Interest rate sensitivity measures how the value of investments, such as bonds or stocks, responds to changes in interest rates, impacting your portfolio's performance and risk. Understanding this concept helps you make informed decisions to manage potential losses during rate fluctuations. Explore the full article to learn how to effectively assess and navigate interest rate sensitivity.

Table of Comparison

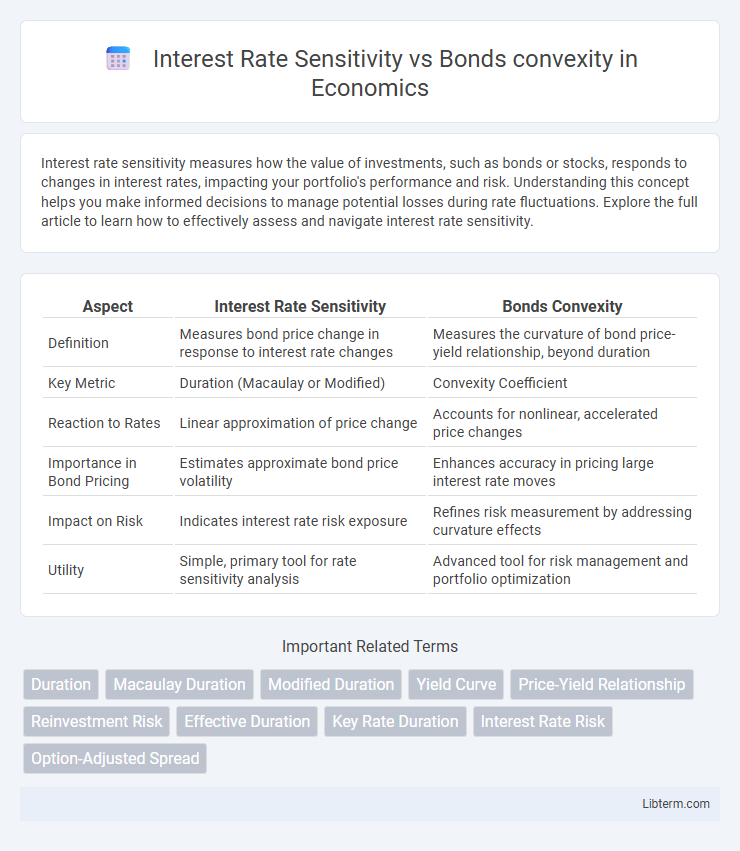

| Aspect | Interest Rate Sensitivity | Bonds Convexity |

|---|---|---|

| Definition | Measures bond price change in response to interest rate changes | Measures the curvature of bond price-yield relationship, beyond duration |

| Key Metric | Duration (Macaulay or Modified) | Convexity Coefficient |

| Reaction to Rates | Linear approximation of price change | Accounts for nonlinear, accelerated price changes |

| Importance in Bond Pricing | Estimates approximate bond price volatility | Enhances accuracy in pricing large interest rate moves |

| Impact on Risk | Indicates interest rate risk exposure | Refines risk measurement by addressing curvature effects |

| Utility | Simple, primary tool for rate sensitivity analysis | Advanced tool for risk management and portfolio optimization |

Understanding Interest Rate Sensitivity

Interest rate sensitivity measures how bond prices respond to changes in interest rates, typically quantified by duration, which estimates price change for a 1% yield shift. Convexity complements duration by capturing the curvature in the price-yield relationship, providing more accurate estimates for larger interest rate movements. Understanding interest rate sensitivity through duration helps investors assess risk exposure, while convexity refines this analysis by accounting for nonlinear price changes.

What is Bond Convexity?

Bond convexity measures the curvature in the relationship between bond prices and interest rates, reflecting how the duration of a bond changes as interest rates fluctuate. It enhances the accuracy of interest rate sensitivity calculations by accounting for the nonlinear price changes caused by varying yields, especially for large interest rate movements. Convexity is a crucial metric for bond investors seeking to manage interest rate risk beyond the linear approximation provided by duration alone.

