Nominal rigidity refers to the resistance of prices and wages to change despite shifts in economic conditions such as inflation or demand fluctuations. This phenomenon can lead to inefficiencies in the market, causing unemployment or reduced output when the rigid prices prevent adjustment to new equilibria. Explore the article to understand how nominal rigidity impacts your economic environment and decision-making.

Table of Comparison

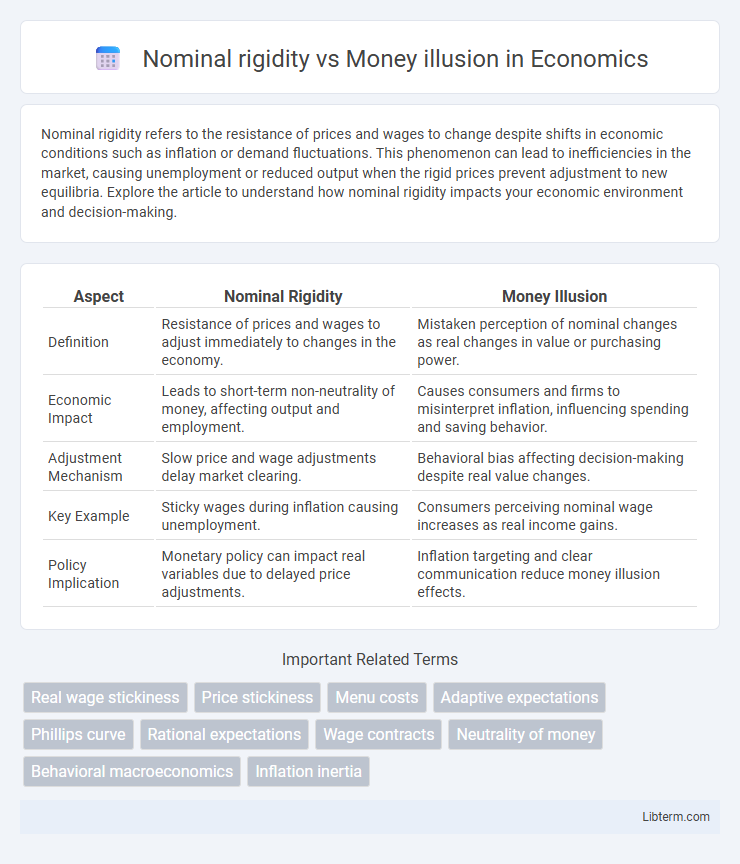

| Aspect | Nominal Rigidity | Money Illusion |

|---|---|---|

| Definition | Resistance of prices and wages to adjust immediately to changes in the economy. | Mistaken perception of nominal changes as real changes in value or purchasing power. |

| Economic Impact | Leads to short-term non-neutrality of money, affecting output and employment. | Causes consumers and firms to misinterpret inflation, influencing spending and saving behavior. |

| Adjustment Mechanism | Slow price and wage adjustments delay market clearing. | Behavioral bias affecting decision-making despite real value changes. |

| Key Example | Sticky wages during inflation causing unemployment. | Consumers perceiving nominal wage increases as real income gains. |

| Policy Implication | Monetary policy can impact real variables due to delayed price adjustments. | Inflation targeting and clear communication reduce money illusion effects. |

Understanding Nominal Rigidity: Definition and Importance

Nominal rigidity refers to the resistance of prices and wages to change despite shifts in economic conditions, causing delays in market adjustments and impacting inflation and unemployment rates. This concept is crucial for understanding how nominal wages and prices do not instantly reflect real economic values, often leading to inefficiencies in monetary policy effectiveness. Recognizing nominal rigidity helps explain the persistence of short-term economic fluctuations and the challenges in achieving full employment and price stability.

What is Money Illusion? Key Concepts Explained

Money illusion refers to the tendency of individuals to think of currency in nominal terms rather than real terms, ignoring inflation's impact on purchasing power. This cognitive bias causes people to interpret wage or price changes based on face value instead of adjusting for changes in inflation or cost of living. Understanding money illusion is crucial in economics, as it influences consumer behavior, wage negotiations, and monetary policy effectiveness.

