Common Deviations and Market Anomalies

Common deviations between interest rate parity (IRP) and forward premium often stem from transaction costs, capital controls, and differing risk premiums across currencies. Market anomalies such as the forward premium puzzle reveal instances where high-interest-rate currencies do not depreciate as IRP predicts, challenging the uncovered interest rate parity assumption. These deviations highlight the impact of market frictions, investor behavior, and expectations on currency pricing mechanisms beyond theoretical arbitrage conditions.

Comparing IRP and Forward Premium: Key Takeaways

Interest rate parity (IRP) explains the relationship between interest rates and exchange rates, ensuring no arbitrage opportunities exist through forward contracts, while the forward premium represents the percentage difference between the forward and spot exchange rates. IRP implies that the forward premium or discount should equal the interest rate differential between two countries, providing a theoretical benchmark for predicting currency movements. Discrepancies between the forward premium and IRP can indicate market inefficiencies, speculative opportunities, or risk premiums embedded in forward rates.

Interest rate parity Infographic

libterm.com

libterm.com