Interest Rate Changes: Impact on Bond Prices

Interest rate sensitivity measures the linear relationship between bond prices and interest rate changes, capturing the initial price decline or increase for small rate movements. Bond convexity reflects the curvature in the price-yield relationship, adjusting for the acceleration or deceleration in price changes as interest rates shift more significantly. Higher convexity implies less price volatility for large interest rate changes, providing a more accurate estimation of bond price fluctuations compared to duration alone.

Duration: The First Step in Measuring Sensitivity

Duration serves as the foundational measure for assessing interest rate sensitivity in bonds by quantifying the weighted average time to receive bond cash flows. It approximates how much a bond's price will change for a given change in interest rates, effectively capturing linear price risk. However, duration alone cannot account for the curvature in price-yield relationships, necessitating convexity analysis to improve accuracy in sensitivity measurement.

Convexity: Enhancing Accuracy in Price Predictions

Convexity measures the curvature in the relationship between bond prices and interest rates, providing a more accurate prediction of price changes for large interest rate movements compared to duration alone. It accounts for the non-linear price sensitivity by capturing the acceleration or deceleration of price changes as yields fluctuate, reducing the estimation error inherent in linear models. Incorporating convexity in bond valuation enhances risk management by offering a refined assessment of price volatility under varying interest rate scenarios.

Key Differences Between Duration and Convexity

Duration measures a bond's price sensitivity to small changes in interest rates, reflecting the linear relationship between bond prices and yield fluctuations. Convexity captures the curvature in this relationship, accounting for the nonlinear price changes as yields vary, providing a more accurate estimate for larger interest rate movements. While duration is effective for estimating price changes with minimal yield shifts, convexity refines this by considering the bond's price acceleration, crucial for managing interest rate risk in volatile markets.

Interest Rate Risk: Duration vs. Convexity Perspective

Interest rate sensitivity of bonds is primarily measured by duration, which estimates price changes for small interest rate movements but assumes a linear relationship. Convexity captures the curvature in the price-yield relationship, providing a more accurate reflection of bond price changes for larger interest rate shifts and enhancing interest rate risk assessment. Combining duration and convexity metrics improves portfolio risk management by quantifying both the slope and curvature effects on bond prices amid fluctuating interest rates.

Practical Examples: Sensitivity vs. Convexity in Bonds

Interest rate sensitivity measures how a bond's price changes in response to small shifts in interest rates, typically using duration as a linear approximation. In contrast, bond convexity captures the curvature in the price-yield relationship, providing a more accurate price change estimate for larger interest rate movements. For example, a 5-year bond with a duration of 4 years and moderate convexity will experience less price decline than predicted by duration alone when interest rates rise significantly, demonstrating the importance of convexity in practical bond portfolio management.

Managing Bond Portfolios with Duration and Convexity

Managing bond portfolios requires careful attention to interest rate sensitivity, primarily measured by duration, which estimates the price change in response to interest rate fluctuations. Convexity complements duration by capturing the curvature in the price-yield relationship, providing a more accurate assessment of price volatility especially for large rate changes. Combining duration and convexity allows portfolio managers to optimize bond pricing strategies, minimize risk, and better hedge against interest rate movements.

Strategic Implications for Investors

Interest rate sensitivity, measured by duration, quantifies a bond's price response to changes in interest rates, while convexity accounts for the curvature in this relationship, providing a more accurate estimate of price changes for large rate fluctuations. Investors strategically use convexity to manage portfolio risk, as higher convexity reduces downside risk during interest rate volatility and enhances returns in declining rate environments. Incorporating both measures enables investors to optimize bond selection, improve hedging strategies, and align fixed-income portfolios with targeted risk-return profiles.

Interest Rate Sensitivity Infographic

libterm.com

libterm.com