Nominal Rigidity vs Money Illusion: Core Differences

Nominal rigidity refers to the resistance of prices and wages to change despite shifts in the overall price level, causing slow adjustments in the economy. Money illusion occurs when individuals confuse nominal values with real values, reacting to changes in money supply without recognizing the impact of inflation on purchasing power. The core difference lies in nominal rigidity being a structural market feature affecting price adjustments, while money illusion is a behavioral bias influencing economic decision-making.

Historical Perspectives on Price and Wage Stickiness

Historical perspectives on price and wage stickiness reveal that nominal rigidity often stems from contracts, menu costs, and institutional factors limiting immediate adjustments in wages and prices. Money illusion, where workers and firms misinterpret nominal changes as real changes, contributes to slower wage corrections during inflationary periods, reinforcing nominal rigidity. Economists such as Keynes and Friedman debated the role of money illusion in wage stickiness, influencing models of macroeconomic adjustment and monetary policy effectiveness.

Economic Theories Underpinning Nominal Rigidity

Nominal rigidity, a fundamental concept in New Keynesian economics, refers to the slow adjustment of nominal wages and prices despite changes in the economy, often explained by menu costs and staggered contracts. This rigidity causes wages and prices to remain fixed in nominal terms, leading to real effects on output and employment when unexpected inflation occurs. Money illusion contrasts with nominal rigidity by describing individuals' tendency to confuse nominal and real values, impacting labor supply and consumption decisions within nominally rigid environments.

Behavioral Economics Insights on Money Illusion

Behavioral economics reveals that money illusion, the tendency to think in nominal rather than real terms, distorts decision-making by causing individuals to overlook inflation's impact on purchasing power. Unlike nominal rigidity, which refers to the slow adjustment of wages and prices, money illusion directly affects consumers' perception of wealth and income, leading to suboptimal financial behaviors. Research shows that overcoming money illusion can improve economic outcomes by aligning expectations with real economic indicators rather than nominal values.

Real-world Examples of Nominal Rigidity in Markets

Nominal rigidity refers to the resistance of prices and wages to adjust immediately in response to changes in economic conditions, often observed in labor contracts and menu costs in restaurants. Real-world examples include wage stickiness during recessions, where employees' nominal wages remain fixed despite decreases in demand, and retail prices that do not drop promptly due to the cost and effort of changing price tags. This rigidity contrasts with money illusion, where individuals focus on nominal rather than real values, leading to misperceptions about purchasing power during inflation.

Money Illusion in Consumer and Employee Behavior

Money illusion occurs when consumers and employees focus on nominal wages or prices rather than real purchasing power, leading to decisions that do not reflect actual economic conditions. Consumers may perceive higher nominal prices as inflation without recognizing unchanged or increased real value, affecting spending patterns and demand. Employees experiencing nominal wage increases without corresponding real wage growth may feel richer, influencing labor supply and wage negotiations despite stagnant or declining real income.

Implications for Monetary Policy and Inflation

Nominal rigidity, characterized by slow adjustment of wages and prices, constrains the effectiveness of monetary policy by causing real effects from nominal shocks, leading central banks to face trade-offs between inflation and unemployment. Money illusion, where agents mistake nominal changes for real changes, can amplify inflation expectations and inertia, complicating inflation targeting and reducing policy credibility. Understanding the interaction between nominal rigidity and money illusion helps policymakers design strategies that anchor inflation expectations and enhance the transmission of monetary policy.

Strategies to Address Nominal Rigidity and Money Illusion

Strategies to address nominal rigidity involve implementing flexible wage contracts and indexing wages to inflation to maintain purchasing power and facilitate economic adjustments. To combat money illusion, educating consumers and workers about real versus nominal values and promoting transparent inflation targeting by central banks improve decision-making accuracy. Policymakers can enhance economic efficiency by combining adaptive wage policies with clear communication on inflation dynamics.

Nominal rigidity Infographic

libterm.com

libterm.com