Economy-wide risk refers to the potential for widespread disruptions that impact multiple sectors and markets simultaneously, often caused by systemic factors such as financial crises, geopolitical conflicts, or global pandemics. Understanding this risk is crucial for investors and policymakers to anticipate market volatility and implement resilient strategies for economic stability. Explore the article to learn how economy-wide risk influences your financial decisions and ways to mitigate its effects.

Table of Comparison

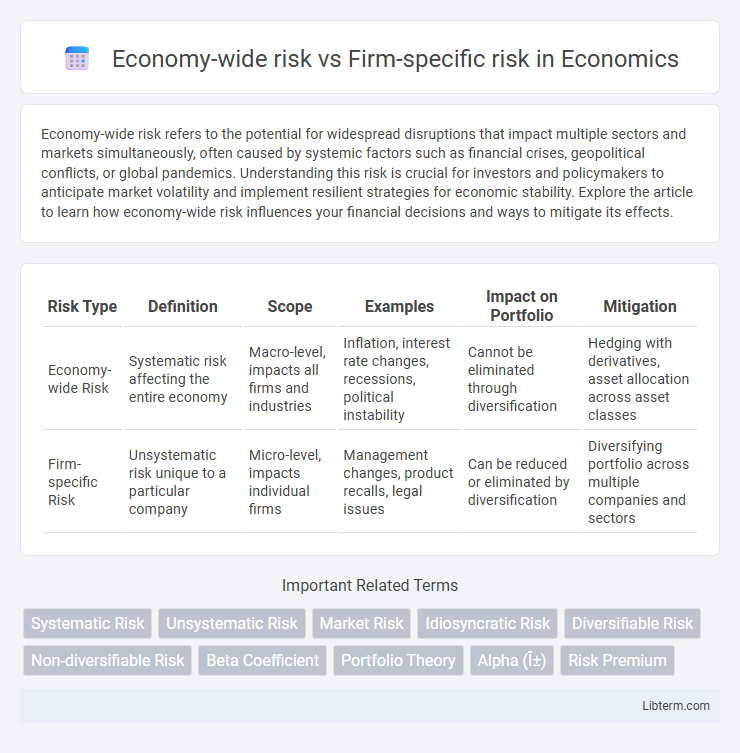

| Risk Type | Definition | Scope | Examples | Impact on Portfolio | Mitigation |

|---|---|---|---|---|---|

| Economy-wide Risk | Systematic risk affecting the entire economy | Macro-level, impacts all firms and industries | Inflation, interest rate changes, recessions, political instability | Cannot be eliminated through diversification | Hedging with derivatives, asset allocation across asset classes |

| Firm-specific Risk | Unsystematic risk unique to a particular company | Micro-level, impacts individual firms | Management changes, product recalls, legal issues | Can be reduced or eliminated by diversification | Diversifying portfolio across multiple companies and sectors |

Understanding Economy-wide Risk

Economy-wide risk, also known as systematic risk, affects all firms and industries through macroeconomic factors like inflation, interest rates, and political instability, making it impossible to eliminate via diversification. This risk influences market-wide price fluctuations, impacting overall investment returns and economic stability. Understanding economy-wide risk is essential for developing effective risk management strategies and building resilient investment portfolios.

Defining Firm-specific Risk

Firm-specific risk, also known as idiosyncratic risk, refers to the uncertainty associated with a single company's operations, management decisions, and industry conditions, impacting its stock performance independently of the overall market. This type of risk can be mitigated through diversification in investment portfolios since it is unique to individual firms. Examples include product recalls, regulatory changes affecting the company, or leadership shifts that do not influence the broader economy.

Key Differences Between Economy-wide and Firm-specific Risks

Economy-wide risk, also called systematic risk, affects the entire market and cannot be mitigated through diversification, influencing all firms due to macroeconomic factors such as interest rates, inflation, and geopolitical events. In contrast, firm-specific risk, or unsystematic risk, impacts individual companies based on internal factors like management decisions, product recalls, or competitive positioning, and can be reduced through diversification. The key difference lies in their scope and controllability: economy-wide risks affect the broader market, while firm-specific risks are confined to particular companies and industries.

Causes of Economy-wide Risk

Economy-wide risk stems from macroeconomic factors such as inflation rates, interest rate fluctuations, recessions, political instability, and natural disasters that impact the entire market or economy simultaneously. Unlike firm-specific risk, which arises from internal business operations or management decisions, economy-wide risk affects all industries and companies, limiting the effectiveness of diversification to reduce risk. Key causes include monetary policy changes by central banks, fiscal policy adjustments by governments, geopolitical tensions, and global economic shocks.

Common Sources of Firm-specific Risk

Common sources of firm-specific risk include management decisions, product recalls, regulatory changes, and operational inefficiencies that directly impact a company's financial performance. These risks are unique to individual firms and are not related to broader economic conditions, distinguishing them from economy-wide risk. Investors can mitigate firm-specific risk through diversification, reducing exposure to adverse events affecting a single company.

Measuring Economy-wide Risk

Measuring economy-wide risk involves assessing macroeconomic indicators such as GDP growth rates, inflation, unemployment levels, and interest rate volatility that impact the entire market. Systematic risk metrics like the Beta coefficient quantify how sensitive an asset or portfolio is to broad market movements, capturing exposure to economic downturns or booms. Economic models and stress testing techniques are applied to simulate various scenarios, enabling investors and policymakers to evaluate potential impacts on aggregate market stability.

Tools for Assessing Firm-specific Risk

Firm-specific risk can be effectively assessed using tools such as fundamental analysis, which examines a company's financial statements, management quality, and market position to identify potential vulnerabilities. Quantitative models like the Capital Asset Pricing Model (CAPM) help isolate firm-specific volatility by comparing individual stock returns against market benchmarks. Scenario analysis and stress testing further enhance risk evaluation by simulating adverse events to gauge their impact on the firm's financial health.

Impact of Risks on Investment Decisions

Economy-wide risk, also known as systematic risk, affects all firms and cannot be eliminated through diversification, leading investors to demand higher returns for bearing market-wide uncertainty. Firm-specific risk, or unsystematic risk, pertains to individual companies or industries and can be mitigated by holding a diversified portfolio, thus having a limited impact on investment decisions. Investors prioritize managing economy-wide risk through asset allocation and market analysis, while firm-specific risk influences stock selection and portfolio diversification strategies.

Strategies to Mitigate Economy-wide and Firm-specific Risks

Diversifying investments across various industries and asset classes reduces exposure to firm-specific risk by minimizing the impact of any single company's performance. Hedging instruments, such as options and futures, protect against economy-wide risks caused by macroeconomic factors like inflation or interest rate fluctuations. Implementing scenario analysis and stress testing enhances risk management by identifying vulnerabilities and preparing tailored responses to both market-wide and company-specific uncertainties.

The Importance of Diversification

Economy-wide risk, also known as systematic risk, affects the entire market and cannot be eliminated through diversification, whereas firm-specific risk, or unsystematic risk, is unique to individual companies and can be significantly reduced by holding a diversified portfolio of assets. Diversification minimizes exposure to firm-specific shocks by spreading investments across multiple industries and geographic regions, thereby stabilizing returns and lowering overall portfolio volatility. Effective risk management through diversification allows investors to optimize their risk-return profile by focusing on market-related risks that cannot be diversified away.

Economy-wide risk Infographic

libterm.com

libterm.com