Arbitrage involves exploiting price differences of the same asset across various markets to generate risk-free profits. This strategy requires swift decision-making and real-time market data to capitalize on fleeting opportunities effectively. Discover how you can leverage arbitrage techniques to enhance your trading success in the rest of this article.

Table of Comparison

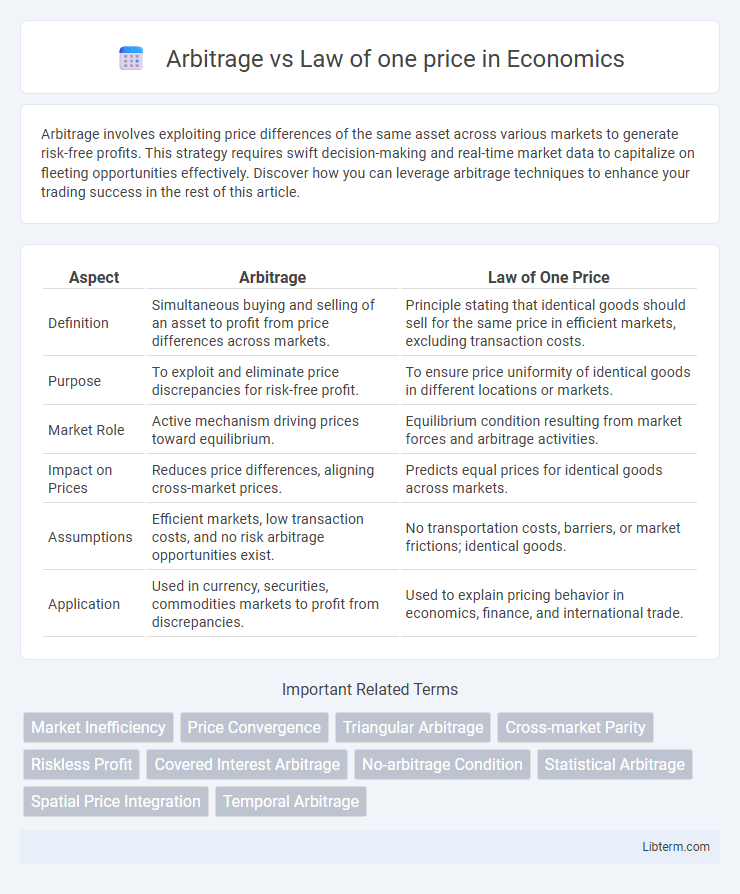

| Aspect | Arbitrage | Law of One Price |

|---|---|---|

| Definition | Simultaneous buying and selling of an asset to profit from price differences across markets. | Principle stating that identical goods should sell for the same price in efficient markets, excluding transaction costs. |

| Purpose | To exploit and eliminate price discrepancies for risk-free profit. | To ensure price uniformity of identical goods in different locations or markets. |

| Market Role | Active mechanism driving prices toward equilibrium. | Equilibrium condition resulting from market forces and arbitrage activities. |

| Impact on Prices | Reduces price differences, aligning cross-market prices. | Predicts equal prices for identical goods across markets. |

| Assumptions | Efficient markets, low transaction costs, and no risk arbitrage opportunities exist. | No transportation costs, barriers, or market frictions; identical goods. |

| Application | Used in currency, securities, commodities markets to profit from discrepancies. | Used to explain pricing behavior in economics, finance, and international trade. |

Introduction to Arbitrage and the Law of One Price

Arbitrage involves exploiting price differences of identical or similar assets across different markets to secure risk-free profits. The Law of One Price states that in efficient markets, identical goods must sell for the same price when prices are expressed in a common currency, assuming no transaction costs or barriers. Arbitrage enforces the Law of One Price by enabling traders to buy low in one market and sell high in another, eliminating price discrepancies.

Defining Arbitrage: Concepts and Types

Arbitrage involves exploiting price differences of identical or similar financial instruments across different markets to achieve risk-free profits. Key types include spatial arbitrage, where traders buy low in one market and sell high in another, and triangular arbitrage, which involves currency exchanges to capitalize on discrepancies in foreign exchange rates. This concept directly supports the Law of One Price, which states that identical goods should sell for the same price globally when accounting for transaction costs.

The Law of One Price: Core Principles

The Law of One Price asserts that identical goods must sell for the same price in efficient markets, eliminating the possibility of arbitrage. Price differences for the same asset across different locations create arbitrage opportunities until supply and demand forces restore uniform pricing. This principle underpins international trade, currency markets, and asset pricing by ensuring price parity in the absence of transaction costs and market frictions.

Historical Context and Evolution

Arbitrage, rooted in 19th-century financial markets, emerged as traders exploited price differences across regions to secure risk-free profits, shaping early international trade dynamics. The Law of One Price, formalized through classical economics by economists like Gustav Cassel in the early 20th century, asserts that identical goods should sell for the same price globally when markets are efficient and transaction costs are minimal. Over time, increased globalization and technological advances narrowed price disparities, reinforcing the Law of One Price while arbitrage strategies evolved with sophisticated financial instruments and electronic trading platforms.

How Arbitrage Enforces the Law of One Price

Arbitrage enforces the Law of One Price by exploiting price discrepancies for identical assets across different markets, ensuring prices converge to a single equilibrium. When arbitrageurs buy undervalued assets in one location and sell them where prices are higher, supply and demand dynamics adjust prices until no profit opportunity remains. This process eliminates price differentials, maintaining market efficiency and confirming the Law of One Price holds true.

Real-World Examples and Case Studies

Arbitrage exploits price differences of identical assets across markets, such as when traders buy gold cheaper on the Shanghai exchange and sell at a premium on the London market, while the Law of One Price posits that identical goods should have uniform prices globally after accounting for transaction costs. In real-world cases, currency arbitrage opportunities arise when exchange rates deviate temporarily from parity conditions, as seen in triangular arbitrage strategies among EUR/USD, USD/JPY, and EUR/JPY pairs. Case studies in commodity markets illustrate how transportation costs, tariffs, and market inefficiencies prevent perfect price convergence, causing divergence between theoretical law and practical arbitrage.

Market Imperfections and their Impact

Arbitrage exploits market imperfections such as transaction costs, information asymmetry, and liquidity constraints that prevent the Law of One Price from holding perfectly. These imperfections create price differentials in different markets for the same asset, allowing arbitrageurs to buy low and sell high until the prices converge. However, persistent market frictions can limit arbitrage effectiveness, causing deviations from the Law of One Price to endure.

Risks and Limitations of Arbitrage

Arbitrage exploits price differences between markets to secure risk-free profits, yet it is constrained by risks such as transaction costs, market liquidity, and timing delays, which can erode potential gains. The Law of One Price assumes identical goods will have the same price across markets, but real-world frictions, including regulatory barriers and information asymmetry, create price discrepancies that arbitrage cannot always fully reconcile. Consequently, arbitrage opportunities often carry execution risks and limitations that prevent perfect alignment with the Law of One Price.

Technological Advances and Market Efficiency

Technological advances in trading platforms and data analytics have significantly enhanced market efficiency by enabling rapid identification and execution of arbitrage opportunities, thereby reinforcing the Law of One Price. High-frequency trading algorithms and real-time price dissemination reduce discrepancies across markets, ensuring asset prices converge more quickly and consistently. This integration of technology minimizes arbitrage risks and transaction costs, promoting seamless price uniformity globally.

Conclusion: Key Differences and Practical Implications

Arbitrage exploits temporary price discrepancies across different markets to generate risk-free profits, whereas the Law of One Price states that identical goods should sell for the same price in efficient markets. The practical implication is that persistent arbitrage opportunities indicate market inefficiencies or barriers, while adherence to the Law of One Price suggests equilibrium. Understanding these differences helps investors recognize when price deviations can be profitably exploited or reflect underlying market frictions.

Arbitrage Infographic

libterm.com

libterm.com